Updated January 20, 2021

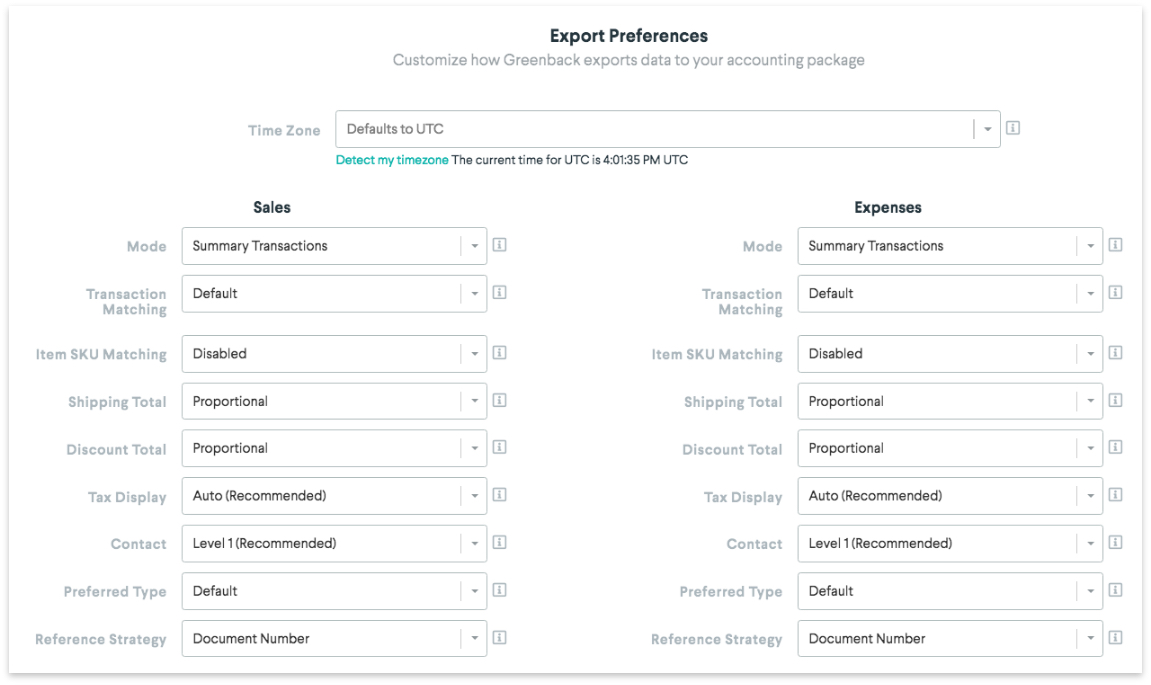

Introduction to Export Preferences

Your export preferences play an important role in how Greenback exports data to your accounting package. Each connected accounting program will have its own set of export preferences.

To configure your export preferences:

- Select the Accounting

icon and then choose your accounting program.

icon and then choose your accounting program.

If you need to add an accounting program see -> Connect Your Accounting Program

Preferences for Sales & Expense Transactions

Greenback gives you the option to configure your export preferences for sales and expenses differently. For example, you can itemize your sales transactions and export expenses in summary mode. Read on to learn more about mode.

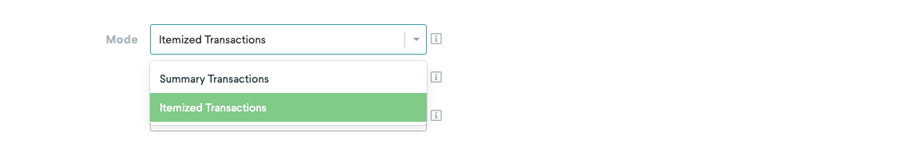

Mode

Greenback allows you to export transactions in one of two ways.

Summary Mode

With summary mode, a transaction is exported as a single line item, associated to a single account in your accounting file.

