Introduction

This article will take through how Greenback will map your expense transactions to both QuickBooks and Xero's chart of accounts.

For QuickBooks users

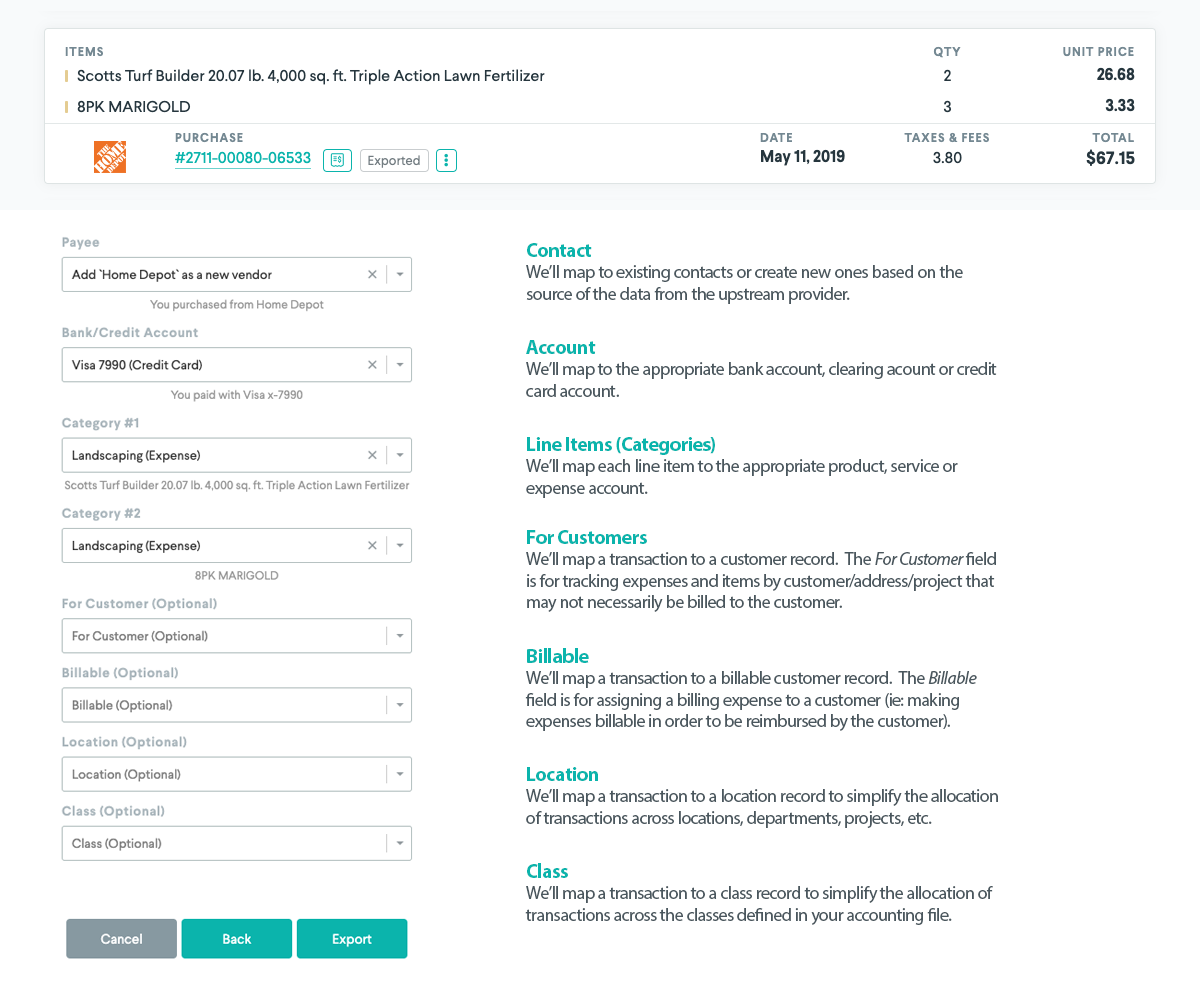

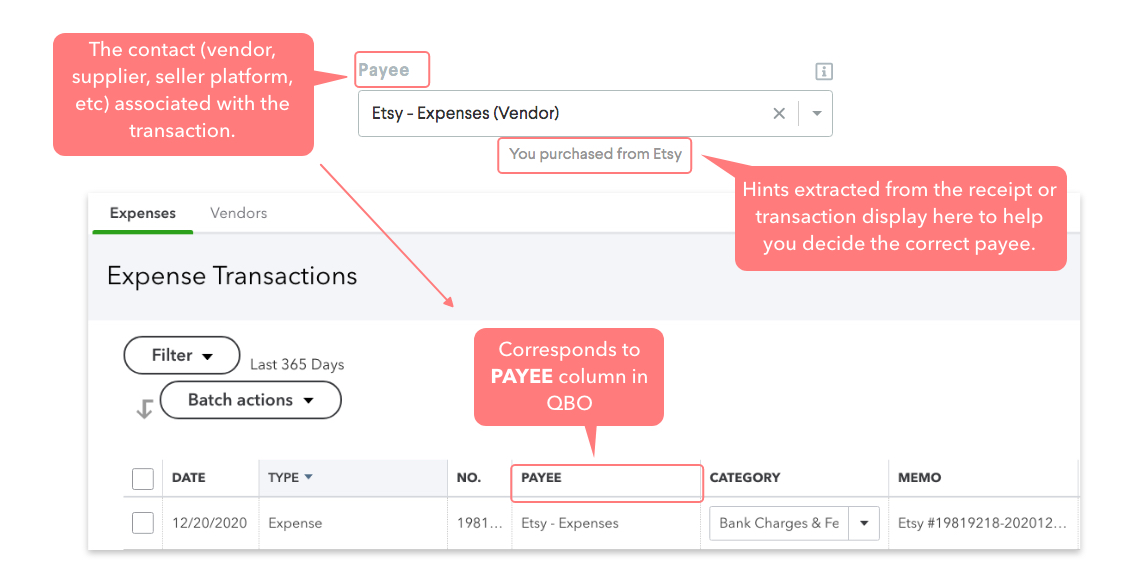

Payee Field

Greenback supports PO #s. If the expense transaction has a PO # (associated with the