Introduction

Everyone seems to love gift cards. Businesses like yours have even more reasons to love gift cards as they are a great way to raise awareness and grow sales. According to Research & Markets, U.S. Gift and Incentive Cards Market is expected to cross $221 Billion by 2024.

The challenge however is that selling and redeeming gift cards introduces a new complexity to accounting for your e-commerce sales. This article is going to take you through how you can configure QuickBooks Online to book both the sale of gift cards as well as the redemption of gift cards on future sales.

You've sold a gift card, now what?

The initial reaction when you sell a gift card is to treat the transaction as a sale. After all, you have money in hand. The challenge however is that you really haven't sold anything yet. We need to think of the gift card as a commitment to make a future purchase and as such should record gift card sales as liabilities for deferred revenue. From an accounting standpoint, selling a gift card is a liability; a future obligation to provide your customer with products or services worth the value of the gift card. It's only when your customer uses the gift card as a payment method on a future sale that we recognize the revenue. This is considered deferred revenue.

To illustrate how this works, imagine your client sells a gift card for $100. To record the transaction, you note $100 as a credit in the gift card deferred revenue category. If you use double-entry bookkeeping, you also note the gift card’s sale as a debit in the cash column. Then, let’s say the customer uses $80 of the gift card to purchase some products from your client. At that point, you debit the gift card deferred revenue column for $80. If this is the only gift card on the books, the total in that column drops to $20. To balance the books, you also record the $80 in the sales or revenue account as a credit.

Let's look at an example.

Susan runs Baked By Susan, a local bake shop that uses the Square point of sale system. Susan promotes her $20 branded Baked By Susan gift cards at the checkout register and on her online store. She also uses Greenback to help her syndicate her Square sales and fees with the bakery's QuickBooks Online account.

Accounting for the sale of the gift card

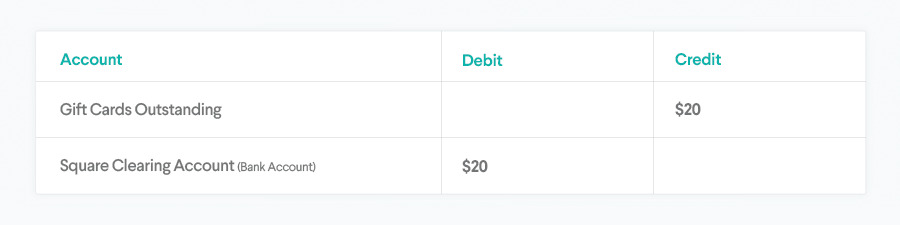

As Susan sells a $20 gift card she will credit $20 to a Gift Cards Outstanding liabilities account, while debiting $20 to the Square bank account (can also be referred to as the Square clearing account). In simple terms, we are adding $20 to a liability account, meaning we at some point owe the customer $20 of products or services, and $20 to a bank account as we just received cash for the gift card. If you use double entry accounting, here is how that might look.

Accounting for the redemption of the gift card

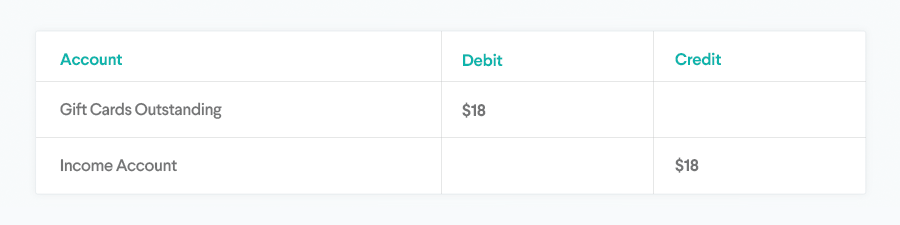

Fast forward a few weeks and now Susan's customer has decided to use the gift card to purchase a few baked goods. It's now time to recognize the sale by debiting the Gift Cards Outstanding and crediting an income account. Let's assume the sale was $18.00 and the $20.00 gift card was used. In this case, Gift Cards Outstanding would be debited $18 and Susan's Income account would be credited $18. The Gift Cards Outstanding account would now have a balance of $2.00 assuming no other gift cards have been purchased.

This may seem complicated at first, but once you have your accounting file properly configured, managing gift cards becomes much easier. With that said, let's walk through how to configure QuickBooks for servicing your gift card sales.

Before you can accurately account for gift card transactions in Greenback you will need to ensure your gift cards are setup as individual line items within each transaction on Greenback. Contact our support team to help ensure your transactions are properly configured to export gift cards.

Start by configuring your QuickBooks account

First, setup your clearing accounts

First things first, we highly recommend that you create clearing accounts for each payment provider and marketplace you sell on. A clearing account is nothing more than a bank account configured in QuickBooks in the name of your payment processor. A good rule of thumb is to create a clearing account in QuickBooks for each provider that takes funds from your customer and makes deposits to your business.

> Learn more about clearing accounts and how to configure them in QuickBooks.

