What is VAT Inclusive?

VAT Inclusive means that the price includes the value of the tax. In some jurisdictions it is mandatory that the displayed price of goods or services is inclusive of VAT. Therefore the term VAT INCLUSIVE is used when describing a price that already includes tax, and the term VAT EXCLUSIVE is used when describing a price to which tax is yet to be added to arrive at the final cost.

Why does this matter?

Accounting for the actual revenue associated with your sales is important and can have a real effect on your business financial statements if done incorrectly. Dext Commerce can help convert your VAT inclusive transactions to VAT exclusive transactions before exporting them to an accounting program. This will allow you to accurately track the price of your products and the revenues generated exclusive of VAT.

How does Dext Commerce address this?

Dext Commerce will convert your VAT Inclusive transactions to VAT Exclusive before exporting your data to an accounting system. We recalculate your transaction to be VAT Exclusive by removing the allocated VAT from each line item and consolidating the VAT fees to its own line item. The end result is a true projection and itemization of your product sales, discounts and taxes; all readily presented for export to your accounting system.

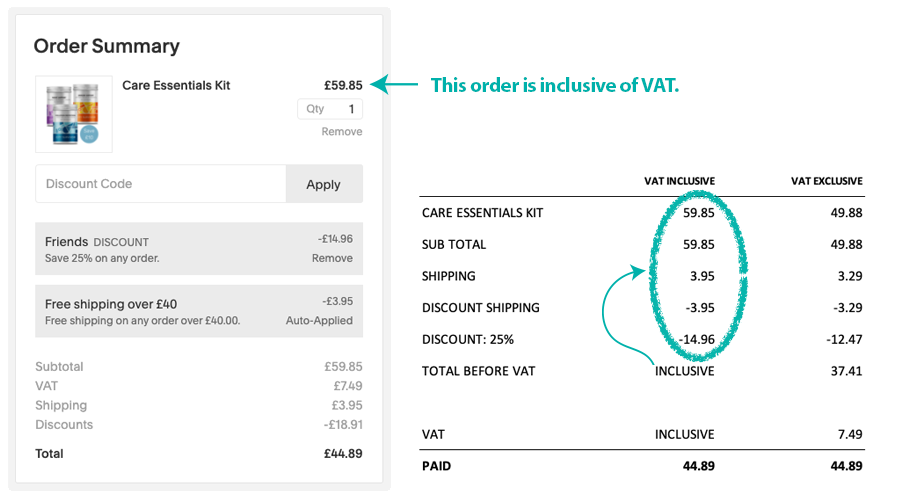

This example transaction contains a single product sold with VAT included. The sale price of the product is 59.85 with 7.49 of the 59.85 allocated to VAT (VAT Inclusive). In this example there is a 25% discount in addition to a "free shipping" discount. To calculate the true cost of the product excluding the VAT we use the following formula:

VAT EXCLUSIVE AMOUNT = VAT INCLUSIVE AMOUNT / (1 + TAX RATE)

To establish the VAT Exclusive amounts, each line item in the transaction is recalculated to remove the allocated VAT and re-establish the VAT as it's own line item.

Sign up for Dext Commerce here to see how it can help you with VAT transactions!