Introduction

The vast majority of e-commerce sales are processed electronically by credit card or other digital payment tools. Sellers rely on a number of 3rd party providers to support their e-commerce sales including seller marketplaces such as Amazon, payment processors such as Stripe and PayPal and e-commerce platforms such as Shopify and Squarespace.

To properly account for your e-commerce sales, you need to maintain a ledger for each provider that collects funds from your customers. These providers should be configured much the same way you would a business checking account.

You may be tempted to manage your e-commerce sales by booking transactions to an undeposited funds account. However, an undeposited funds account will not adequately address the numerous transaction types (sales, sales related expenses, refunds and reimbursements) nor will it simplify the process of reconciling payout deposits.

The solution is to configure a clearing account for each provider that collects funds from your customers and makes payout deposits to your business bank account. Clearing accounts are configured the same way you would any other bank account within your accounting file. Clearing accounts provide a clean way to manage the ledger from each provider, tracking your itemized sales, sales related expenses, refunds and reimbursements.

If you sell on Amazon marketplace, to properly track your e-commerce sales and expenses, you need to configure a bank account within your accounting file titled “Amazon Marketplace Clearing.” You then configure all of your Amazon sales, expenses, refunds and reimbursements to export from Greenback to the new clearing account within your accounting file. Lastly, as Amazon makes payout deposits to your business bank account, you will simply treat those deposits as transfers from the Amazon Marketplace Clearing account to your business bank account.

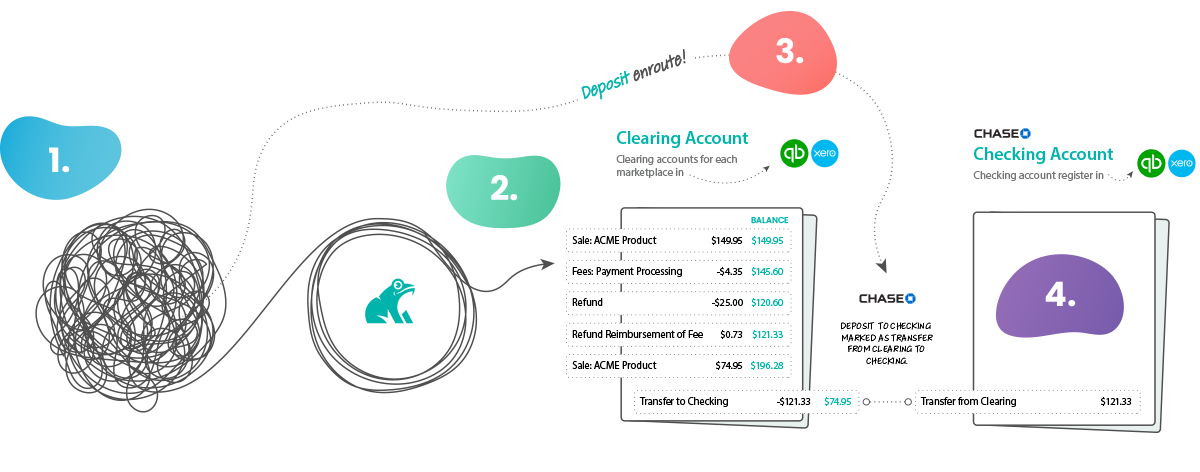

How it works

- Your data is messy. You sell across multiple marketplaces, payment providers & e-commerce sites. The first step is to create clearing accounts for each provider that collects funds.

- Greenback consolidates and normalizes your sales data including sales related expenses like payment processing fees.

- Export transactions to each clearing account within your accounting file

- You will categorize your payouts as transfers from the appropriate clearing account

Identify What Clearing Accounts You Need

You need a clearing account configured within your chart of accounts (COA) for each provider that collects funds from your customers.

Brewing Supply Co. sells brewing products online using a Squarespace e-commerce website. The company accepts both credit cards, processed by Stripe, and PayPal as acceptable forms of payment. In addition to selling on their own website, the company also sells their products on the Amazon Marketplace.

The company needs to set up the following clearing accounts:

- Stripe Clearing

- PayPal Clearing

- Amazon Clearing

Since Amazon is a seller marketplace, it utilizes its own payment processing and fulfillment services. Amazon will collect payment from your customer and make payouts to your bank account. We call this Branded Payments.

