What is eBay Managed Payments?

eBay Managing payments is the new way to sell and get paid on eBay. eBay is following in the footsteps of other seller marketplaces such as Etsy and Amazon Seller by migrating to their own branded card processing and payment service. Today, eBay manages payments for thousands of sellers, with more joining every day. eBay Managed Payments will give sellers a consolidated payment service while giving buyers even more ways to pay. Automated payouts and deposits for all sales will now originate from eBay, regardless if the buyer paid via a credit card, PayPal account or Apple Pay.

Buyers have more payment options including credit, debit, and gift cards; Apple Pay; Google Pay; PayPal and PayPal Credit. You will no longer need a separate PayPal account - for buyers or sellers. Learn more about eBay Managed Payments here

What does this mean for my PayPal bank account in QuickBooks Online?

It means "Houston we have a problem". If you are currently relying on the PayPal bank account or a PayPal app from the QuickBooks app store to automate the flow of your sales data from eBay, you will now realize that most of your sales data is no longer flowing into QuickBooks automatically.

eBay sellers that have migrated to the Managed Payments service will now see all sales "clear" through the new managed payments service. Your direct PayPal accounts will no longer contain the sales data needed to automate the accounting of your sales.

How do I automate my eBay sales once I have migrated to eBay's Managed Payments?

Greenback simplifies accounting for your eBay sales. This article will help you get started using Greenback to automatically sync your accounting data from eBay Managed Payments to QuickBooks. Greenback auto-fetches your sales, sales related fees, refunds and reimbursements directly from eBay Managed Payments and syncs them to QuickBooks.

Let's start by connecting eBay

From the left navigation in Greenback:

- Click the Sales

icon.

icon. - Select New >> Sales.

- Press Connect on the eBay tile and Connect again.

You are redirected to eBay and instructed to authorize Greenback to connect to your eBay account. Once completed, you are redirected back to Greenback where an initial sync begins. You will start to see a few of your transactions flow into Greenback.

Let's also make sure you have QuickBooks connected

From the left navigation in Greenback:

- Click the Accounting

icon.

icon. - Select New >> Accounting.

- Press Connect on the QuickBooks tile and Connect again.

You are redirected to QuickBooks and instructed to authorize Greenback to connect to your account. Once completed, you'll be redirected back to Greenback.

Let's configure QuickBooks

Introduction to clearing accounts

In almost all cases, eBay Managed Payments will maintain a balance of funds on their platform for your products/shop. They act like any other bank account for your business. As a best accounting practice, you'll want to use clearing accounts within your accounting program to manage your sales transactions. A clearing account is no different than a bank account within your accounting program.

You may be tempted to manage your e-commerce sales by booking transactions to an “undeposited funds” account. However An undeposited funds account will not adequately address the numerous transaction types (sales, sales related expenses, refunds and reimbursements) nor will it simplify the process of reconciling payout deposits.

The solution is to configure a clearing account for eBay Managed Payments. Clearing accounts are configured the same way you would any other bank account within your accounting file. Clearing accounts will provide a clean way to manage the ledger, tracking your itemized sales, sales related expenses, refunds and reimbursements.

Lastly, as eBay Managed Payments makes payout deposits to your business bank account, you will simply treat those deposits as transfers from the eBay Managed Payments Clearing account to your business bank account.