Example: An Amazon expense that consists of three different products is bundled into one expense category. The details of the order, including the description of all three items are combined into the Description field for the single line item expense.

Itemized Mode

With itemized mode, each line item within a transaction is separated and categorized separately.

For example, an Amazon expense that consists of three different products requires you to assign an expense category to each of the three items within the order.

You may manually override your export preferences when exporting transactions. Configuring your export mode will only define the default method for which you wish to export.

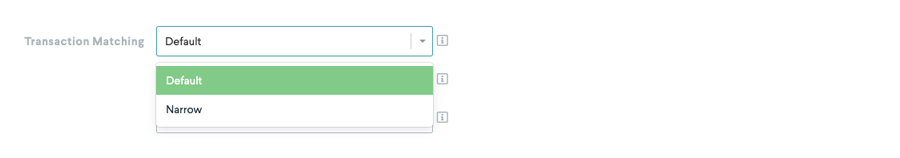

Transaction Matching

Greenback takes precautions when exporting data to your accounting file by identifying potential transactions that may already exist on your books.

Default

Transactions are marked as potential duplicates based on the transaction amount and the transaction date (within five days).

Narrow Matching

Transactions are marked as potential duplicates based on the transaction amount, transaction date and the reference number (order number, invoice number, etc.).

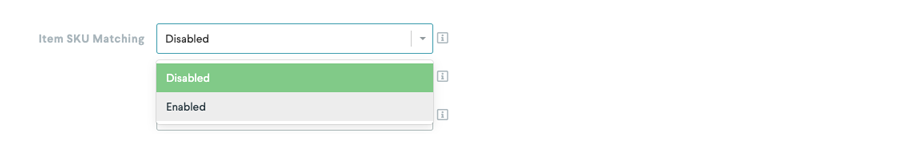

SKU Matching

SKU matching is a great way to automatically map transactions to an appropriate product or service item within your accounting program.

In many cases, Greenback has access to the underlining product SKU associated with your sales and purchases. When a SKU from the upstream provider matches a SKU within your accounting program, Greenback maps the line item to the appropriate product or service during export.

In many cases, Greenback has access to the underlining product SKU associated with your sales and purchases. When a SKU from the upstream provider matches a SKU within your accounting program, Greenback maps the line item to the appropriate product or service during export.

Disabled

When SKU mappings are disabled, your transactions are mapped according to your preset export mappings. Preset export mappings are defined automatically within Greenback based on previous exported transactions. If a pre-set export mapping does not exist, you are prompted to categorize the transaction.

Enabled

When SKU mappings are enabled, Greenback first attempts to categorize a transactions using the SKU data from the upstream provider. When a SKU is not present or Greenback is unable to map a SKU to a product/service item, Greenback attempts to map your transactions based on any pre-set export mappings. If a pre-set export mapping does not exist, you are prompted to categorize the transaction.

At any time, you may override the mappings and categorize a transaction manually.

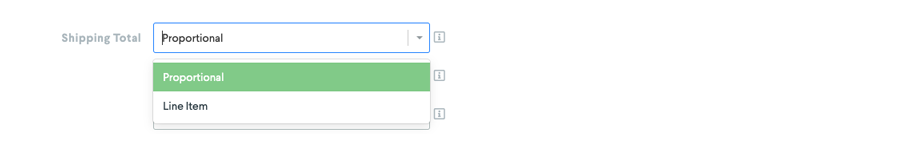

Shipping Totals

Greenback gives you the option to itemize ancillary elements within a transaction. One of these items is shipping revenue and shipping costs.

Proportional

If you do not wish to track shipping, you can choose to allocate the shipping revenue or expense proportionally across all line items in a transaction during export.

Sales Example: You sold three widgets to a customer at a cost of $15 each and charged your customer $9.00 for shipping. With proportional shipping configured, each line item on the order is allocated $3.00 of the shipping revenue for a total of $18 per line item.