vendor), it will appear in the text-receipt under Details. Make sure you have an open PO and that POs are turned on in your settings.

-> Learn more about PO# setup in QBO

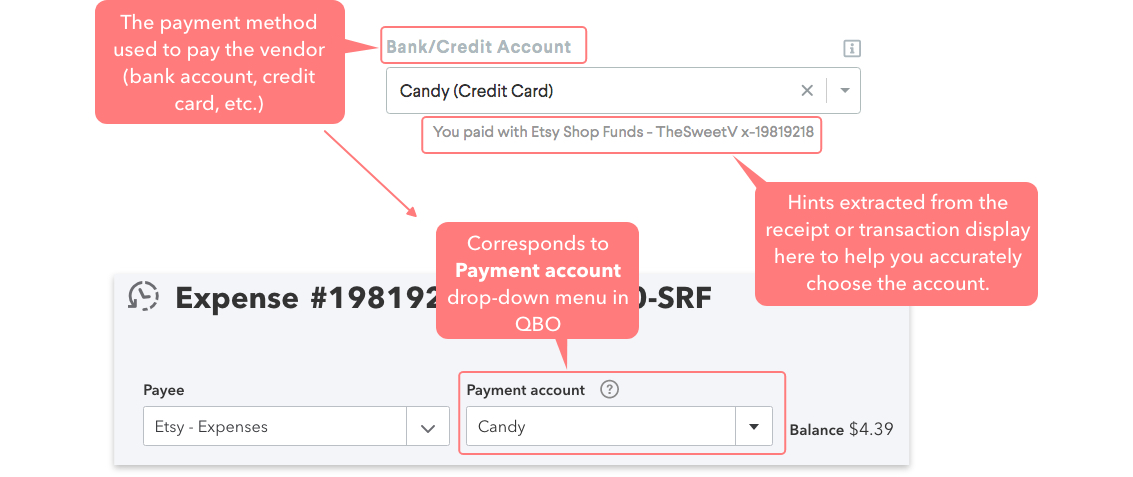

Bank/Credit Account Field

Options for this field populate from all Bank and Credit Card types of accounts in your Chart of Accounts in QBO.