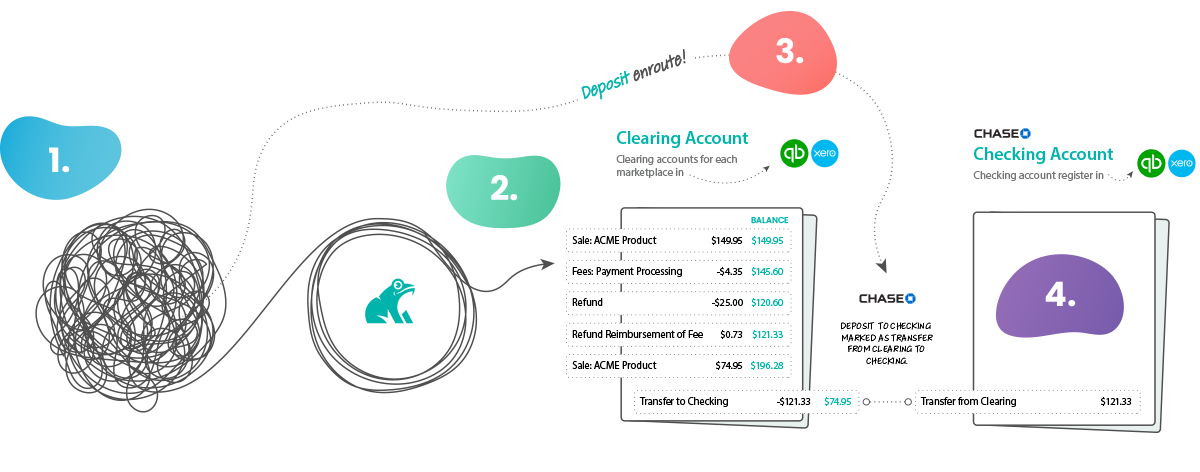

This illustration helps explain how Greenback uses clearing accounts

- Your data is messy. You sell across multiple marketplaces, payment providers & e-commerce sites. The first step is to create clearing accounts for each provider that collects funds.

- Greenback consolidates and normalizes your sales data including sales related expenses like payment processing fees.

- Export transactions to each clearing account within your accounting file

- You will categorize your payouts as transfers from the appropriate clearing account

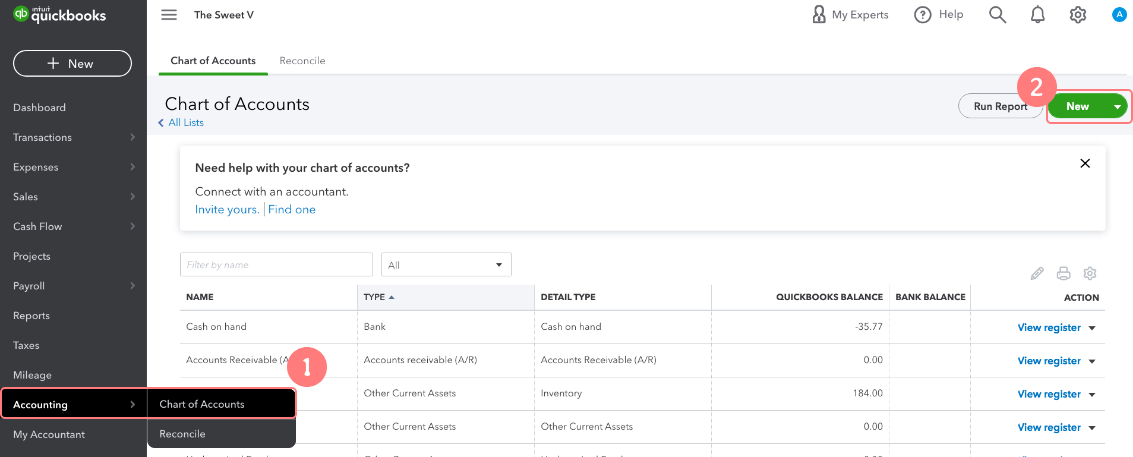

Create Clearing Accounts in QuickBooks Online

- Navigate to Accounting >> Chart of Accounts.

- Select New.

The Account popup window opens.