Expense Example: You purchased three books from Amazon at a cost of $6.00 each and Amazon charged you $6.00 for shipping. With proportional shipping configured, each line item on the order is allocated $2.00 of the shipping expense for a cost of $8.00 per book.

Line Item

Alternatively, you can choose to export shipping revenue and expenses on its own line item. This method gives you the ability to associate shipping revenue and expenses to its own account during export.

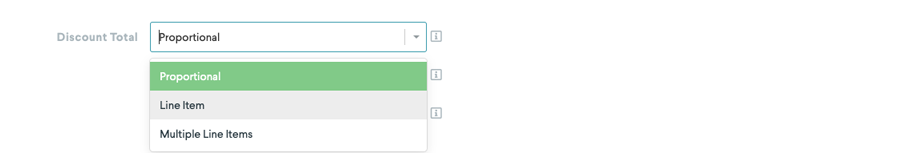

Discount Totals

Greenback gives you the option to itemize ancillary elements, such as Discounts, within a transaction. Greenback provides three methods for handling discounts that may exist within a sales or expense transaction.

Proportional

With the proportional method all discounts are allocated proportionally across line items during export.

Example: You purchased three books from Amazon at a cost of $6.00 each and Amazon provided you with a $3.00 discount. With proportional discounts configured, each line item on the order is allocated a $1.00 discount for a cost of $5.00 per book.

Line Item

With the line item method all discounts on an order are bundled and exported as a single, grouped line item. This method gives you the ability to associate all discounts to a single account during export.

Multiple Line Items

With the multiple line item method all discounts on an order are provided their own line item during export. This method gives you the ability to associate multiple discounts on an order to different accounts during export.

Sales Example: You sold three widgets to a customer at a cost of $15 each and provided your customer with a $3.00 discount. The customer also used a promotion code for an additional $1.00 off. With multiple line items configured, each discount on the order is allocated its own account, giving you the ability to export the $3.00 discount to a general sales discount category and the $1.00 promotion code to a promotion code discount category.

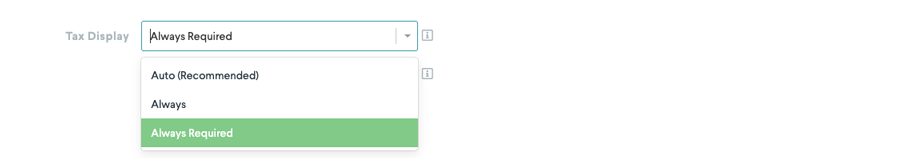

Tax Display

Managing taxes on your sales and expenses is both easy and robust with Greenback. The tax display setting provides three ways to configure how Greenback presents tax items during export.

Auto

The Tax Display field only displays if tax is present on the transaction and is greater than zero.

Always

The Tax Display field always displays even if tax is not present. The field is optional if there are no taxes present on the transaction and required if tax is present and greater than zero.

Always Required

The Tax Display field is always displayed and required regardless of whether tax is present and greater than zero.

Contact or Customer Records

When exporting transactions from Greenback to an accounting program, Greenback attempts to match a transaction to an existing customer or vendor contact. When a match cannot be made, Greenback creates a new contact within your accounting file during the transaction export process. Greenback can create contacts using one of two methods.

Level 1 Contacts

Greenback matches or creates the primary contact (Customer/Vendor) based on the source of the transaction (e.g. Amazon, Etsy, Stripe, etc.). Level 1 contacts are recommended if you have a large number of transactions and prefer to keep your contact lists small within your accounting file.

Level 2 Contacts

Greenback matches or creates a new contact using the secondary contact on the transaction (e.g. your buyer or seller name). Level 2 contacts are helpful for e-commerce sellers that prefer to associate sales with their customer names within the accounting file.

Some accounting packages are designed to handle a smaller numbers of contacts ; therefore, Greenback generally recommends Level 1.