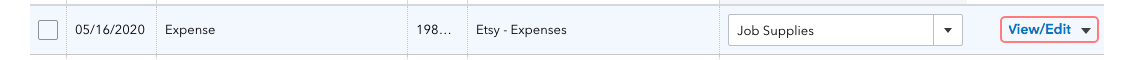

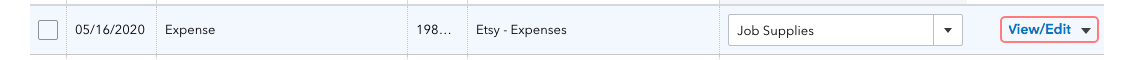

- To access the Payment account drop-down menu in QBO, click View/Edit next to the expense transaction.

- The Expense screen opens.

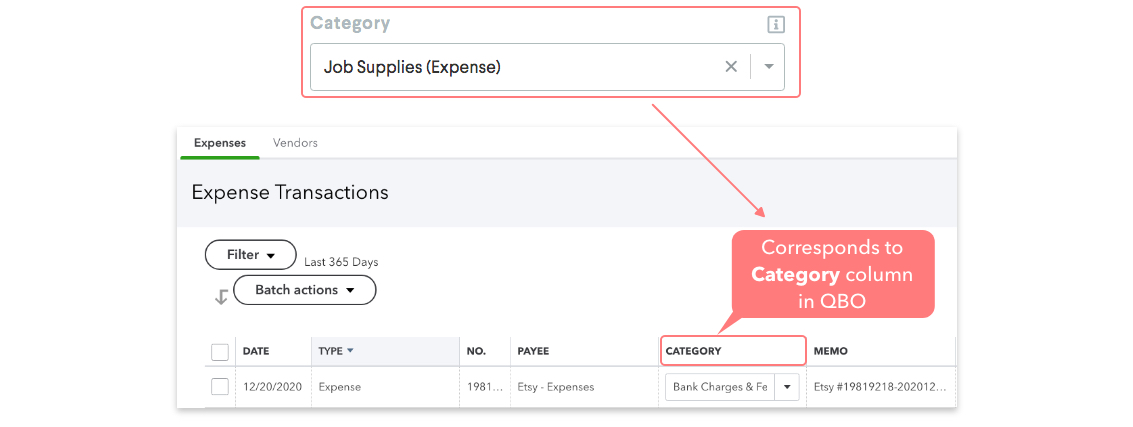

Category Field

The remaining fields explained here are accessible only to Greenback paid users.

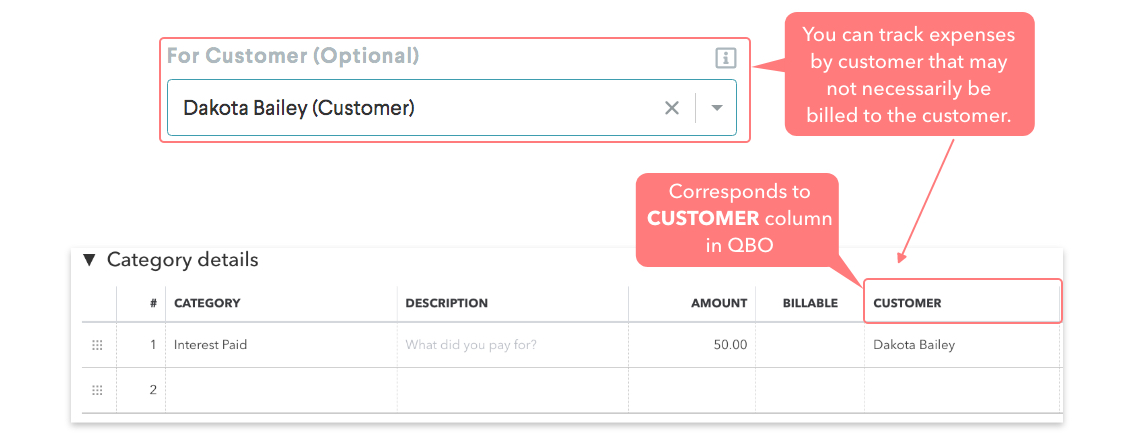

For Customer Field (Optional)