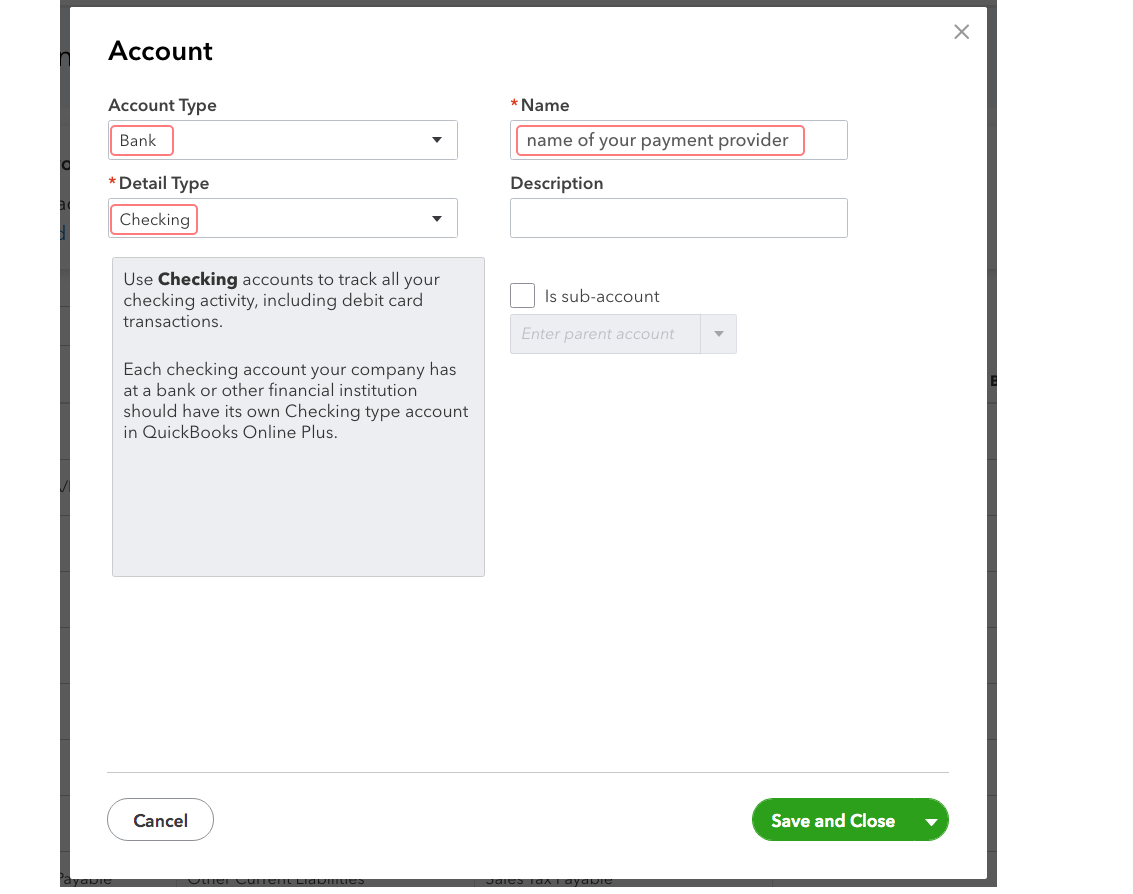

3. Create a new account with the following parameters:

Account Type: Bank

Detail Type: Checking

Name: eBay Managed Payments Clearing

The remaining fields are optional. QuickBooks Online may also ask when you want to start tracking your finances from the account. Choose an appropriate date. Unless otherwise instructed, set the beginning balance to $0.

- Click Save and Close.

Repeat these steps for each integration that requires a clearing account.

Expense accounts for seller related fees

eBay Managed Payments will charge you various fees for doing business on their platform. To simplify accounting for these fees, Greenback recommends creating a new operating expense account category titled "Merchant Processing Fees" to represent the merchant fees. Some businesses will account for merchant fees as a Cost of Goods Sold (COGS) or Cost of Sales (COS), but most accounting professionals we surveyed recommended that they be treated as a standard operating expense.

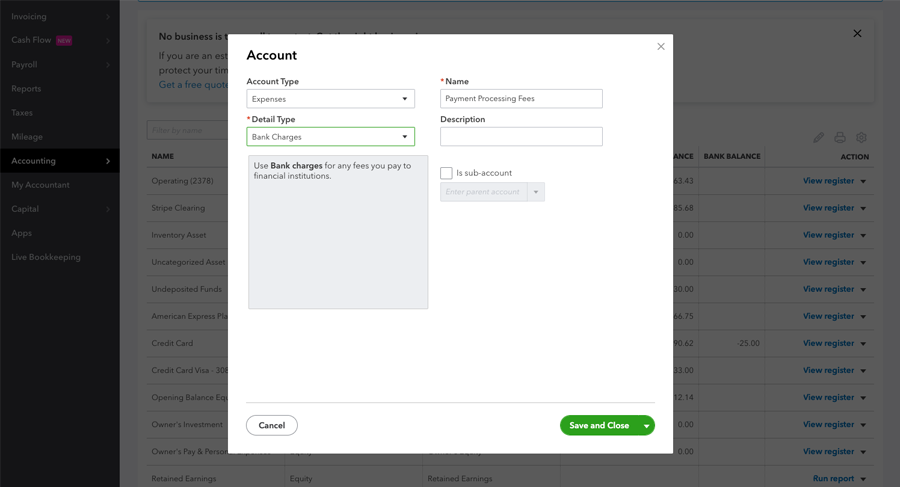

To create a new expense account in QuickBooks:

- Go to Accounting >> Chart of Accounts from the left navigation in QuickBooks

- Click the New in the top right corner of the page.

