Overview

There are many benefits for members of Home Depot's Pro Xtra loyalty program. You don't have to be a pro to participate either! Whether you are a contractor, property manager, or accountant, aren't you tired of hunting down receipts and scanning them or snapping photos for your construction accounting, tax compliance, or job costing? We'll show you how you can have your Home Depot Pro Xtra receipts automatically tracked for you every time you or your employees make a purchase.

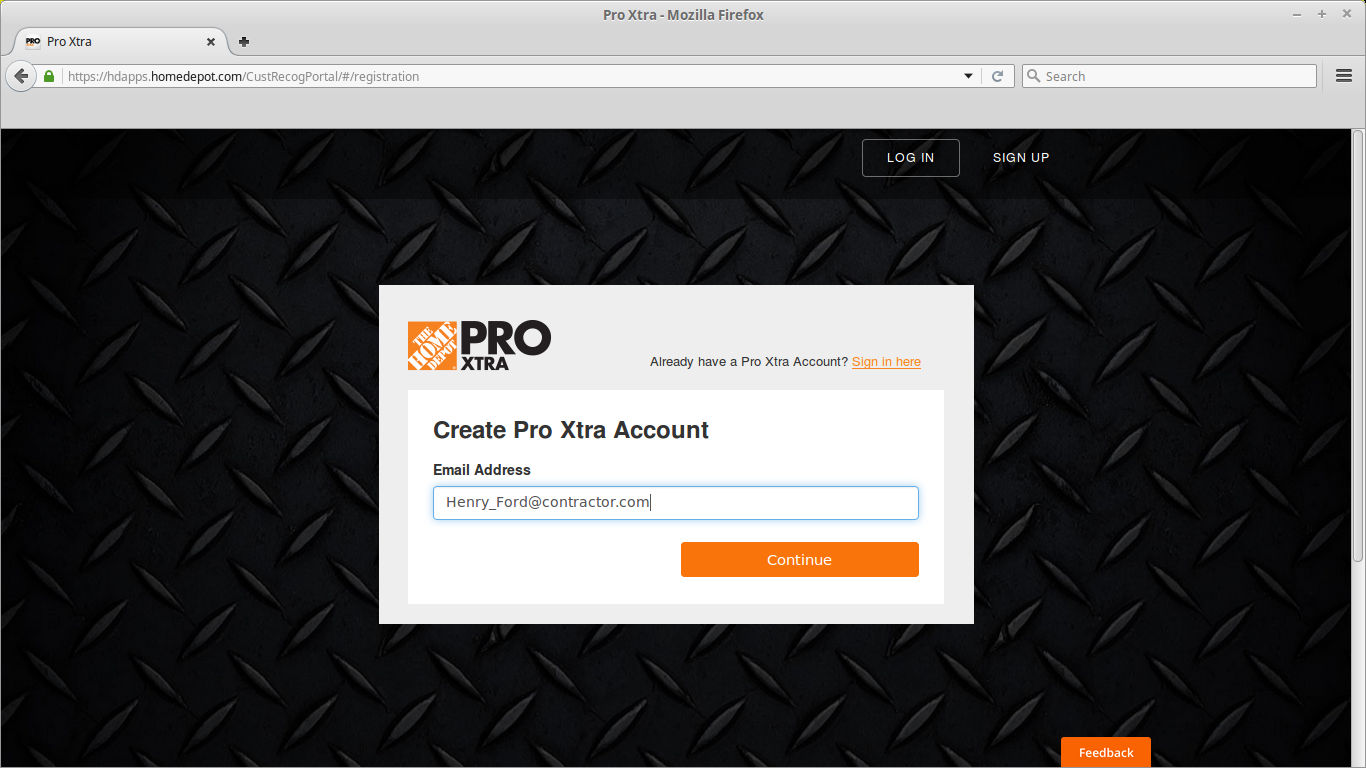

Create a Home Depot Pro Xtra Account

Open your browser and go to the Home Depot Pro Xtra Customer Portal to create your Pro Xtra Account. This automatically registers you for both a Home Depot Pro Xtra Account and a Home Depot My Account. You will have 2 accounts with matching login credentials unless you change it.

