The easiest way to reconcile your Amazon Seller (Singapore) transactions.

Automated accounting for everywhere you sell. Greenback automatically fetches your Amazon Seller (Singapore) transactions and itemizes your sales, fees, refunds and reimbursements.

-

Connect your Amazon Seller (Singapore) account along with any other marketplaces or payment platforms you do business with.

-

Greenback separates your Amazon Seller (Singapore) transactions into itemized sales, fees, reimbursements and refunds.

-

Export your Amazon Seller (Singapore) transactions to your preferred accounting program.

Connect your Amazon Seller (Singapore) account and we'll auto-fetch your sales, fees, taxes, shipping, refunds and reimbursements.

Bank and credit card feeds only give you a partial view of your transactions. Greenback's powerful data fills in the rest. You get an accurate, comprehensive, and detailed transaction feed - automatically.

Accurate & Compliant.

We focus on providing GAAP compliant data for businesses that value accuracy when it comes to automating their accounting processes.

Getting your Amazon Seller (Singapore) data into Greenback.

-

-

Itemized Data

Greenback separates transactions into itemized structured data across sales, expenses, fees, taxes, shipping costs, refunds and reimbursements.

-

Time Zones

Date and time attributes vary across retailers, marketplaces and accounting platforms. Greenback gives you control to standardize how date and time values are stored, displayed and ultimately exported.

-

Multi-payment Support

Transactions that contain multiple payments on a single transaction are easily handled by Greenback.

-

Multi-currency Support

With support for 162 currencies, Greenback tracks the currency associated with the inbound data, along with the "point in time" exchange rate (if supported by integration). Export your transactions to multi-currency enabled accounting programs like QuickBooks. For example: If your transactions are in USD, but your accounting programs primary currency is CAD, Greenback will help you export that data.

-

Discounts

Choose how you apply discounts to your itemized transactions. You can spread discounts out proportionally across all itemized transactions or choose to export the discount as a separate line item.

-

Meta-data & Attributes

Many integrations will provide additional meta-data which we consider attributes of a transaction. Attributes can be used as decision points when configuring account mappings and transforms. Attributes can also be included in the data passed through to your accounting program.

We go way back! Request a Catch Me Up for historical data.

-

-

Complimentary 300 transactions over past 90 days

Paid plans include up to 300 historical transactions over the most recent 90 days at no cost to you. Need more data? Check out our extended Catch Me Ups.

-

Extended Catch Me Ups

Extended Catch Me Ups start at $49.00 for the first 500 transactions. Additional historical transactions can be fetched at a cost of $0.03 each. Historical Catch Me Ups are performed by a support engineer to ensure accuracy and completion of data.

Original Receipts.

Greenback fetches and stores a copy of your original receipts. View your original receipts anytime in Greenback. We'll also push a copy of each receipt to your accounting program when you export your data as well.

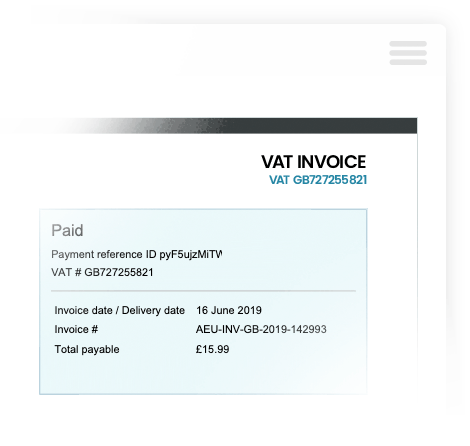

All Things VAT.

-

-

VAT Invoices

Greenback will fetch and store your VAT invoices, and in some cases can help create VAT supported invoices when they are missing.

-

VAT Refunds

Are you subject to jurisdictional VAT refunds? We can help you collect the VAT invoices necessary to submit your refund requests.

-

VAT Missing?

Is VAT tax missing from your transactions? Some integrations may not support itemized VAT. With Transforms, we'll help you restructure your transaction data to "backfill" the VAT taxes so your accounting file stays accurate.

Taxes & Shipping.

-

-

Taxes

If your jurisdiction and accounting program will support itemizing sales tax, Greenback will allow you to associate the sales tax to a pre-defined tax account.

-

Shipping

Itemize and categorize your shipping costs to better track how much you're spending on shipping.

Taxes & Marketplace Facilitator Taxes.