To see this option, ensure Track expenses and items by customer is ON in your QBO settings.

-> Learn how here.

If you start your workflow in QBO, leave it unassigned to a customer; you will assign it here.

- To access the Customer field in QBO, click View/Edit next to the expense transaction.

- The Expense screen opens.

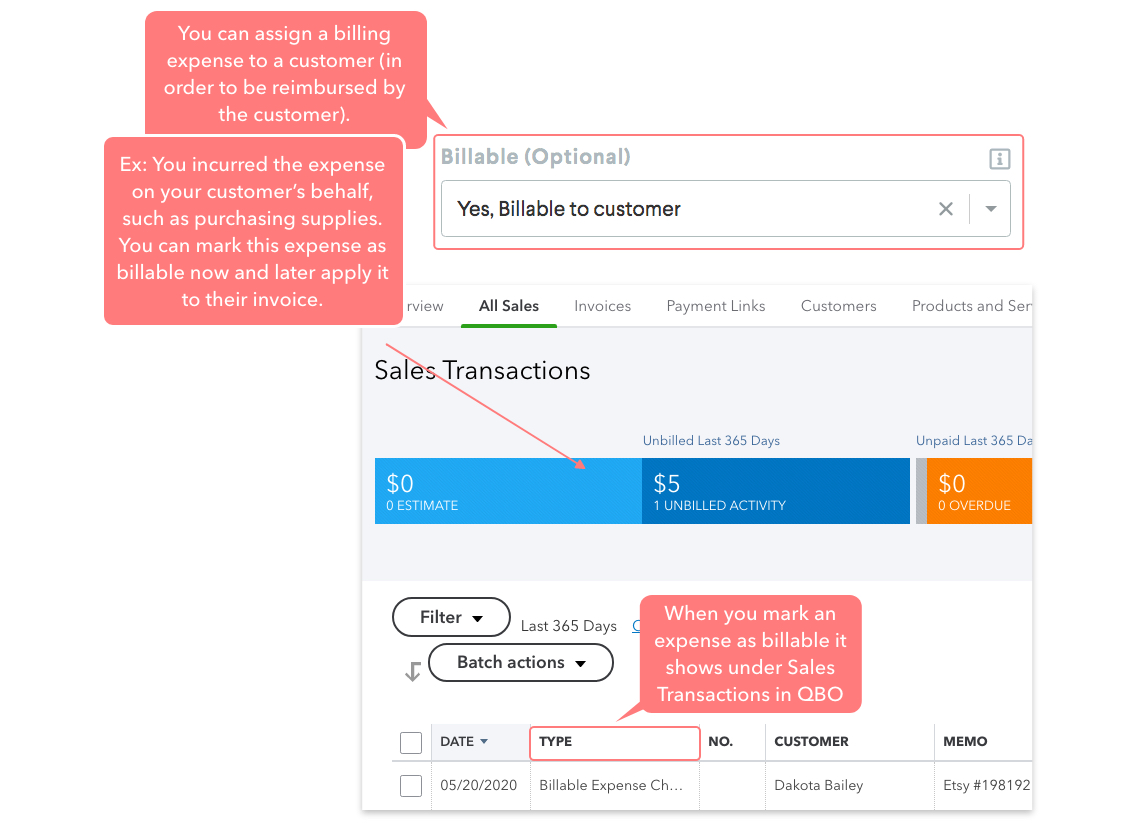

Billable Field (Optional)

If you start your workflow in QBO, leave the expense unassigned or don’t click the Billable box; you will choose it here.

