It should come as no surprise that many financial firms are eagerly embracing the digital data revolution. Banking was built on data. But others, mostly the bigger traditional banks, are falling behind by ignoring the potential of today’s technology tools.

And their customers are starting to notice.

The stragglers risk disappointing their customers who are demanding both higher quantity and quality data. It’s creating a growing mismatch between what customers demand and what banks are delivering.

Tech-savvy fintechs are drastically changing the financial services landscape. A recent report on banking industry trends by Capgemini put it best: “Customers cannot unsee the superior experiences they enjoy from online retailers and others, and now demand similar personalized innovation from their corporate banks.”

Businesses want their banks to deliver data in real-time.

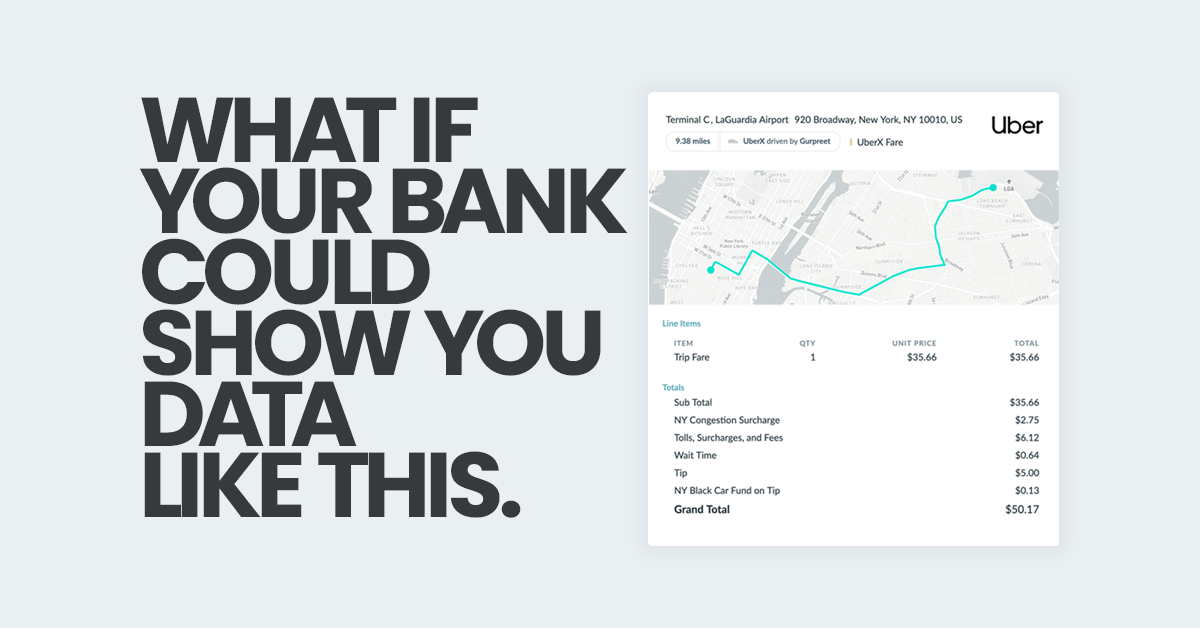

Business customers are crying out for more frequent and more transparent transactional financial data. That’s because more detailed data reporting, available literally at the customer’s fingertips, makes business customers more efficient, competitive and profitable.

Virtual banking, more robust online reporting services and the 24/7 convenience of digital financial data is in high demand.

And this offers a great opportunity for traditional banks to strengthen customer relationships and promote loyalty. However, the banks have been slow to catch on.

A recent Forbes article points out that “just one in five community banks had deployed (application programming interfaces) APIs before 2020, with a quarter planning to do so this year. One in five don’t even have APIs on their radar.”

Beyond APIs, traditional banks and financial firms have even bigger opportunities for adoption of blockchain technology and distributed ledgers to help speed up payment processing and settlements while making it more secure for their customers in the process.

Businesses want more data, better data.

As Capgemini points out: “Advanced technologies and cloud services can play an integral part in the shift from labor-intensive manual processes to automation to add productivity, cost efficiency... and flexibility.”

The end result for big banks is that by embracing big data they end up making themselves more efficient and profitable in the process. As a bonus, the cloud offers banks enhanced data processing and storage protection as well. And increased cybersecurity is a critical need as banks generate more valuable, detailed data.

Although they were perhaps slow to embrace the digital data revolution, industry trends point to the financial services industry taking meaningful steps to catch up more quickly. Large technology firms such as Microsoft, Amazon and IBM have developed and deployed blockchain networks through cloud-based service platforms.

Businesses want personalized experiences.

Personalization and customization are redefining what the customer experience is like in just about every industry right now, and financial services is no exception. Digital technology is making it easy to tailor services and even marketing to each customer, rather than taking the old one-size-fits-all approach, leveraging data to create messaging that will resonate with each individual.

For instance, a 2018 report sponsored by Mastercard found that 90% of bank customers “expect businesses to anticipate their needs and act accordingly. For banks, that requires an understanding of which metrics will best capture, analyze and evolve the role of personalization in the sales process.”

What better way to target messaging and sell to customers than to tap insights into their purchases and deposits, at scale, with level 4 transaction data? Customer data like this can include everything from “life stage events” -- when brand loyalty is imprinted based on where the customer and their business are in their development and meeting their needs at this very moment -- to simple preferences, targeting marketing and messaging around the products and services that customers use and buy the most.

Businesses want better advice

Financial advice is one thing, but good financial advice is what long-lasting commercial banking relationships are built on.

Most financial institutions can develop tailored recommendations based on the segmented data they already have recorded in their customer accounts, but deeper level data can take these services much further than they can today. Having a better understanding on where their customers’ money is going and where they can make adjustments, banks can be better equipped to help them make wise budgeting decisions.

This is where Greenback’s level 4 data comes in. By combining transaction data from payment networks with data from authoritative sources such as the user’s email account (for receipt details) or directly from a retailer like Amazon, we’re able to deliver deeper information for each data point, information that banks can use to better understand their customers.

Learn more about Greenback’s APIs at (https://www.greenback.com/platform)[https://www.greenback.com/platform]