Overview

Make your data your own with Transforms by Greenback. Have your sales & expense data converted into your desired, consistent format, regardless of volume or complexity. Greenback has powerful rule building to intelligently match specific transactions and transform them even by line item. The "if this, then that" recipes are endless. Any combination is possible. Enhancing your transaction data before exporting it saves you the time and hassle of having to go in later to change it or forgetting about it and looking for the problem after the fact.

How it Works

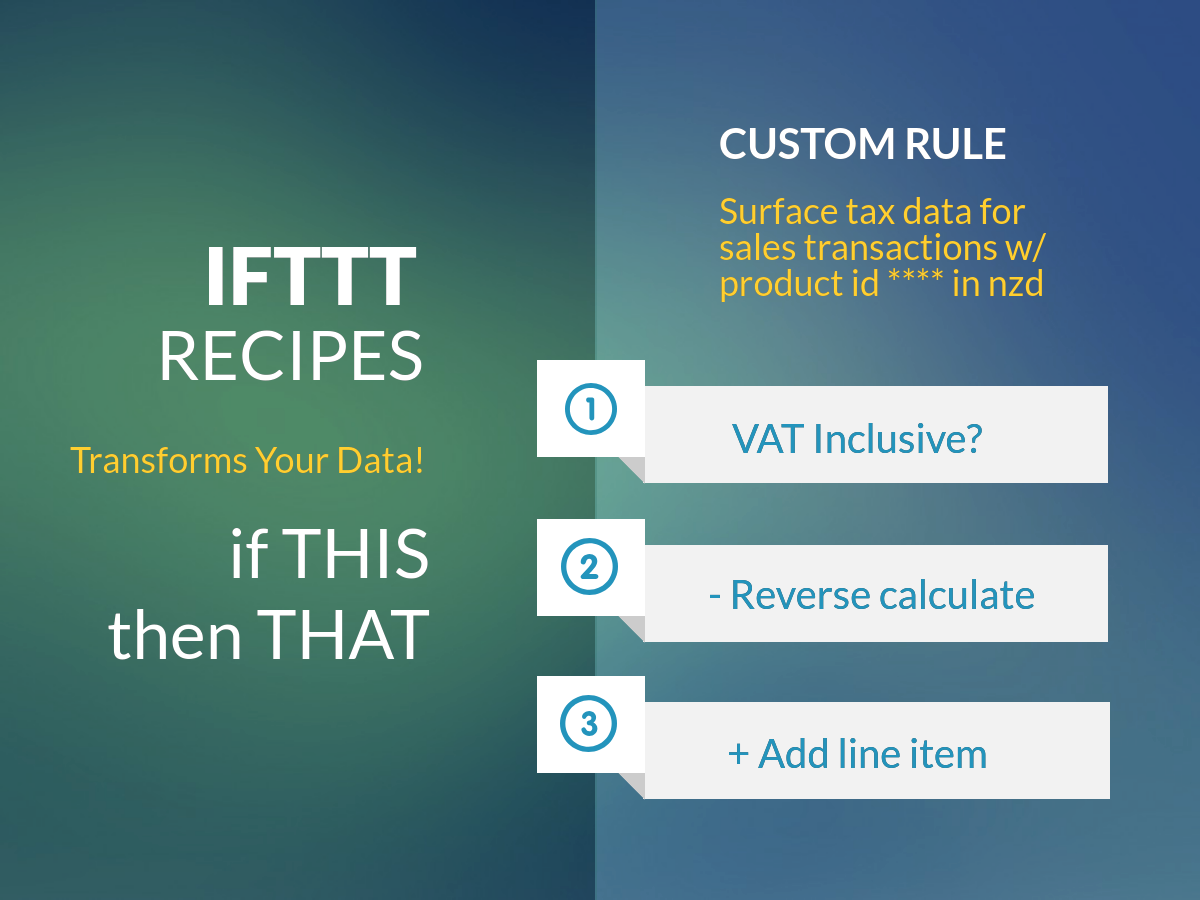

Just tell us all the criteria that is needed before we apply a custom rule such as "only on sales transactions" and/or "when the shipping address is in the UK." Send your request to: support@greenback.com. Once you let us know what the parameters are, we will build your custom rule and have you review it. If it looks good to you, we can activate it and then let it run on new data. If you are happy with it, we can then go back and re-index your old data as well. Greenback maintains two copies of your data on our platform - your original authoritative source data untouched and also what we index and display to you on the dashboard. Since your original data is still available, if you need us to undo a transform and change it back, we can. Greenback will soon have a user interface (UI) where you can build these on your own and apply them to your exports.

Tax Transforms

There will always be data not provided by your vendors and platforms. But we can surface that data if it's available and add anything that you need. We allow you to set rules for handling default tax settings and even region or market data fields that your accounting platform isn’t set up to handle. If you need to add a tax treatment (e.g. VAT/GST/HST/PST Inclusive or Exclusive, Zero-Rated, No Tax, etc.), or handle tax rates by country, add amount adjustments because of rounding or worry about mixed rates, we can build a custom rule for you. If you have tax inclusive sales and need to record the sales tax liability on your books, we can build a rule. Tax data is typically never provided by payment processors (e.g. Stripe, Etsy) because there was not a separate charge for it specifically so it needs to be reverse calculated. They do not provide all the data that you need or expect to be there.

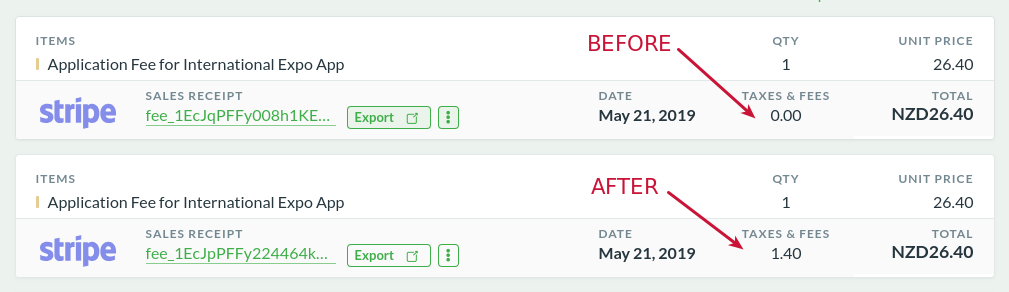

Here is an example of a Stripe transaction that doesn't show any tax data at all before it was transformed. The default settings on your accounting platform (e.g. Xero) are only for manually entered invoices. They weren't made for transactions imported from a payment processing platform like Stripe or Stripe Connect. Each one needs corrected by hand individually even though you have a default tax rate. If you are constantly frustrated with nuanced accounting problems like this one, let Transforms by Greenback enhance your transactions.

Duplicates and SKU Transforms

Every business is unique and there are many ways to handle transactions but an override can conflict with your settings on your accounting platform and wreak havoc on your books. They aren't designed for rules and exceptions---leaving lots of room for human error when the decision making is compounded and manually entered. However, Greenback can wrangle your structured data so you don’t have to worry about incorrect or missing values or duplicates. We can surface the missing data and also allow you to set criteria or exceptions depending on the SKU, product, or service (even when it’s missing).

Advanced Transforms

Transforms by Greenback can help with whatever you need to simplify your workflow and make your sales and expense data work for you with a custom fit. For example, we can automatically create a billable expense based on customer name/contact, shipping location, vendor etc.