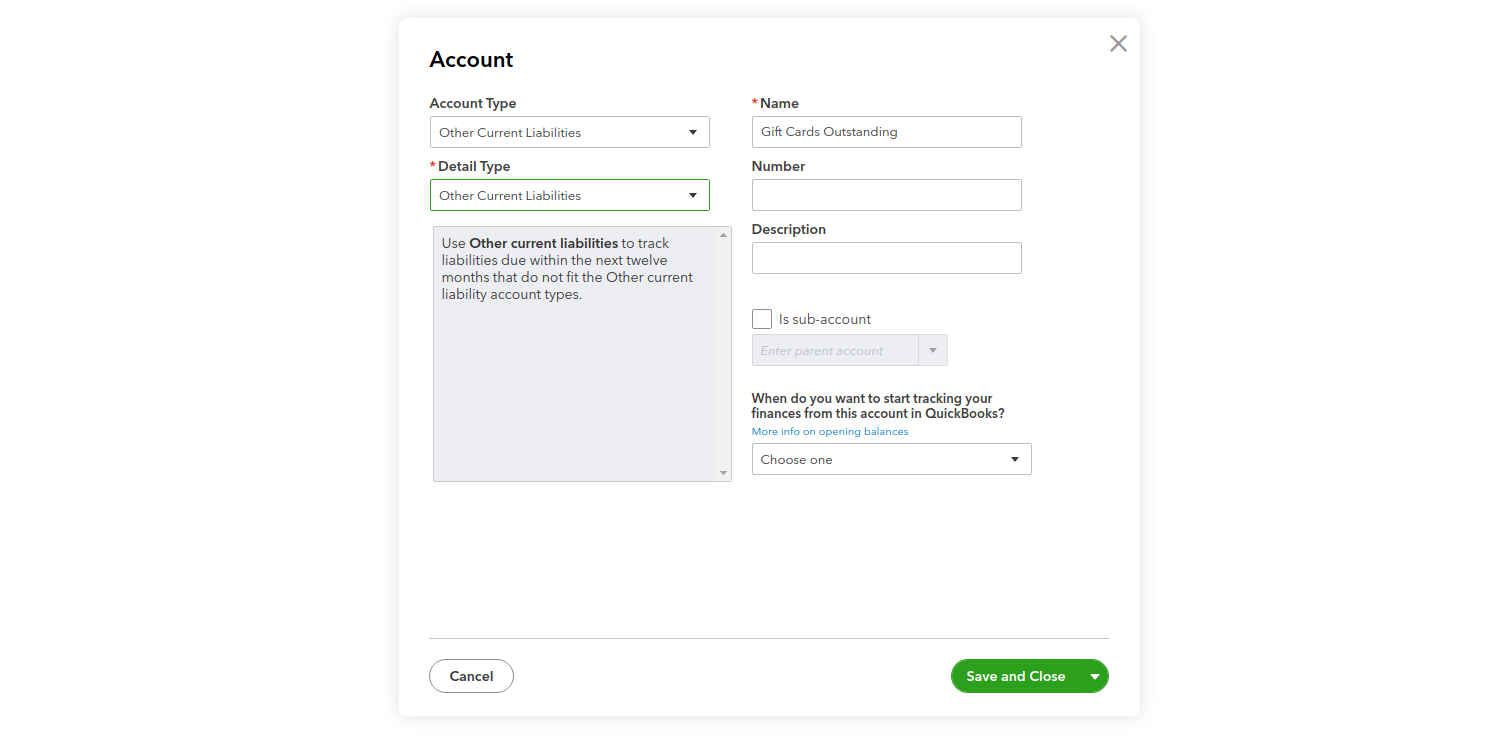

Second, Setup your liability account

Next, let's create a liability account to store the sale of gift cards to customers. To setup a liability account, go to Accounting > Chart of Accounts from the left navigation and select the New button to create a new account. You'll want to create a new account with the following settings:

- Account Type - Other Current Liabilities

- Detail Type - Other Current Liabilities

- Name - Gift Cards Outstanding

- Start Date (When do you want to start tracking your finances from this account in QuickBooks?) - choose an appropriate start date