To see this option, ensure Make expenses and items billable is turned on in your QBO Settings.

-> Learn how here

Pro-Tip: There are many ways to track expenses by job. QBO Pro Advisors recommend Class Tracking as a Job Costing workaround. See Job Costing Workaround.

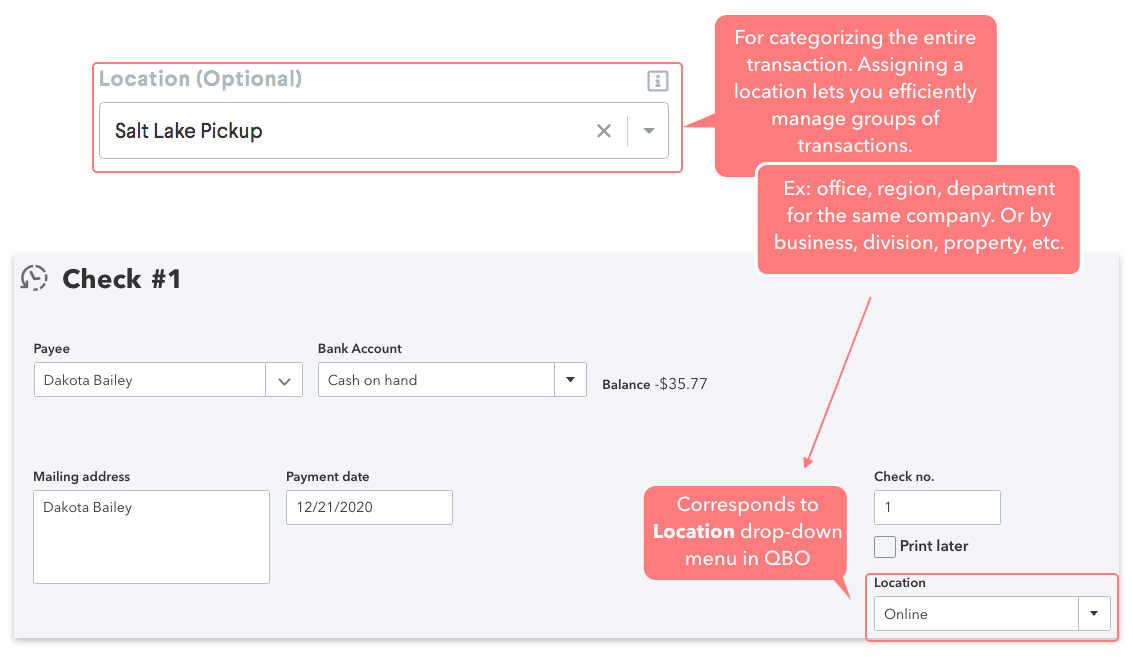

Location Field (Optional)

If Class Tracking and/or Location applies to this transaction, additional Category fields will display for each line item.

