Over the last five years, fintech has moved into the mainstream of financial services. According to EY’s 2019 Global Fintech Adoption Index, 64% of customers worldwide now use fintech-backed services, with 75% of them using money transfer and digital banking services and half using insurance tech. The use of finance and banking APIs is growing as well, with ProgrammableWeb showing 1956 financial APIs as of last year, with nearly 300 added in 2019 alone.

It’s happening because we’re living in a world of data. Today there is more and richer financial data available than ever before, but the challenge has become how to properly secure it, and use it to enhance the customer experience, inspire customer loyalty and as a result increase market share.

Some financial firms eager to embrace digital data will thrive. But for others, the digital revolution poses a real threat to their survival in the 21st century financial world.

For instance, Plaid is disrupting traditional banking by bringing tech integration to everything from transaction data, to account authorizations, to account holder information and more. Stripe is doing the same thing for payments, breaking open the black box system and giving small business users real insights into their sales and revenue streams. Even blockchain-based APIs are changing the game, redefining how digital records are stored and financial data is shared between institutions.

As more consumers choose to do their banking online and over mobile devices, traditional financial services from brick and mortar banks to card service providers are re-evaluating their business models.

The days of bank branches on every corner and bank tellers processing transactions are numbered. The future of banking is founded in consumer convenience and the need for quality data will be the cornerstone of the consumer banking experiences going forward.

The revolution in data delivery

The foothold that many fintech’s are exploiting is the liberation of financial data that has historically been unattainable. While companies such as Plaid have focused on the liberation of bank statement data, the real value will be found in the itemization of those transactions.

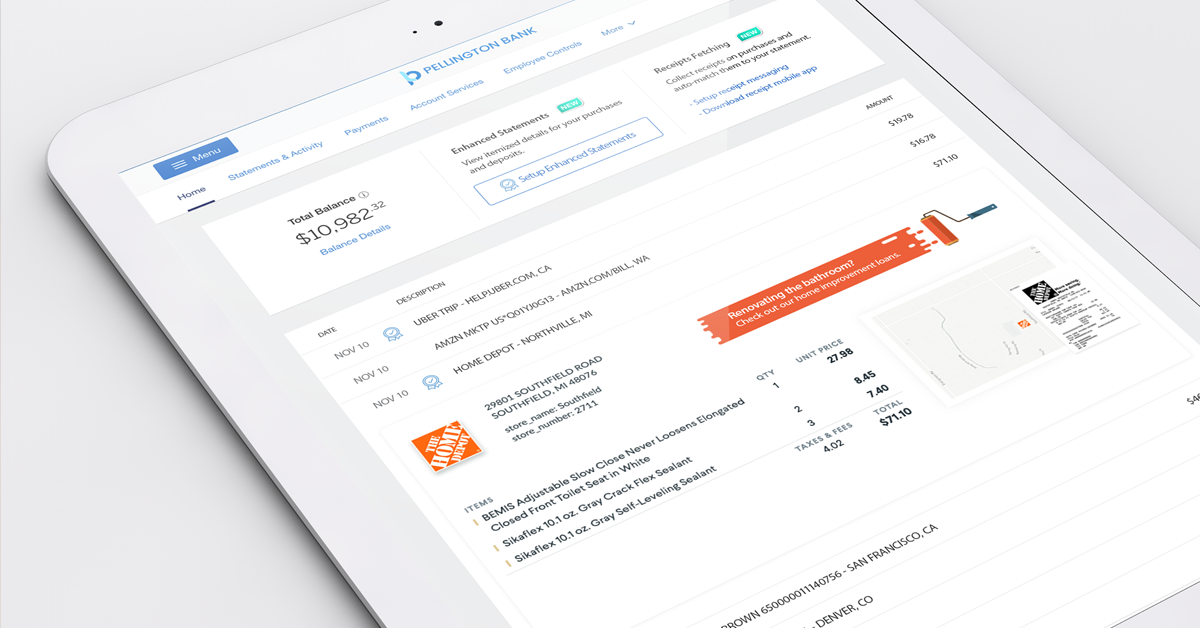

How often have you glanced over your very basic bank statements and wondered: What was that Amazon.com purchase and was in for my home or office? Or was this Uber trip for business or personal? How much of last night’s dinner bill was tip?

The ability to look beyond the bank statement line item to view the itemization of a purchase or deposit can empower financial services to provide the next generation of banking products and services.

Today, transactions are classified as either level 1, 2, or 3 based on how much data is transmitted to qualify each transaction, with more detail added as you move up the levels along with lower interchange rates for merchants. Level 1 is the most common and includes nothing more than an account number of credit card number, the card expiration date, billing address and zip code. Level 2 adds in the customer code, merchant name and location, tax amount of the transaction and tax identification, while level 3 adds in details like the shipped-from zip code, invoice number, item number, item description and more.

But, whatever the level, these datasets all fall short because, even though they’ve been around for a long time, they are still very lightly used and are all but unavailable to small- and medium-sized businesses. Even when they are used, the results are ugly. Just take a look at the average bank statement and try to make sense of what’s included for each transaction.

The better approach is to combine data from the payment network with data from authoritative sources such as the user’s email account (for receipt details) or directly from a retailer like Amazon. We call this high def financial data, or level 4, and the technology to unlock this capability at scale has finally arrived.

The potential use cases for level 4 data are varied. For instance, deeper data points can be used to automate complex accounting, automate expense reporting, improve consumer budgeting and improve internal fraud protection services. More detailed data mined from banking and credit card statements can be used for targeted marketing of new products and services. This includes promotional and loyalty offers that can save customers money, and at the same time boost revenue for savvy digital-banking firms.

Fintech firms essentially bridge the gap between the merchant and the bank by partnering with merchants to produce more detailed data about every transaction you make.

This can either be an opportunity, or a threat, for the big banks and traditional financial firms. In fact, a survey of banking executives found over one-third of them believe that online payment processors (like PayPal, Apple Pay and Square) or digital-only banks (like SoFi and ally bank) are the biggest competitive threat to their businesses.

The stakes for financial institutions are high

Today’s customers know what they want and their service expectations are high. Traditional banks need to reposition themselves in order to more easily integrate with other tech services and APIs in order to deliver on these expectations.

It’s already starting.

Major banks like Citi, Deutsche Bank and Bank of America, among many others, have built portals to provide more robust platforms for third-party developers to access and enhance the banks’ data using APIs to deliver expanded customer services 24/7/365. These institutions are also now offering customers the ability to easily share their own data from outside retailers, email accounts, etc for the purpose of improving the banking experience. As mentioned previously, this can help customers streamline their accounting, improve their budgeting and more, while helping the bank strengthen their relationships with those users.

This is where the Greenback API, and level 4 data, can help financial institutions step up and offer more to their customers.

Learn more about Greenback’s APIs at www.greenback.com.