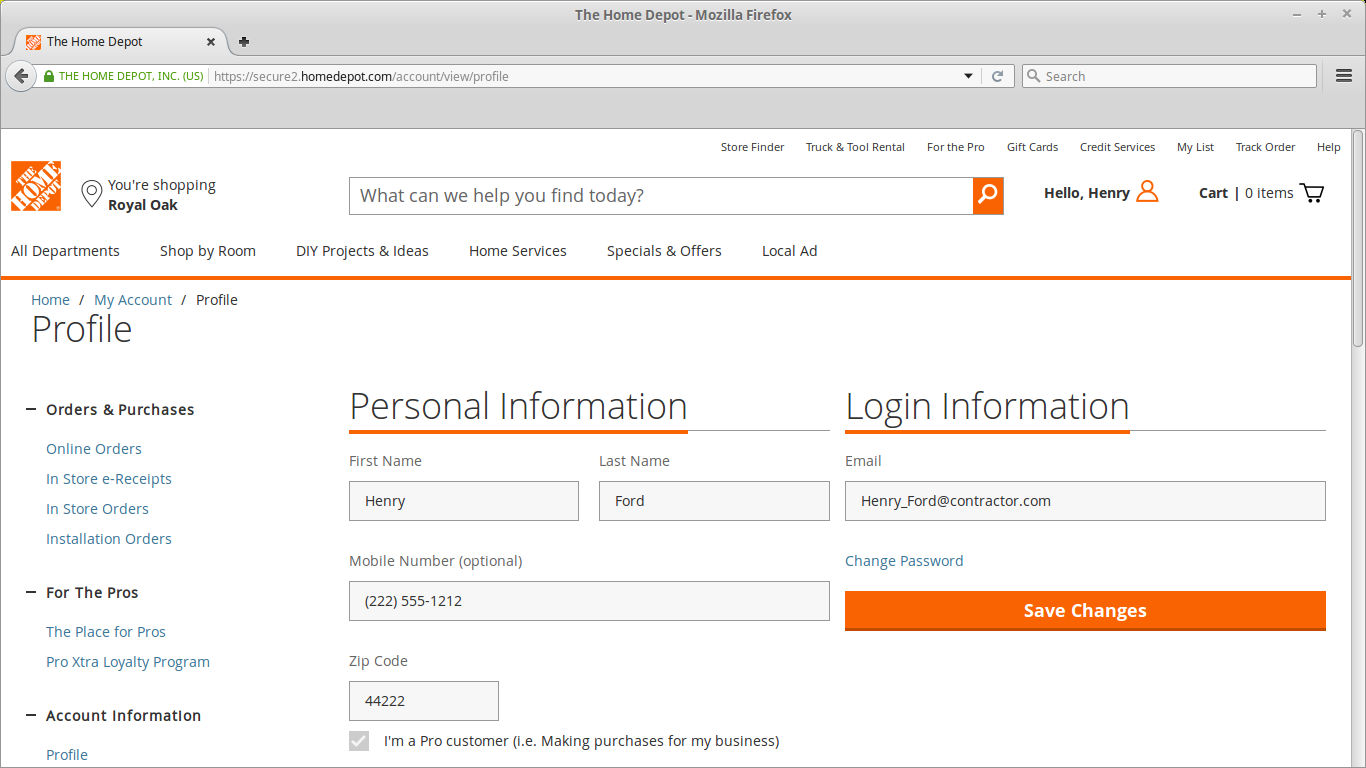

If you already have a Home Depot My Account, you can add a Pro account and keep your existing Login ID as your Pro Xtra Login ID. Just go to HomeDepot.com then click on “My Account” and click on your “Account Profile”. Check the box “I'm a Pro customer” and save changes to prompt a Pro Xtra account form. Complete the “My Account Registration”. You now have 2 accounts and are eligible for all the rewards, benefits, and discounts on paint, bulk supplies, tax exemptions and more for pros.

