Connecting your Account

You'll need to authorize Dext Commerce to connect the Amazon Seller Marketplace account. Follow the simple steps below:

In order to use Amazon Seller with Dext Commerce, your account must meet the following requirements:

- You must have Super-Admin (store owner) access

- You must have a Pro Seller subscription and be using Amazon Seller Central Marketplace or Amazon Handmande

- You will need to do provide access for each region you intend to connect.

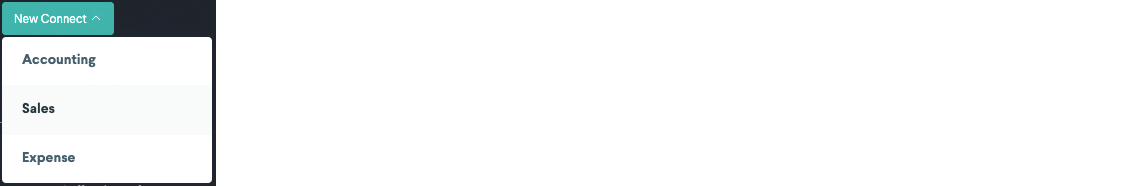

- In the sidebar, navigate to Sales > New Connect and select Sales

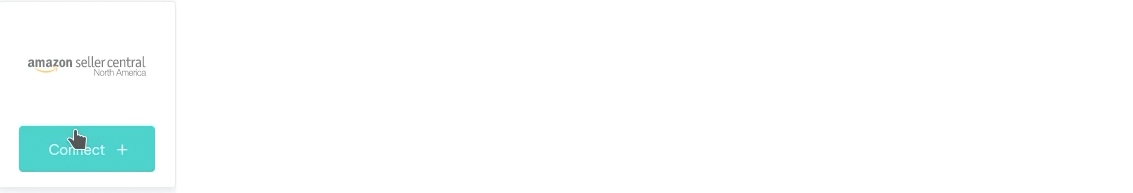

- Choose Amazon Seller Central with the region you wish to connect.