- Complete the form using the following:

Account Type: Expenses

Detail Type: Bank Charges

Name: Payment Processing Fees - Click Save & Close.

Would you like to match sales to the appropriate accounts using Product/Service SKUs?

When SKU matching is enabled, Greenback attempts to match the appropriate product/service in your accounting file based on the SKUs from eBay. SKU matching requires that the SKUs defined within eBay will match to the SKUs defined for your products and services in your accounting file. When SKU matching is disabled, Greenback will only match an item to a SKU if it was previously mapped.

SKU matching with Greenback will pass through the quantity if you have Inventory set up in your accounting file. For example, a sale of a product will decrease your inventory by one. A sales return would increase it. SKU matching can be configured from your accounting preferences section under your connected accounting file in Greenback.

For more information on SKU matching, check out our article on configuring your export preferences.

Exporting your sales & sales related expenses to QuickBooks

Introduction

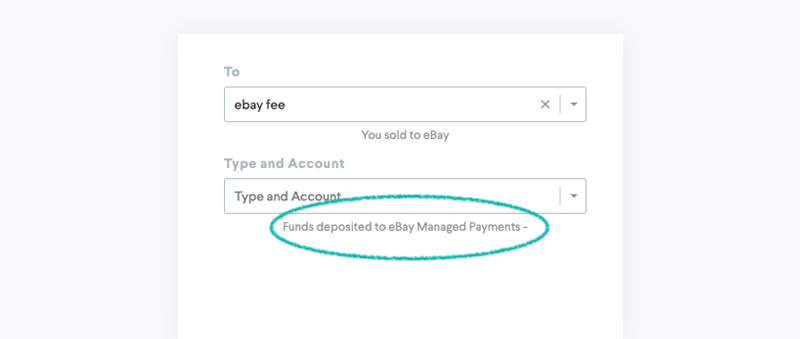

For those accounts that have migrated to the new eBay Managed Payments service, you will now see eBay transactions that have cleared via PayPal (historically) as well as eBay transactions that are now clearing via the eBay Managed Payments service. It's important to remember that you will want to export your eBay sales to the corresponding clearing account based on how the transaction was processed. In this case, eBay transactions that have historically cleared via PayPal will continue to be exported to a PayPal clearing account. eBay transactions that are now cleared via the new Managed Payments service will now export to an "eBay Managed Payments" clearing account.

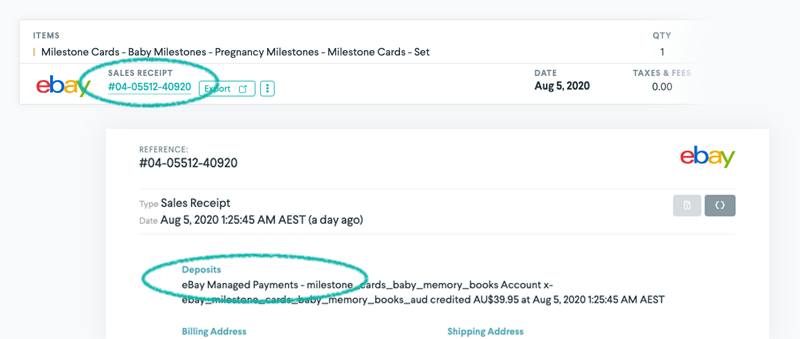

How can I tell which transactions are serviced with eBay Managed Payments?

It's easy to tell which transactions have been serviced via the new Managed Payments service. Simply view the details of any transaction and reference the Payment detail.

You can also review the payment method during an export (see below).

Reconciling your eBay payouts

Because you have already booked your eBay sales and sales related expenses to the clearing account, you will not be treating payout deposits as sales (as this would result in the overstatement of revenue). Instead, all payout deposits are treated as transfers from the eBay clearing account to your business checking account. Let's look at an example:

Brewery Supply Co has sold 145 orders of their brewing supplies over the past 30 days on eBay. The company has already exported from Greenback the details of each sale to the eBay clearing account within their accounting file. eBay has then deposited $12,900 to the business checking account. To categorize the deposit, the business has created a rule within their accounting file to treat all deposits from eBay as transfers from their eBay clearing account to their business checking account.

For more information on reconciling payouts, please read Reconciling & Categorizing Your Payouts.