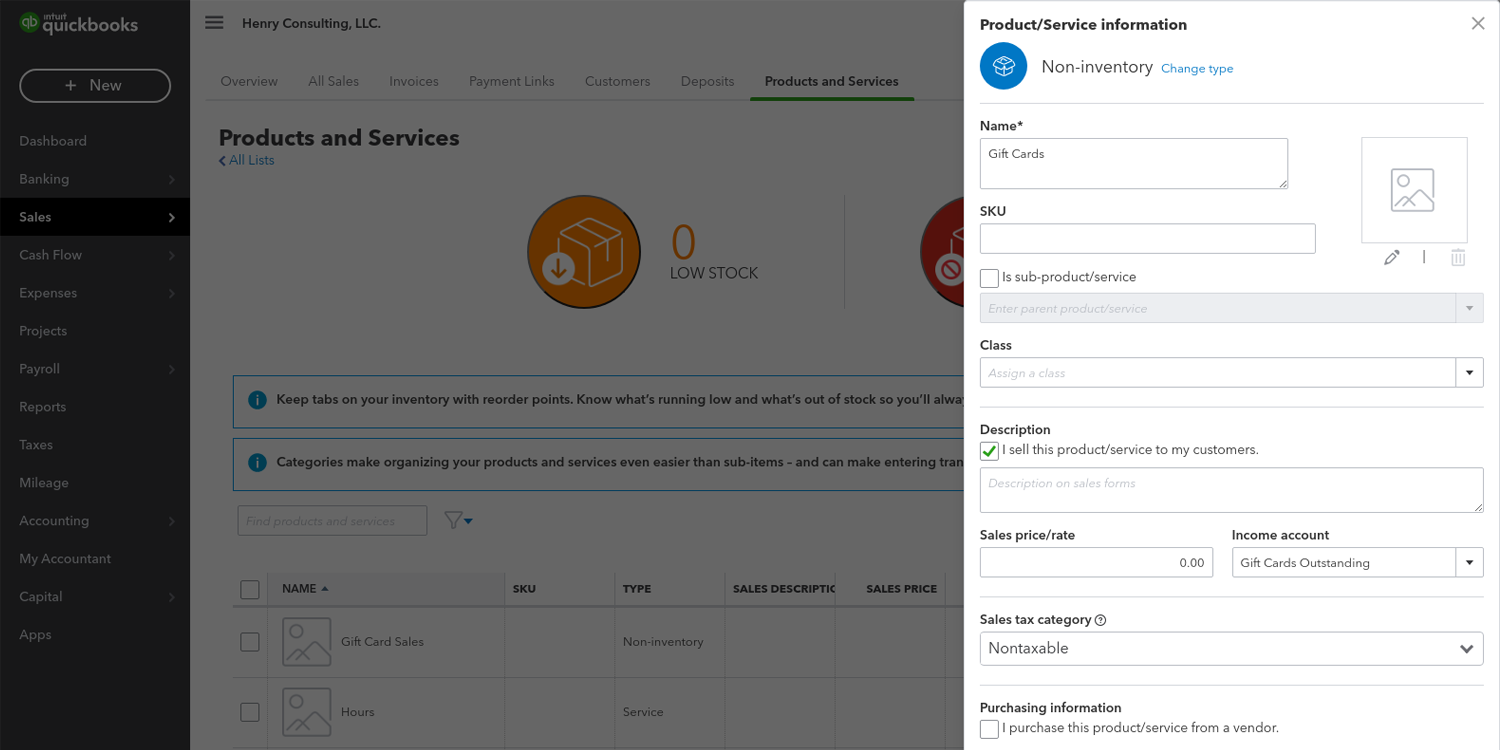

Lastly, create a product item for gift card sales

In order to properly book the sale of your gift cards we'll need to create a new product item in QuickBooks. To setup a new product, go to Sales > Products and Services from the left navigation and select the New button to create a new product. You'll want to create a new product with the following settings:

- Product/Service Type - Choose Non-inventory

- Name - Gift Cards

- SKU, Class, Description - If you care to assign values at this time, please do so.

- Sale price/rate - You can leave this as $0.00. (The sale price will be defined from your data on Greenback)

- Income Account - Gift Cards Outstanding (you will want to choose the liability account we created in the previous step)

- Sales Tax Category - Do you charge sales tax on the purchase of gift cards? If so, choose an appropriate tax rate.

- Save and close.

Now you're ready to record transactions in QuickBooks

Now that you have QuickBooks properly configured, let's look at an example of how we would record the sale and future redemption of a gift card.

We're going to use the Baked By Susan example above to illustrate how this will look in QuickBooks. We will assume that Susan also runs an e-commerce website using Squarespace with Stripe as the payment gateway for all credit card transactions processed via her Squarespace store.

