Etsy’s New Billing System

We are excited to announce that we’ve made an enhancement to account for Etsy’s new billing system! As of Nov 1, 2018, Greenback will start generating daily bill charges and reimbursements. Our feature mirrors how Etsy now deducts these directly from your payment account. Remember that before this change Etsy would require you to pay these separately.

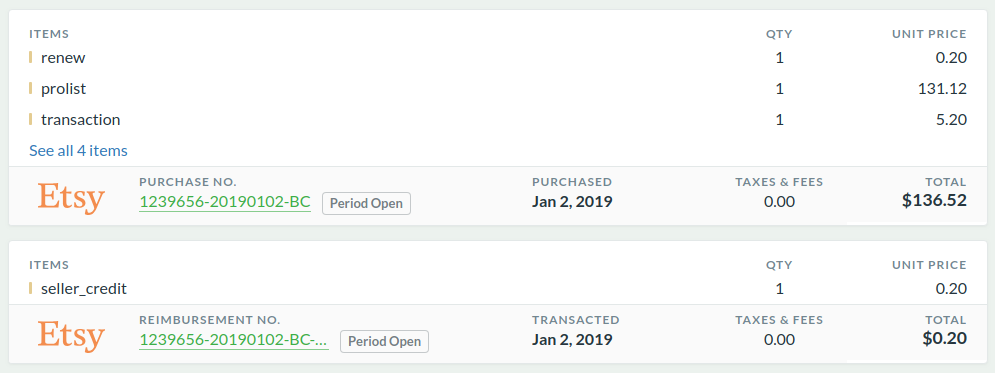

Greenback will tally up all your charges by day, group each type as a line item, and present you with a single daily transaction. If Etsy credits or reimburses you on that day, we'll generate another daily transaction to represent what you've been reimbursed.

You'll notice in our screenshot that we've marked these transactions as "Period Open" since the the day is not yet finished. We will not allow you to export these to QuickBooks, Xero, or elsewhere until the period is closed on your next sync.

International Sellers

If your payment account is in anything other than US dollars with Etsy, the new billing system now charges you in your local currency. Until Etsy completes their full billing system rollout in early 2019, Greenback can only access the US dollar version of your bill charges.

As you know, Etsy charges fees in USD except when your account is set for your local currency instead. Currently you can see accurate amounts, but behind the scenes, the API data is still in USD. We’ve added a feature to automate the conversion into your local currency until they are done with their rollout. You simply need to download your Monthly Statement as a CSV file from Etsy and upload it to Greenback. Then click "sync" and we'll automatically convert any USD charges to the exact amount that Etsy charged or reimbursed you. The instructions below have more detail. (You may need to do this on a desktop computer, and not your phone.) That way everything you see on your Etsy screen will match what Greenback sees in your data and is ready to export to your accounting system (optional). Etsy’s data is accurate, we just need your data from the CSV file until they are done updating.

Etsy’s New Marketplace Facilitator Tax Feature

Etsy is now keeping track of the states that have recently added economic nexus or new “Notice & Report” laws. They are automatically charging Etsy Seller’s customers the state sales tax for you (if your shop meets state reqs/economic thresholds) and even remitting payments to that state on your behalf. This is only for the nexus states. View current list. You are still responsible for all the states that you are required to collect taxes for and for any sales in your home state (if your state has sales tax) of course. See Sales Tax Checkup and Sales Tax Is Not Income Tax below.

Since you don't have any liability for this sales tax, Greenback will detect this kind of tax was applied, and represent it as a new line item on sales called "Automatic Sales Tax". We will also generate an expense that negates this amount on your payment processing fee transaction. The two values net out of your net proceeds on the sale.

NOTE: Remember that Income tax (Federal, State, Local), Self-Employed taxes, Employee taxes (Social Security/FICA, Unemployment Insurance, Medicare, Workmans’ Comp, etc), and resale tax exemptions/wholesale purchases are not the same thing.

How To Download Your Etsy Monthly Statement (CSV File)

If your Etsy Seller account is NOT in USD (US Dollars), just login to your Greenback account, click on Etsy on the left nav, and click on the grey “Uploads” tab. Next, click on “Etsy Monthly Statements” in the green box. You will be taken to your Etsy Shop Manager where you will see your current monthly statement. If needed, select the month and year ie: Dec 2018 and then click on the CSV button. Save the .csv file (ex: etsy_statement_2018-11.csv). Next go back to the Greenback tab in your browser (or click on the back arrow to return to the upload screen in Greenback). Click on the file shortcut at the bottom left corner or locate the file and drag and drop (or click on the green box, locate the file, and click the “Open” button) to upload the file. You will see “File successfully uploaded!...” You can download more files if you wish. (You don’t have to worry. Greenback prevents duplicates!) Lastly, click on the Sync button at the top right. You’re done! Your bill charges and payments will have updated currency now.

We recommend the "Etsy Monthly Statements" link we created in Greenback to hop on over to Etsy because it’s easier and takes you to the right screen. But if you’d rather start in Etsy instead, here’s the link Etsy Billing Statement. Only download the CSV file. Do NOT download the VAT file!

IMPORTANT: Do not look for files located at Shop Manager>Settings on the “Download Shop Data” tab at "www.etsy.com/your/shops/me/download”. They are NOT the correct files that you need!

Give Your Business an Annual Sales Tax Checkup

Find out which states have economic thresholds. It’s imperative to stay up to date on which states have economic thresholds or reporting laws in effect. There are some states that even Etsy has not added to their list yet! Stay updated on what you need to do by looking for .gov, dept of treasury, or dept of revenue websites for each state that you are selling in. Taxes can even differ from the state sales tax depending on the city or zipcode. Check here.

Sales Tax Is Not Income Tax!

Make sure not to confuse Sales Tax with other taxes like Business Income Tax. Always consult with a CPA or a Tax Consultant to help you out. State and local laws always apply for Sales Tax--also known as Gross Receipts or Use Tax. --Even if you think you don’t own a business and it’s only a hobby, or you must not need to collect Sales Tax because you don’t know how, that is not the case. Merchants must comply with sales tax laws and collect pass-through taxes on their sales.

You may even owe taxes in other states or need to comply with the new Notice & Report laws. Even though Etsy is helping with their Auto-Tax feature, you are responsible for all of your sales channels if you have any etc. Current state laws on economic or click-thru nexus vary. The sales thresholds go from $10,000 to $500,000 in sales, or usually 200 transactions. Some states don’t have a transaction threshold at all. “Effective July 1, 2018, the Supreme Court gave states the ability to require sales tax if you sold to any customers in their state, regardless of whether or not you have nexus there.” Read more at Sales Tax Basics Do not guess. It’s better to look it up now so that you will not owe any missing sales tax later and end up with expensive fines as a result. It is worth the time to do your research. You can always limit your sales to only one state, use a third-party automation app, or rely on a professional to help you with compliance. Here is a list of the states that help streamline sales taxes to help businesses spend less time on compliance. Streamline States