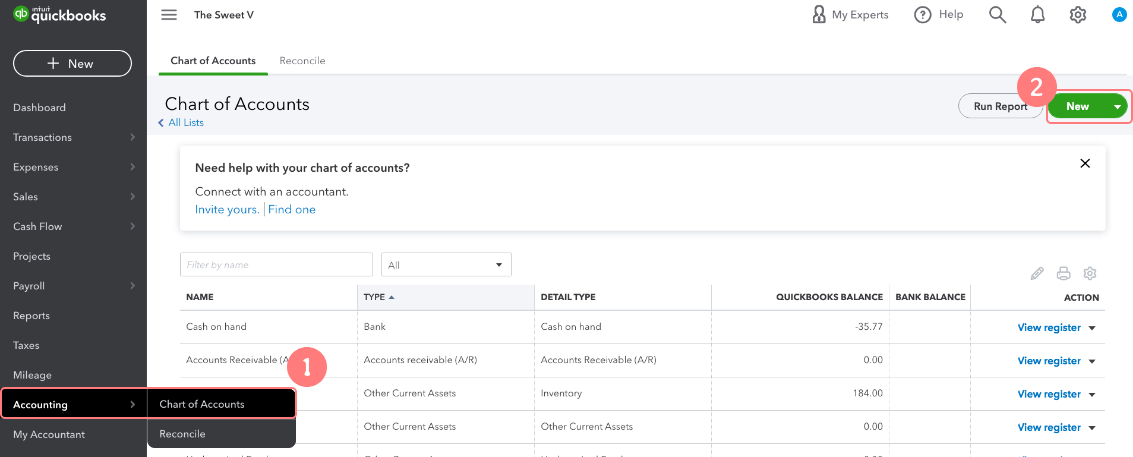

Create Clearing Accounts in QuickBooks Online (QBO)

- Navigate to Accounting >> Chart of Accounts.

- Select New.

The Account popup window opens.