-

-

Taxes for Sellers

Greenback itemizes the sales tax you've collected on your sales ensuring you categorize sales taxes properly within your accounting program.

-

Marketplace Facilitator Taxes

Many of today's seller marketplaces are required to collect and remit tax on sales sold by third party sellers. Greenback will define Facilitator Taxes as "Automatic Sales Tax" within your transactions and will treat them as an expense line item. We do this because the burden of collecting and reporting sales tax now belongs with the marketplace.

Working with your data on Greenback.

-

Taxes

If your jurisdiction and accounting program will support itemizing sales tax, Greenback will allow you to associate the sales tax to a pre-defined tax account.

-

Viewing & Managing Your data

Working with your data is easy on Greenback. View, search, and transform your data, all while maintaining GAAP compliance.

-

Transforming your data

With Transforms you can automatically modify your data upon placement in Greenback, perfect for correcting missing taxes, assigning SKUs, creating new customer names, and more.

-

Reporting & Insights

Greenback helps visualize your data in ways accounting programs fail to so you can make informed decisions.

-

Collaborate With Colleagues

Invite your accountant and colleagues to collaborate across your connected accounts.

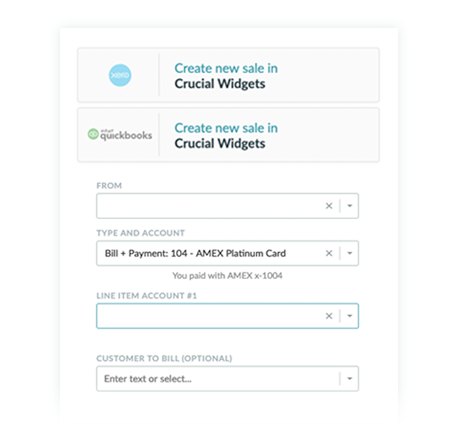

Export to Accounting.

-

-

Itemized or Summary Exports

Itemized export will enable you to categorize each line item separately when exporting to your accounting program. Don't need that level of detail? Choose summary exports and define all items on a transactions to a single account in your accounting system.

-

Export individually, in bulk or on Cruise Control

Export your transactions individually or watch over a bulk export of 100 transactions at a time. Ready to automate your exports? Simply configure your account mappings and export rules and Greenback will export relevant transactions automatically.

-

Re-export Transactions

Need to undo your previous exports? Greenback gives you control the review, undo and re-export previously exported transactions.

-

Transaction Matching

Greenback's transaction matching intelligently matches existing transactions in your accounting file and simply enhances the data already on your books. When no match is found, Greenback will create new transactions.

-

Original Receipts & VAT Invoices

Greenback fetches and stores a copy of your original receipts & VAT Invoices. View your original receipts anytime in Greenback and when it comes time to export to accounting, we'll add a copy of the original receipt with the transaction directly in your accounting program.

-

Contact Creation

Greenback can create new contacts in your accounting program to match the data found in your synced transactions. Level 1 contacts are created based on the source of the data ' such as " Amazon Seller (Singapore)", where as Level 2 contacts are defined based on the use of meta-data from the transaction, such as a specific customer's name.

-

Allocate Taxes

When applicable, Greenback will allow you to associate the sales tax to a pre-defined tax account. Alternatively, when using itemized exports, Greenback will distribute taxes proportionally across all line items.

-

Allocate Shipping

Allocate shipping costs proportionally across all line items or separate shipping costs as a separate line item.

-

SKU Matching

Automatically assign accounts on export based on the SKU match between your data and the products in your accounting program.

-

Duplicate Prevention

Greenback intelligently analyzes all attributes of a transaction to ensure there is no duplication of transaction data within your accounting program. We'll even identify duplicate transactions that may exist across multiple integrations, such as a single transaction that exists on eBay as well as Shopify.

-

Export Confirmations

Greenback intelligently analyzes your transactions after they have been exported to ensure the accuracy of the data once it's been serviced by your accounting system. Situations where your accounting program may have incorrectly processed your transaction data are flagged for your review.

-

Multi-currency Support

With support for 162 currencies, Greenback tracks the currency associated with the inbound data, along with the "point in time" exchange rate (if supported by integration). Export your transactions to multi-currency enabled accounting programs like QuickBooks. For example: If your transactions are in USD, bit your accounting programs primary currency is CAD, Greenback will help you export that data.

Ready to get automated?