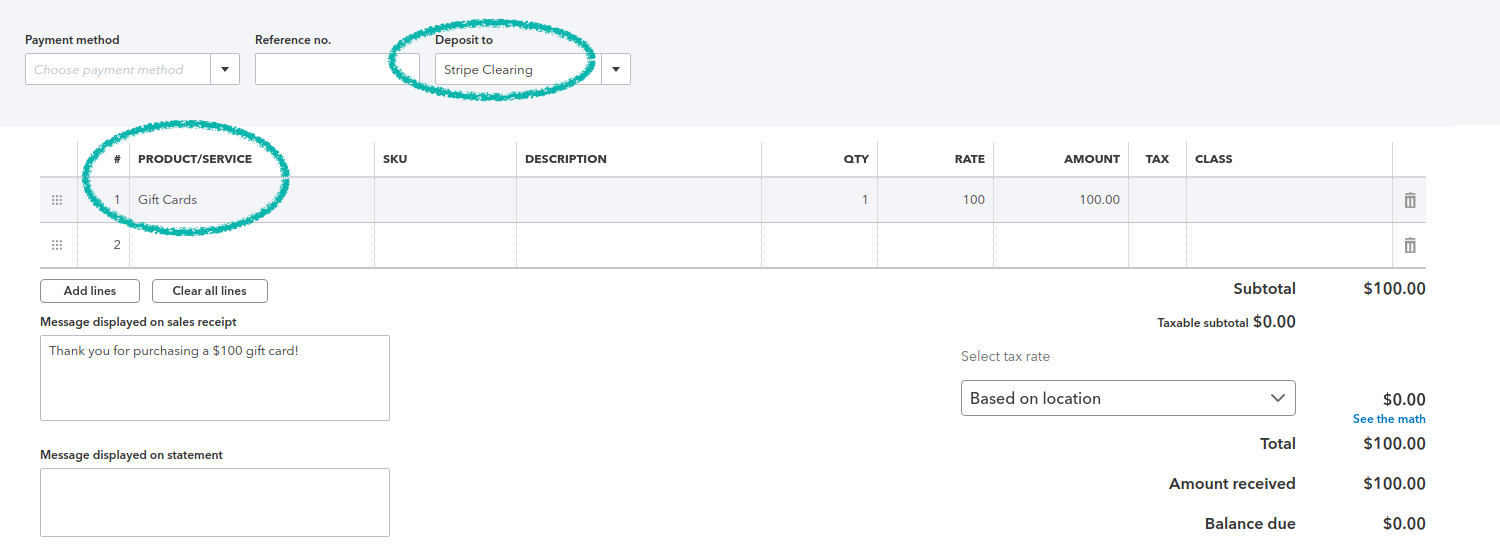

Record the sale of gift cards in QuickBooks

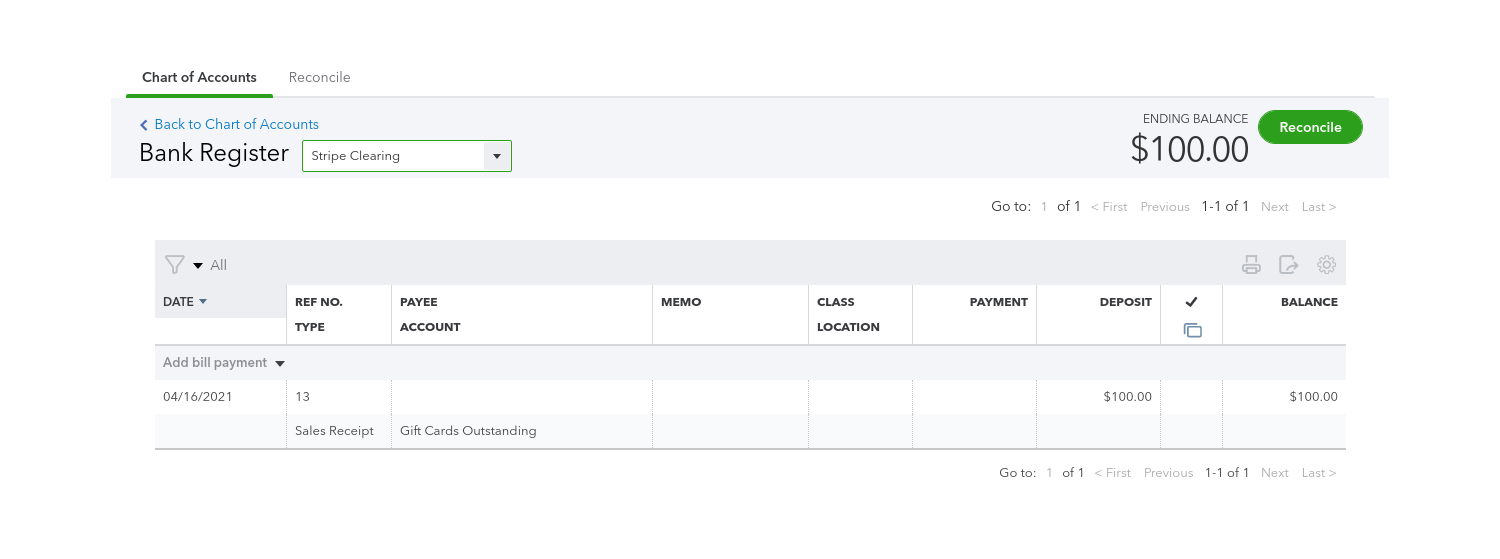

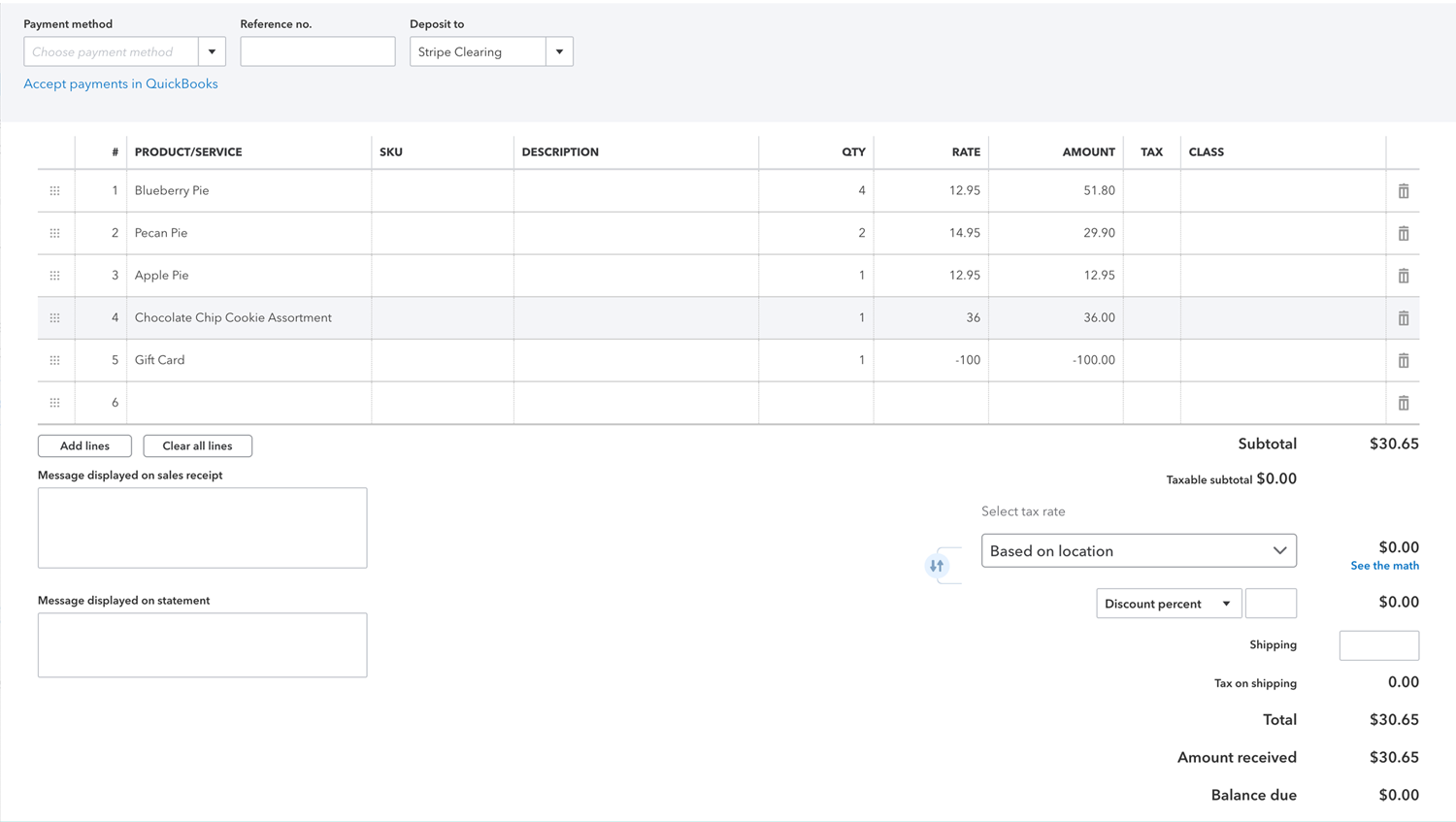

To record the sale of a $100 gift card, Susan would first create a new sales receipt or sales invoice that includes the sale of a gift card. Notice how in this example we use the Gift Card product we configured earlier as the line item on this sales receipt. You'll also notice that the payment for this gift card is booked to the Stripe Clearing account.