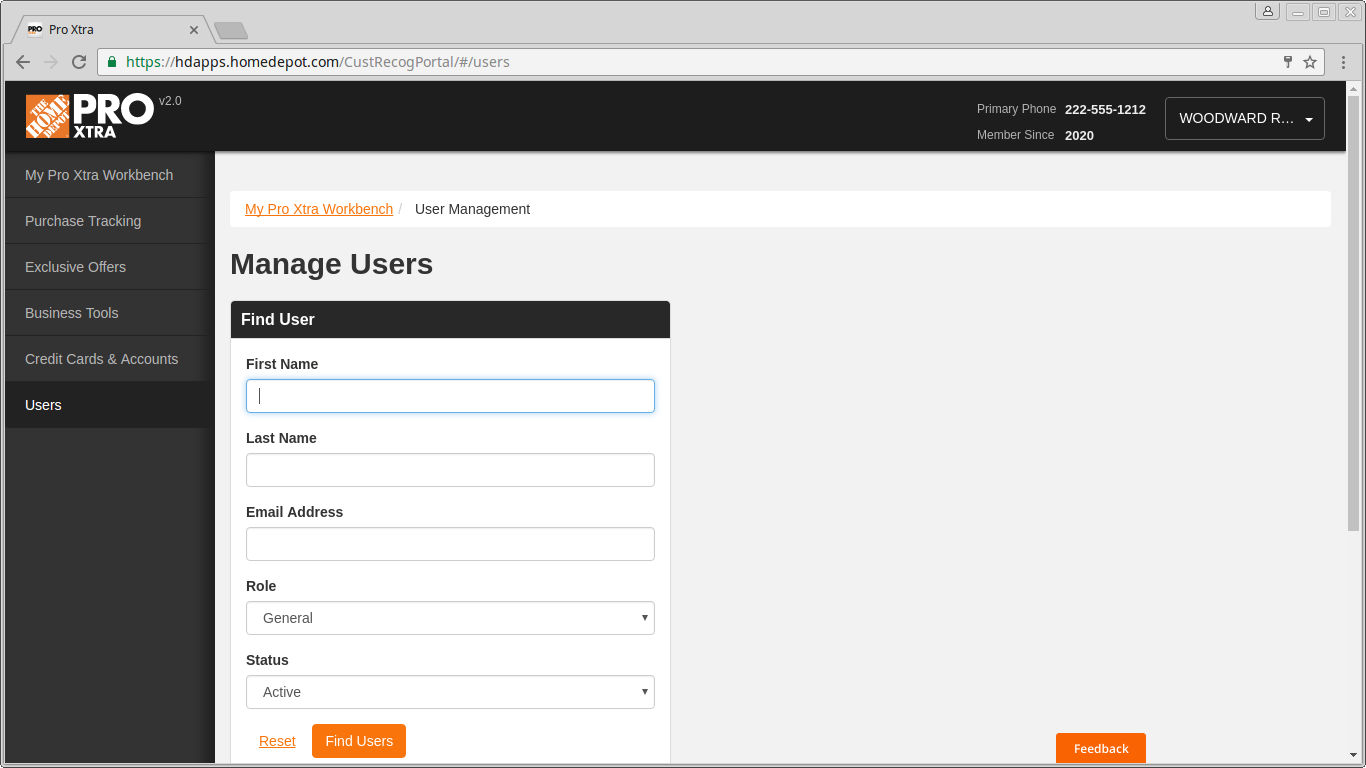

You can also have employees, contractors, etc. assist you with managing your account. Go to “Users” and add their name(s) and email address(es).

Add Your Credit Cards and Checking Accounts

Adding your cards is key for automating your transactions. Go to “Credit Cards & Accounts” to register your credit cards, debit cards, Pro Xtra Reloadable cards, gift cards, and your checking account. You can customize Authorization levels with Actions and Modify if you want to override the Default setting. Cards that you register in your Pro Xtra Account do not automatically appear in your regular Home Depot My Account unless you add the same cards there also. If you need employees to make purchases for you, you could give them Pro Xtra Reloadable cards to keep track of their purchases. Receipts can only appear in one account (duplicates are prevented), so you'll know it only landed in your account associated with their tracked card rather than also in a contractor's own account as well.