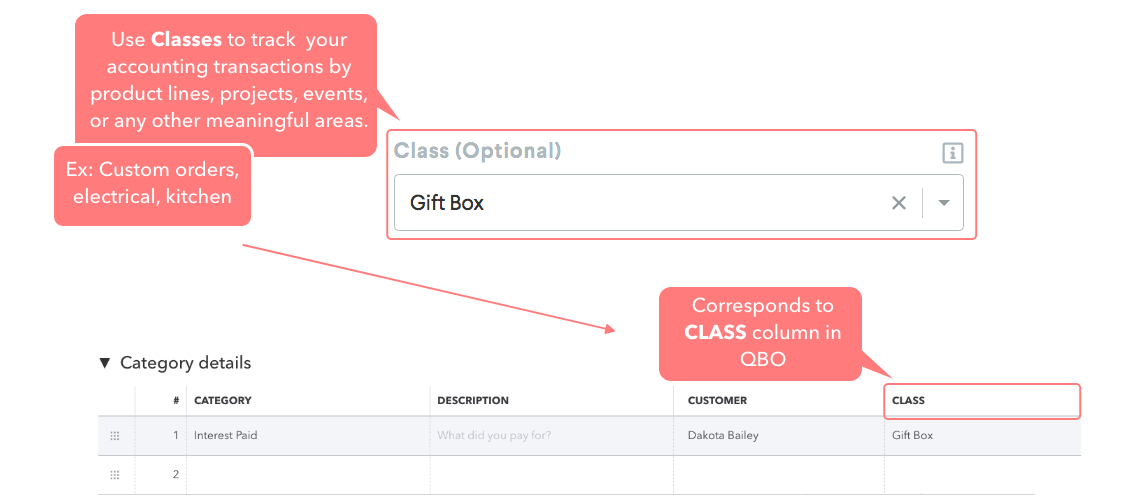

Class Field (Optional)

If you need Class Tracking and/or Locations, ensure they are set up in QBO before exporting. You can set it up to use either one separately or both of them together. (Greenback paid users only.)

-> Learn how to set up Class Tracking in QBO

-> Learn how and why to use Expense Classes

-> Learn more about Classes and/or Location Tracking

for Xero Users

From Field

The “From” field is the Contact (vendor (creditor), supplier, marketplace, seller platform, etc) that will be associated with the transaction. This mirrors the “From” field in the Xero UI on their own transaction form.

Type + Account Field

The “Type + Account” field is Greenback’s way of representing two concepts in one field. It represents both the type of transaction to create and which account it was paid with. Depending on how you have your Chart of Accounts set up in Xero, you may see “Bill”, “Bill + Payment”, and “Bank Transaction” types.

Bill

This will create an “unpaid” Bill (Purchase) in Xero.

Bill + Payment

This will create a Bill (Purchase) transaction and also create (apply) one or more Payment transactions in Xero. Greenback will display a unique “Bill + Payment” entry for every account you’ve flagged as “payable” in Xero. See Enable Payments to an Account

Bank Transaction

This will create a Spend Money transaction in Xero. Greenback will display a unique “Bank Transaction” entry for every bank account in Xero.

Pro-Tip: A deleted Receive Money transaction can not be restored. So re-export it from Greenback. See below.

Choosing the right method

Either Bill + Payment or Bank Transaction accomplish the same general goal. Depending on your Xero subscription, you may have limited “Bills” you are allowed to create. In that case we’d suggest you primarily use Bank Transactions. If you have unlimited Bills then we suggest you use Bill + Payment.

Hints extracted directly from the receipt or ancillary transaction will display below the field to help you accurately decide the export destination. Ex: “You paid with Visa x-4242”, “You paid with Etsy Shop Funds-Acme Soap x-1200400

Line Item Account Field

“The Line Item Account” field is the account to associate with the expense. Usually, you think of this as the “category” of what you’ve spent, but in double entry bookkeeping it’s possible it represents something else like an Asset. This mirrors the “Account” field in the Xero UI on their own transaction line items. Select the default remembered from the last export or select from the dropdown. You should see the account code, account name, and the account type (Expense, Asset, etc). Ex: 6000 Advertising (Expense), Material (Cost of Goods Sold), 601 Marketplace Fees (Expense), etc. If you need a new account, go to Xero to add it and then start your export over again in Greenback. The dropdown is in CoA order and displays the right group to help you.

Customer to Bill (Optional)

The “Customer to Bill” field is (Greenback premium only feature) for assigning a Billable Expense to a customer. This mirrors the “Assign expenses to customer” link in the Xero UI on their own transaction form. If you start your workflow from Xero instead, leave the expense unassigned or “Decide Customer Later”.

You can edit and/or not add outstanding expenses when prompted in Xero later.

Greenback will remember it for the next time.

Pro-Tip: Xero recommends “Xero Projects” to assign expenses to a project ie: job costing.

Tracking Categories (Optional)

The “Tracking Category” field(s) are (a Greenback premium only feature) for setting your configured tracking categories in Xero. If you’ve setup Tracking Categories in Xero then Greenback will display them as optional fields (paid users only). Ex: Division (Optional).