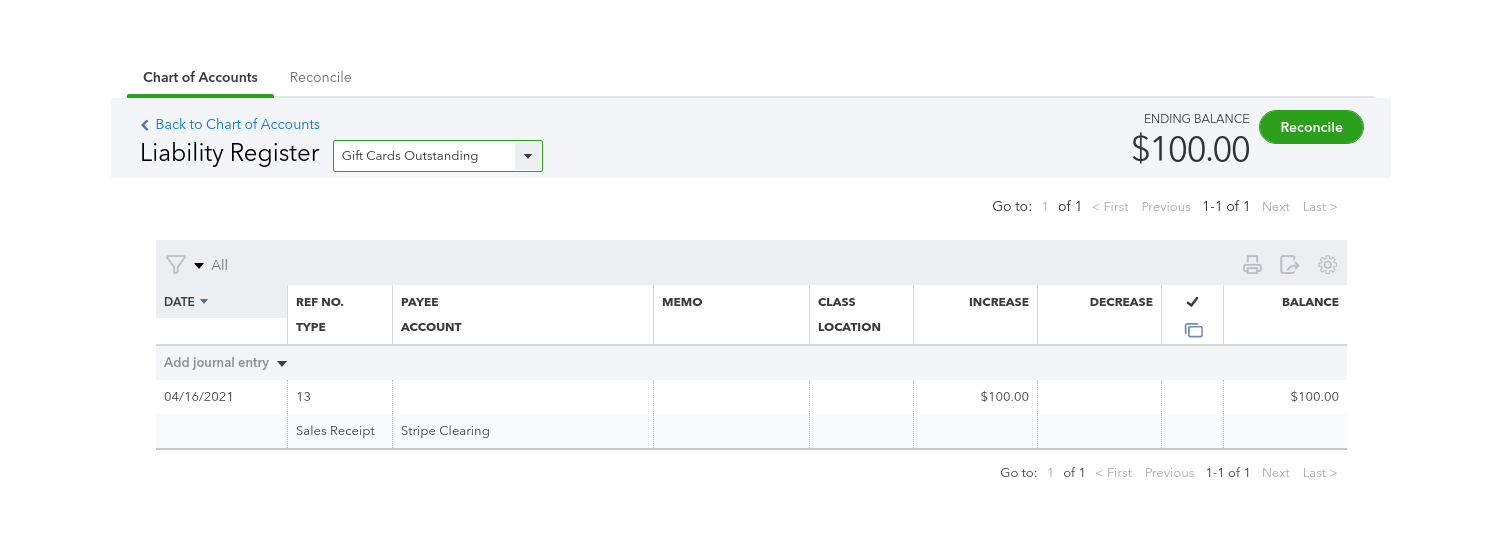

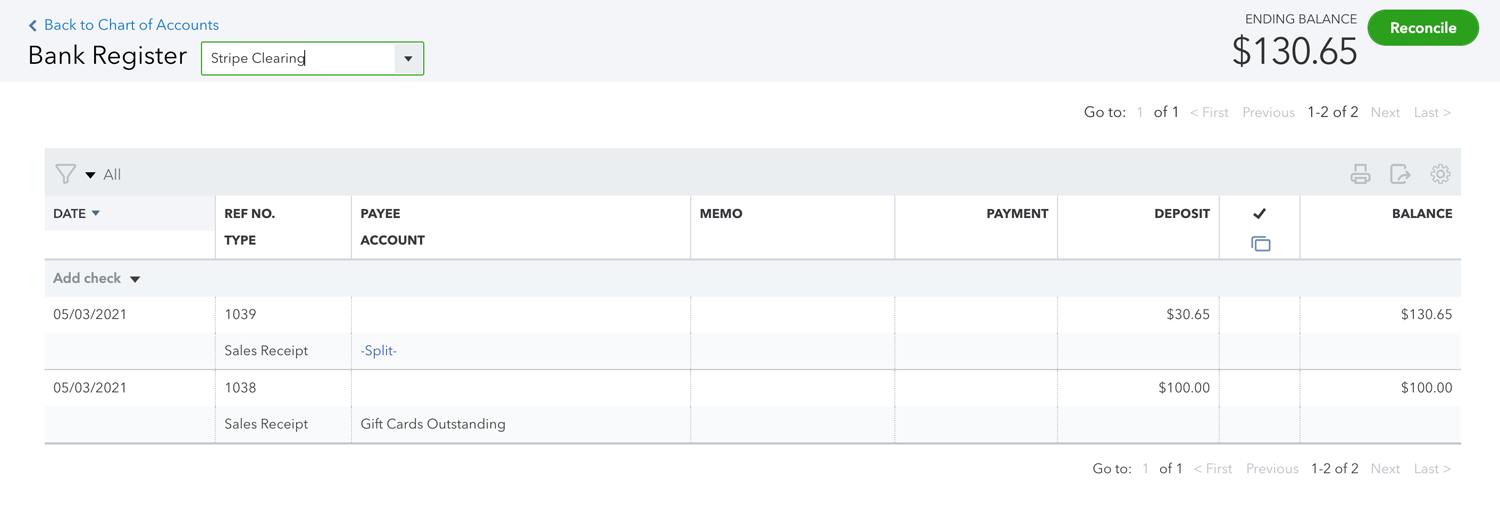

After saving this sales receipt you will now see a deposit of $100 to the Stripe Clearing account and an increase of $100 to the Gift Cards Outstanding liability account.

