What Are Itemized Taxes?

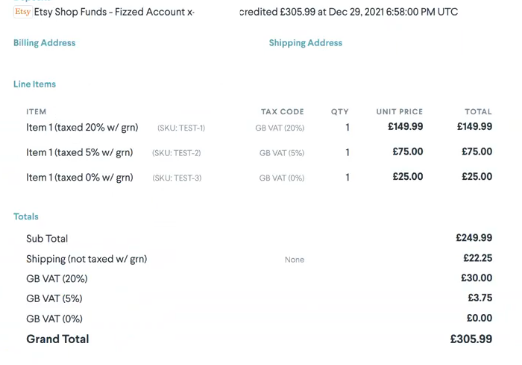

Itemized Taxes is a Greenback feature that allows users to apply mixed tax rates to individual line items. Now you can create and select tax rates in order to associate them with specific goods or services.

Why Itemized Taxes Are Valuable?

Uncompromised Precision

Greenback's itemized taxes apply rates directly to the product without additional calculations or estimations based on subtotals. Whether the tax data is supplied by the upstream provider or you have custom Transforms, tax rates move effortlessly from sale through reconciliation.

Customized Accounting

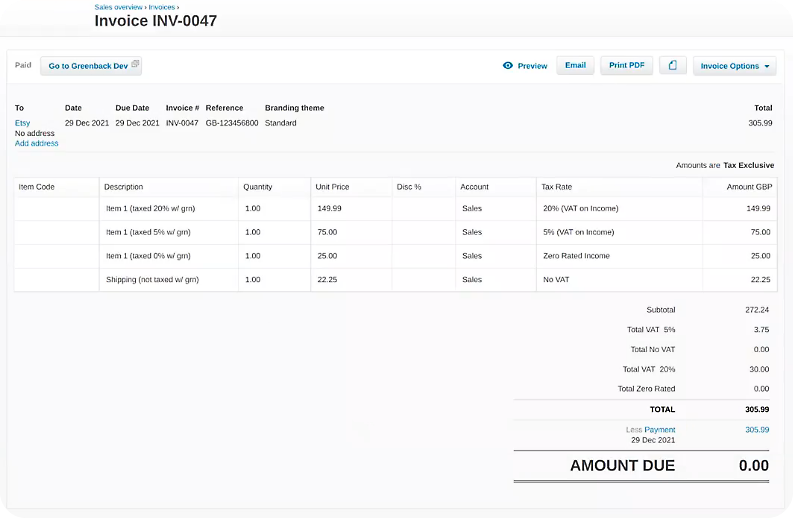

No matter how you analyze, reconcile, and report your numbers, Greenback has you covered. With Itemized Taxes, see your totals by tax rate in summary or line item views - including your accounting invoice.

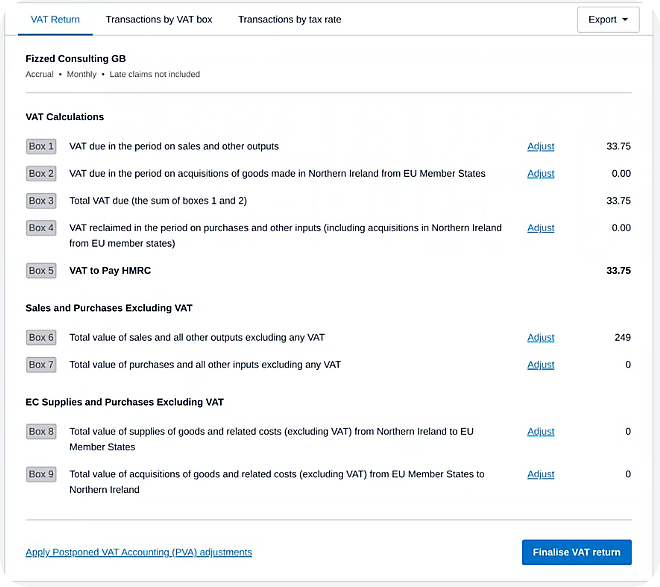

Tax Reporting

Greenback's Itemized Taxes feature allows you to seamlessly generate digital tax forms in Quickbooks Online and Xero.

Efficiency

Tired of working endlessly in spreadsheets matching SKUs to tax rates? Get your time back by allowing Greenback to ensure that your products and services are taxed accordingly from beginning to end.

How To Enable Itemized Taxes?

Itemized Taxes are available to qualified subscribers during the onboarding process. Qualified subscribers that have already onboarded, request Itemized Taxes by emailing support@greenback.com.