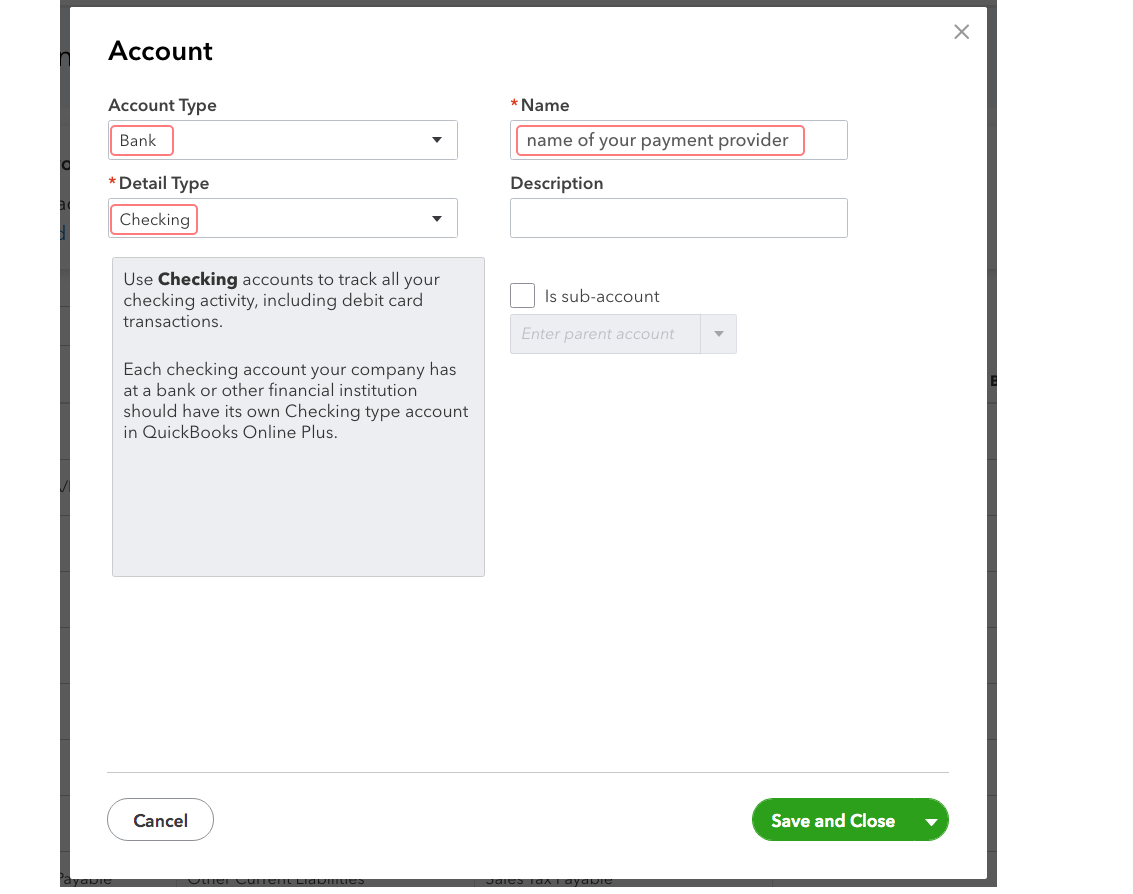

3. Create a new account with the following parameters:

Account Type: Bank

Detail Type: Checking

Name: Name of your payment provider, such as Stripe or PayPal followed by the word Clearing

The remaining fields are optional. QuickBooks Online may also ask when you want to start tracking your finances from the account. Choose an appropriate date. Unless otherwise instructed, set the beginning balance to $0.

- Click Save and Close.

Repeat these steps for each integration that requires a clearing account.

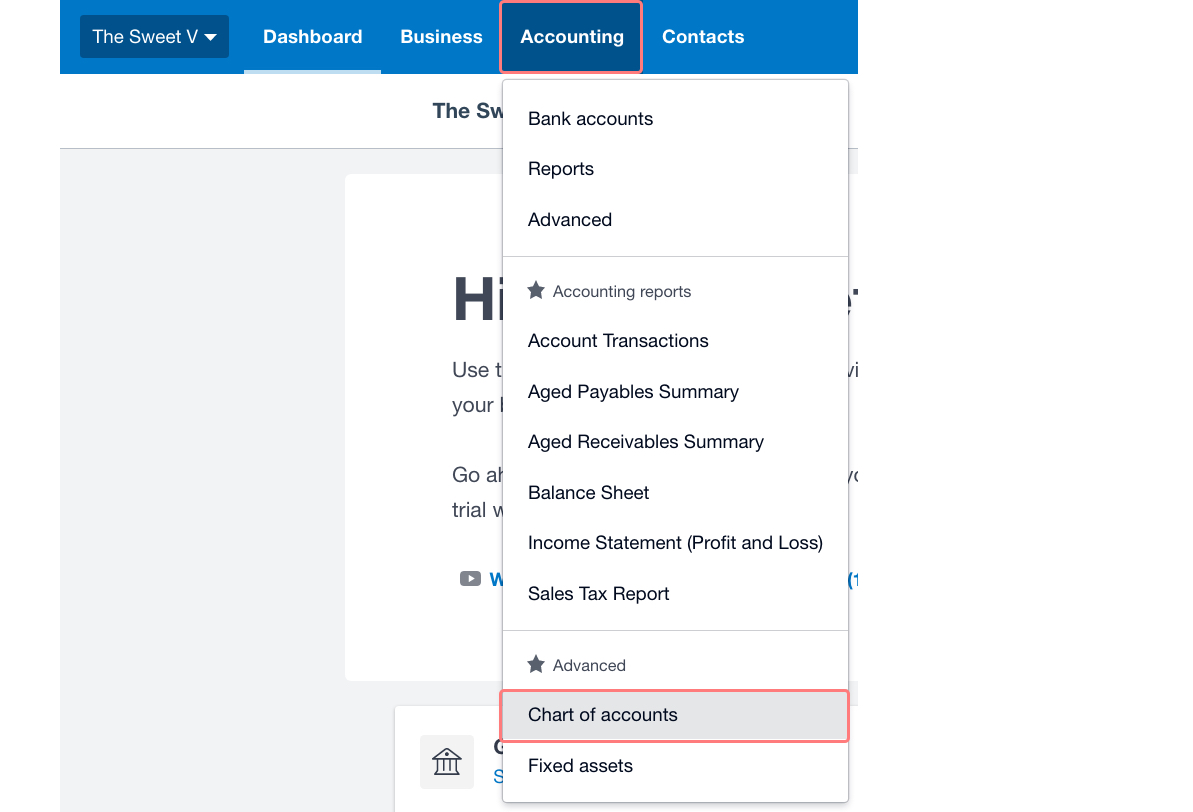

Create Clearing Accounts in Xero

- Navigate to Accounting >> Chart of Accounts.

2. Click the Add Bank Account

2. Click the Add Bank Account  button.

button.