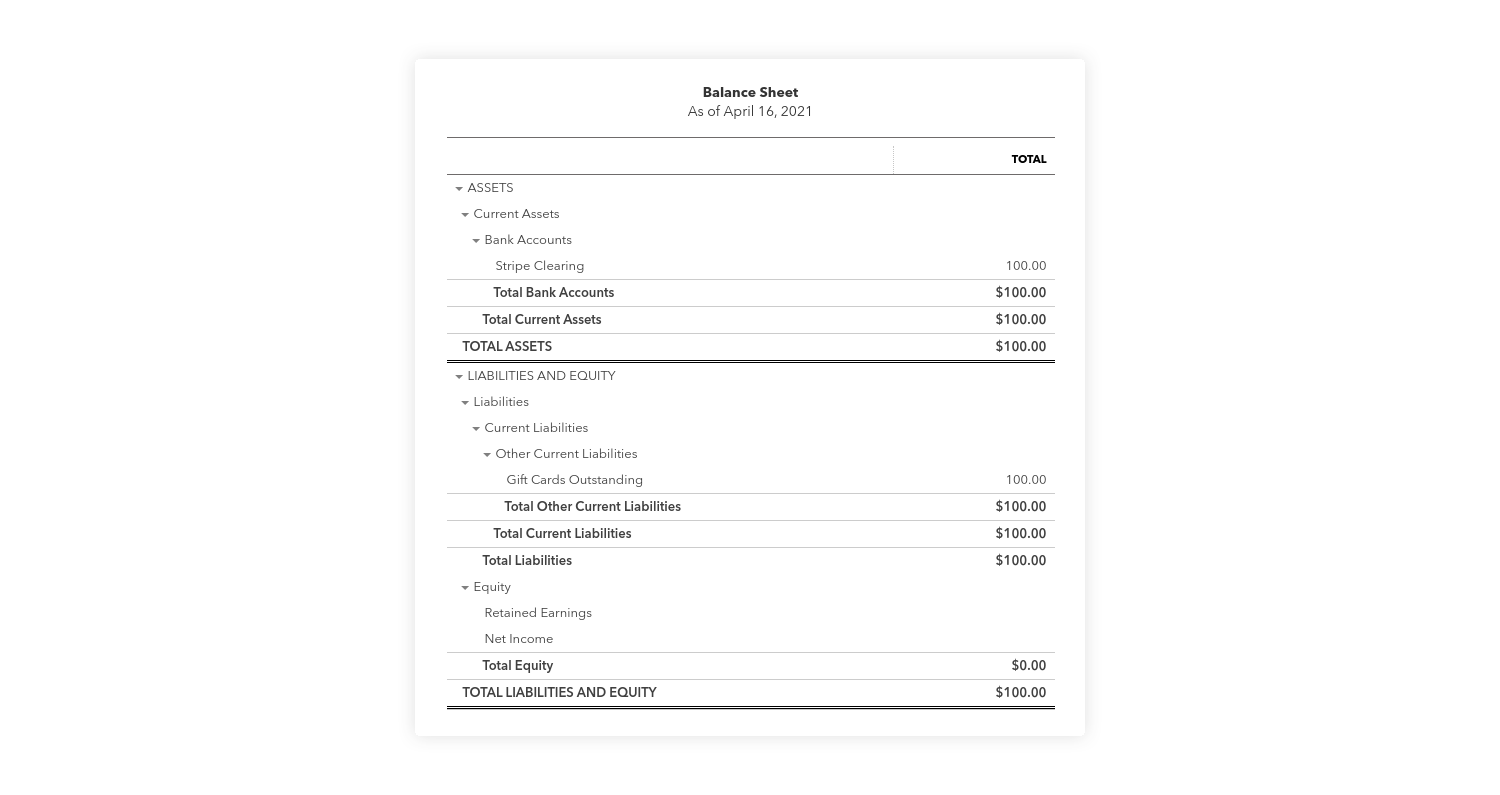

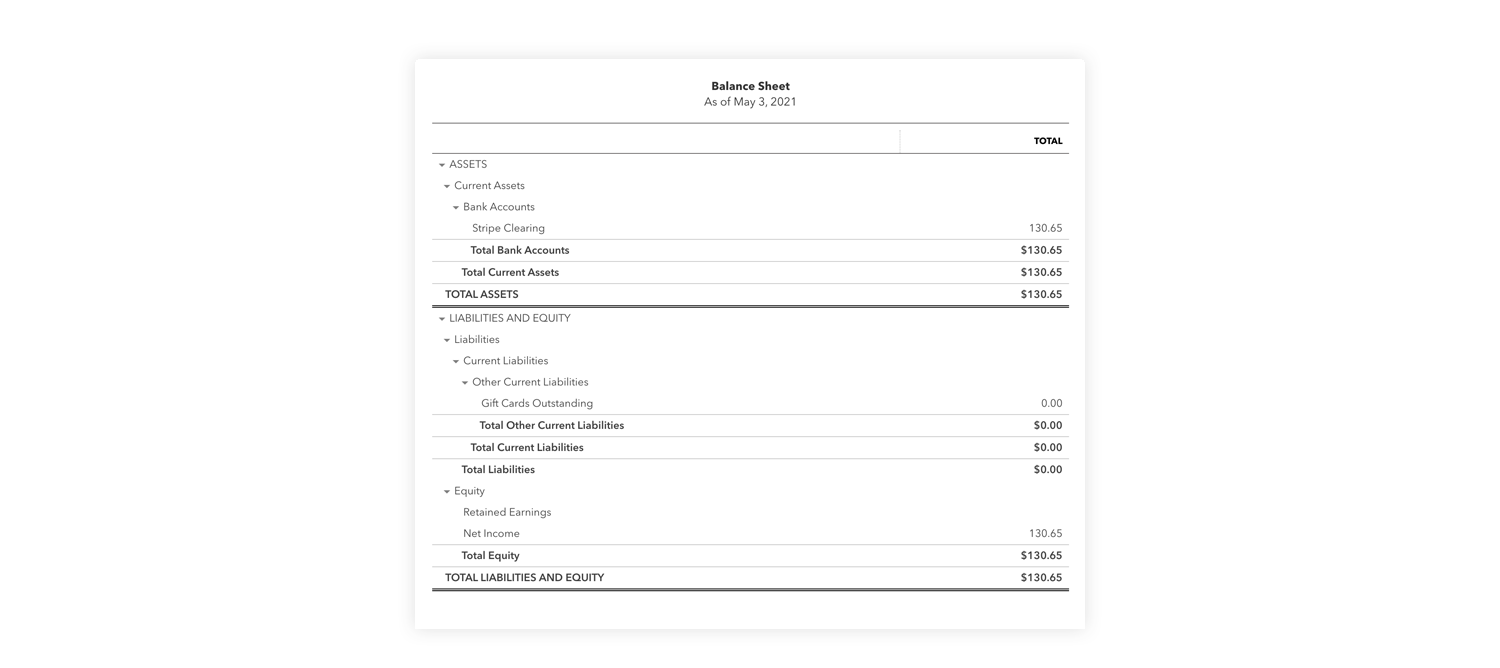

Assuming there are no other transactions within your QuickBooks file, this is how the sale of the gift card would present on a balance sheet.