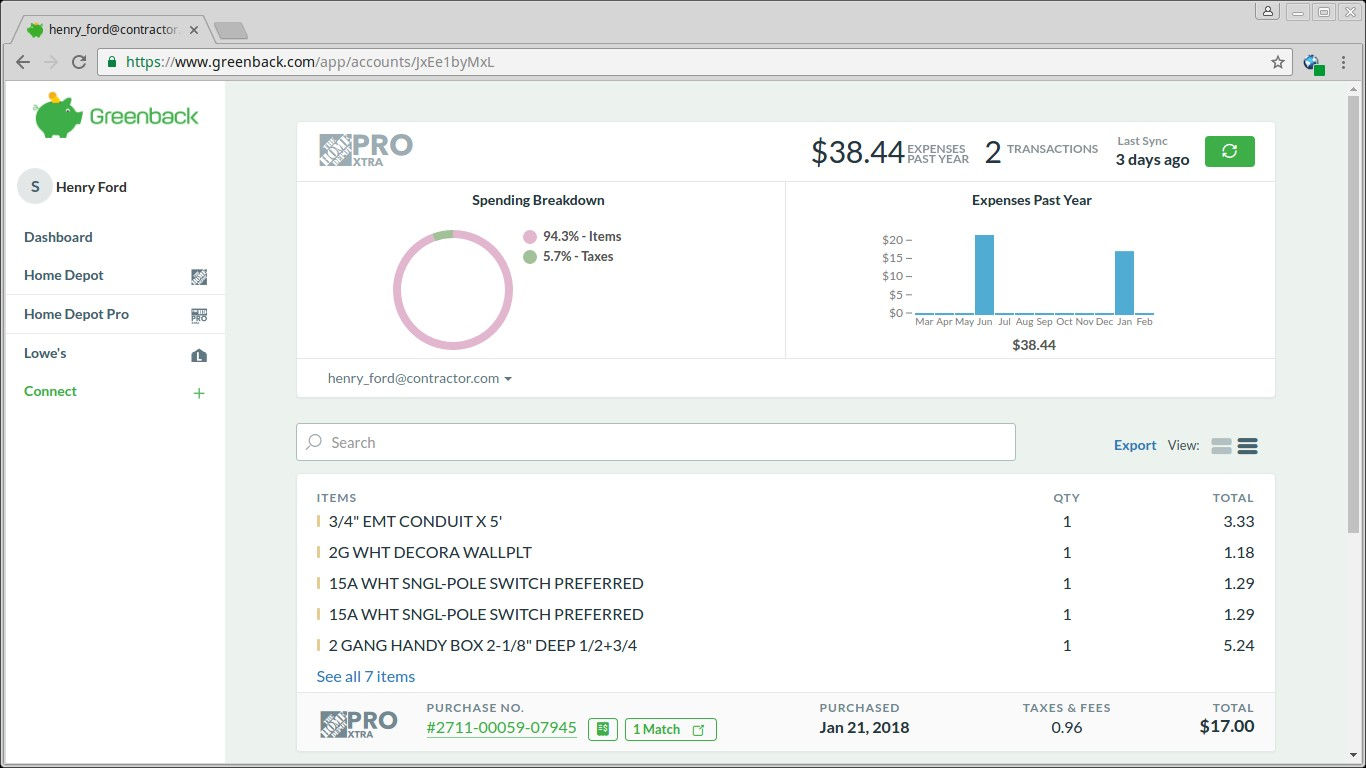

Automate with Greenback

Take your receipts to the next level by connecting your Home Depot Pro Xtra account to Greenback. Greenback automatically captures your receipt data from your Home Depot accounts, Lowe's, Menards, Amazon, eBay, and more on one dashboard and syncs them to QuickBooks or Xero. It's way easier to custom search, sync, or export with Greenback. And your bookkeeping will be hands-free since there's no manual data entry. Check out our Features to discover how receipts with an IQ can save you time and automate your accounting. Let's get started!

- Sign up for a Free or Premium Greenback account at Greenback.com.

- Connect your Pro Xtra account(s).

- Connect your accounting platforms. (Optional) That's it!

As soon as you connect your account, Greenback starts fetching your receipt data. You'll see your transactions immediately on your dashboard. For premium accounts, Greenback also supports billable customer, billable expense, class tracking, and locations/departments in QuickBooks and exports to Xero include billable expenses and tracking.

IMPORTANT: At checkout, always pay with one of your registered cards at the card reader or with a check. Enter your Home Depot ID# (If you didn't indicate one during sign up, the default is your phone number). Make sure to assign a Job Name or PO# if you have one. If you don't know or don't have one, just input something. That way you can always change it later if it isn't left blank.

What About Past Receipts?

Did you know that you can get receipts from discontinued credit cards, closed credit cards, reloadable Home Depot cards, and empty gift cards from the past 2 years from Home Depot? And you can get lost receipts paid by check from the past 90 days? This is a great feature for catching up on your record keeping or if you are looking for receipts that you need to reconcile.

Storing Receipts for Taxes

You need to retain your receipts for a minimum of 3 years or more for tax purposes yet most vendors have limited storage and only store your receipt data for 2 years or less. Why not control how long you store your own receipts and where? And aggregate all of your receipts from all of the places where your business shops the most rather than just one. You'll not only have a clearer view of your daily spending per Job Name or PO#, but you'll also improve tax compliance and be prepared for a pre-audit or tax-audit.

Home Depot® Branded Credit Cards

For more about Home Depot's consumer and commercial credit cards, read How to Automate Home Depot® Branded Credit Card Receipts

Pro Tip: Add your Home Depot cards to your loyalty account to track receipts paid by that payment method.

Apple Pay & Mobile Payments

For in-store purchases where they accept Apple Pay or other mobile wallets, transactions are basically anonymous and not tracked. Merchants never receive your identity or your actual credit or debit card numbers in their systems. Instead, your device is giving them a virtual account number. Nothing to identify you is stored on your device or on your mobile wallet service provider's servers to share with the store so it is not possible to track those receipts for you. It's similar to using cash. Greenback recommends sticking to regular credit/debit cards for in-store purchases so you can automatically track your receipts.