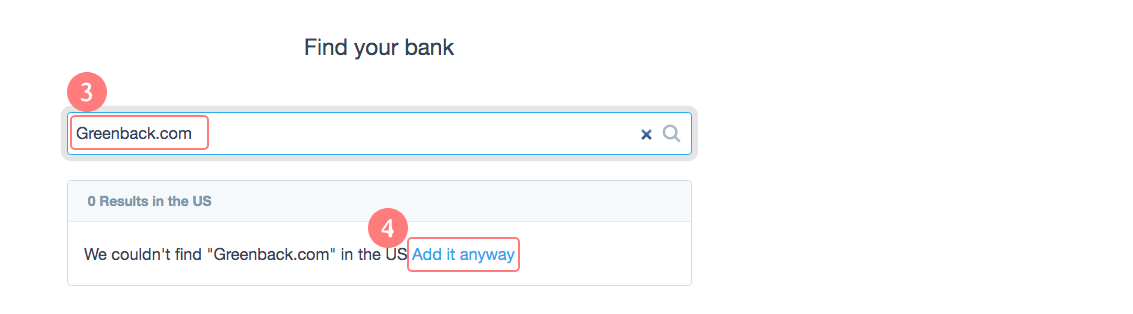

The Find your bank page opens.

3. Type greenback.com and hit Enter.

4. Select Add it anyway.

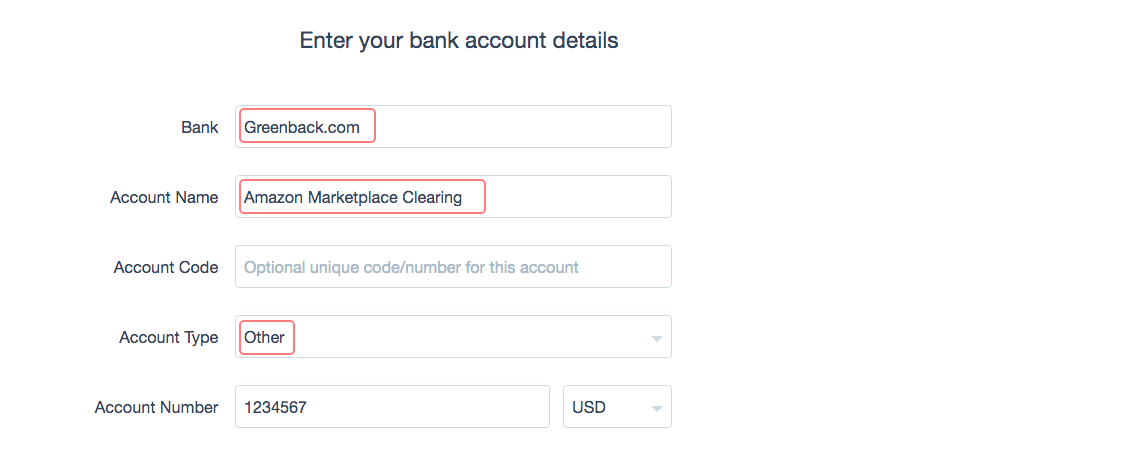

- Create a new account with the following parameters:

Bank: Greenback.com

Account Name: We suggest you use the integration name followed by the word Clearing.

Account Code: optional, complete at your own discretion.

Account Type: Other

Account Number: complete at your own discretion.

Currency: complete at your own discretion.

- Click Save.

Repeat this step for each integration that requires a clearing account.

Export Your Transactions

Now that you have clearing accounts configured, you can begin to export transactions from Greenback to your accounting file. For a more detailed guide on exporting your transactions, please check out the Export Data to Your Accounting File articles

Reconcile and Categorize Your Payout Deposits

Because you are containing all of your e-commerce related transactions to individual clearing accounts, categorizing your payout deposits is extremely easy.

In most all cases, payout deposits will not match up cleanly to specific sales transactions. The provider likely has rules that dictate how often and how much they pay out. This is often to protect them from charge-backs and refunds they may have to issue back to your customers.

Because you have already booked your sales and sales related expenses to the clearing account, you will not treat payout deposits as sales (as this would result in the overstatement of revenue). Instead, all payout deposits are treated as transfers from the appropriate clearing account to your business checking account.

Brewery Supply Co has sold 145 orders of their brewing supplies over the past 30 days on the Amazon Marketplace. The company has already exported from Greenback the details of each sale to the Amazon Marketplace clearing account within their accounting file. Amazon has then deposited $12,900 to the business checking account. To categorize the deposit, the business has created a rule within their accounting file to treat all deposits from Amazon as Transfers from their Amazon Marketplace Clearing account to their business checking account.