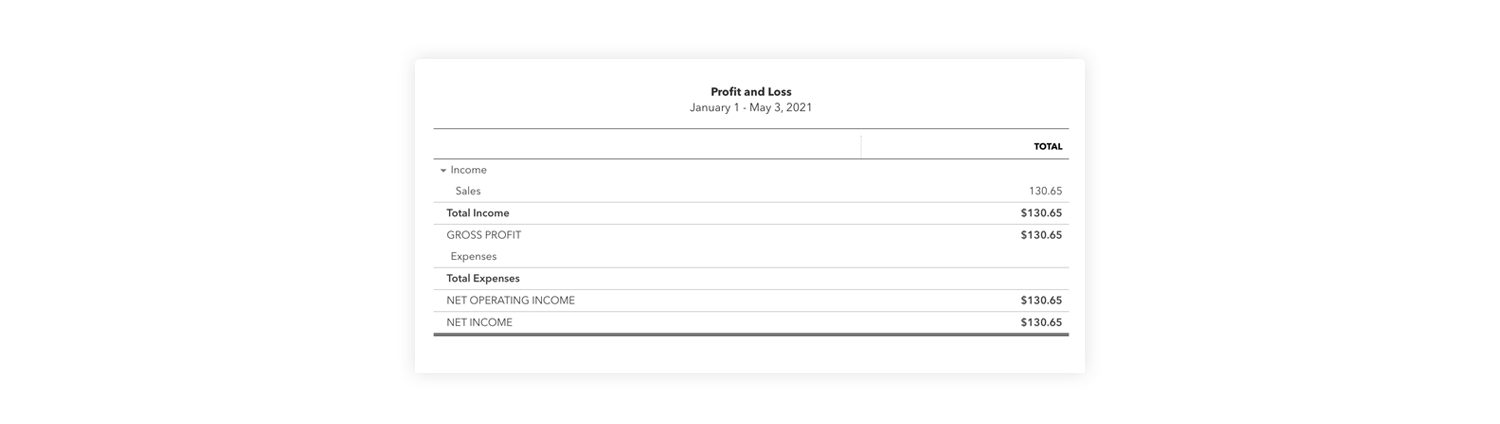

Now, you may be wondering if the income statement shows the sale of the gift card, after all you did receive $100 from the sale of that gift card. In this case however, the income statement will not reflect the sale as the revenue has been deferred as a liability (Gift Cards Outstanding) until such time that the gift card is redeemed.

Record a sale where a gift card is redeemed in QuickBooks

Susan's baked goods are praised by her customers and it's no surprise that the $100 gift card is quickly redeemed for an assortment of pies and cookies. To account for the redemption of the gift card Susan would create a new sales receipt and simply add the gift card product as a line item and assign a negative value to the amount being redeemed from the gift card. In this example, the gift card holder is using $100 gift card, leaving a balance of $30.65 that was paid using a Visa card.

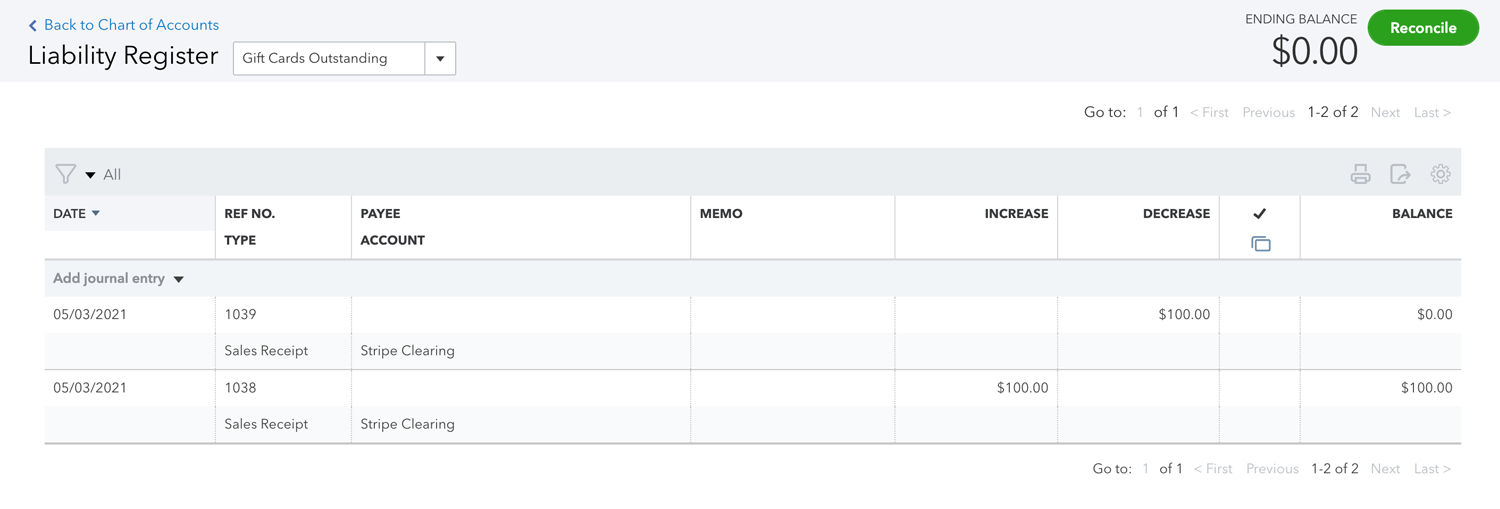

The result of this transaction will leave the Gift Cards Outstanding liability account at $0.

The Stripe clearing account will include the original $100 gift card purchase as well as the $30.65 balance from the sale of the baked goods.

You will now notice the balance sheet also reflects a $0 balance on the Gift Cards Outstanding liability account while also properly reflecting the balance of the Stripe Clearing account.

And lastly the Income Statement will now properly recognize the revenue generated from the sale of baked goods in which a gift card was used as a payment method.