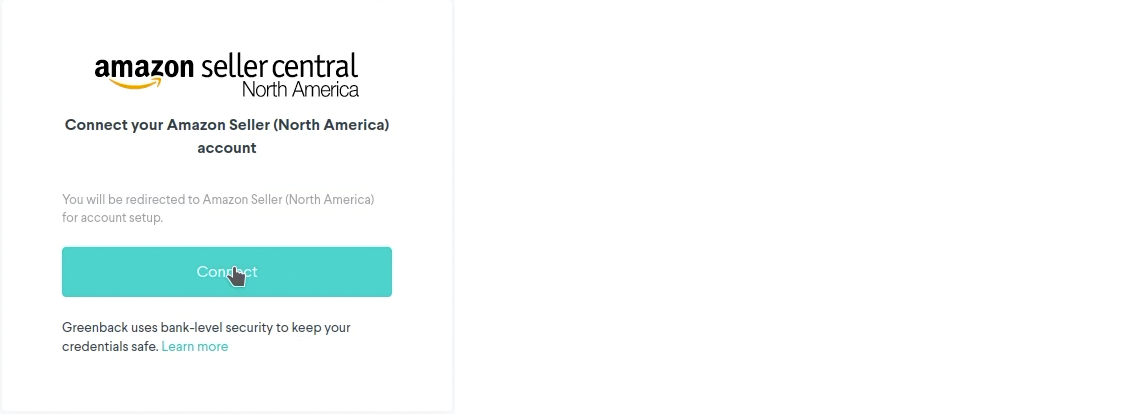

- Select Connect

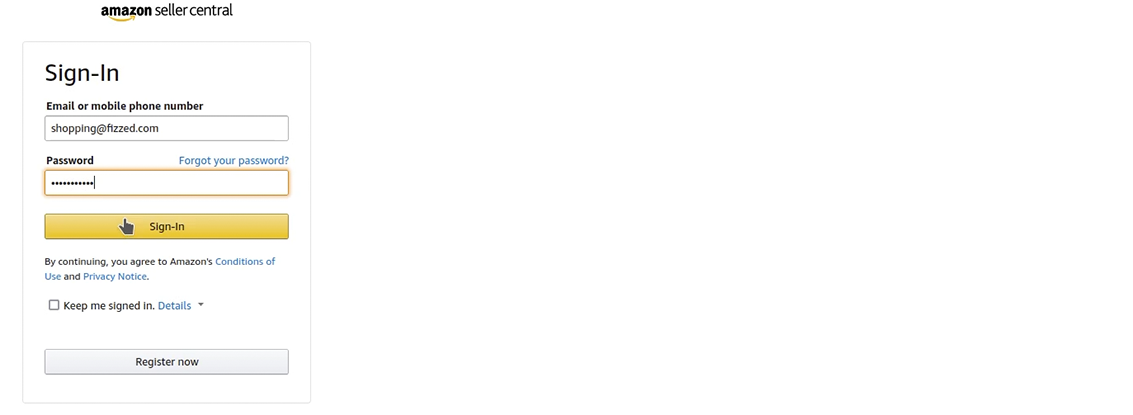

- You will be redirected to an Amazon Seller authorization page. Enter your Amazon Seller credentials and select Sign-In

- Review the terms, and check the authorization box at the bottom. Then select Confirm

- Commerce will begin to fetch your transaction data.

Supported Regions

Commerce currently supports all regions in which Amazon Seller Central operates. Those regions are:

- North America (Canada, Mexico, United States)

- Australia

- Brazil

- Egypt

- Europe (UK, Italy, France, Germany, Netherlands, Poland, Spain)

- India

- Japan

- Saudi Arabia

- Singapore

- Turkey

- U.A.E

How to Unarchive Amazon Statements

If you need Amazon Seller Central statements containing transactions older than 90 days, you need to request them from Amazon. By default, Amazon archives statements after 90 days.

Follow these steps to unarchive your Amazon Seller Central statements:

- Login to your Amazon Seller account

- Click Reports > Payments

- Click All Statements

- Locate the desired time frame(s) then click Request Report

Important Note: Make sure you find ALL the reports for your requested time range, or our system will not be able to pull your requested data.

Keep in mind that settlement reports may have beginning dates before the dates you request, those reports will need to be unarchived as well. Additionally, keep in mind that all reports for your requested time frame will need to be unarchived. For instance, if you use Amazon Seller Europe, and request historical data for your UK Amazon store, you will still need to check Amazon FR and Amazon DE etc. to see if any Amazon reports need to be unarchived for the requested time period, even if you don't typically sell in those regions. Another place that reports may be hiding is in the dropdown for "Account type", there may be a report for a single invoice based sale, even if you don't typically do business in that way

Once unarchived, Greenback is able to access the transactional data. Amazon will archive them again in 90 days, but the data will now remain in Greenback.

While they are accessible, you are essentially sharing them with Greenback just like they were new transactions being auto-fetched for you. There's no need to worry about duplicates; Greenback always searches for matching transactions and prevents them.

Catch Me Ups

If you are in need of your historical transactions, Commerce can gather those for you. Amazon Seller Central archives your statements after 90 days. If you require data beyond this archive period, you must unarchive those reports from your Amazon Seller Central account.

Learn more about unarchiving your statements

Learn more about gathering your historical transactions

Your Data

Commerce gathers all data associated with each transaction from connected integrations. Amazon Seller Central provides:

- Normal transactions

- SKUs

- ASINs

- Shipping Addresses

- Buyer names

- Buyer email addresses

- Order state (Open, Closed)

- Taxes

- Fees

- Commissions

- Fulfillment

- Shipping

- Storage

- Facilitator

- Sales reference IDs

Amazon Seller Central data does not include:

- Billing addresses

- Advertising Fees

Additional Info

ASINs vs. SKUs

Commerce treats ASINs the same as SKUs. This information will be gathered and associated with their respective transactions.

Order Fulfillment

Commerce supports the following fulfillment options from Amazon Seller Central: * Fulfilled By Merchant (FBM) * Seller Fulfilled Prime (SFB) * Fulfilled By Amazon (FBA)

Once your Amazon Seller Central integration is connected, there is no additional work required to gather fulfillment data/ Commerce will gather the fees associated with Amazon’s fulfillment options.

Amazon Fresh

Commerce does not currently support expense transactions from Amazon Fresh.

Amazon Handmade

Commerce supports Amazon Handmade. Associated transactions will be available as part of your Amazon Seller Central transactions.

Australian GST

You remain responsible for collecting and remitting GST on goods you sell that you ship from within Australia if you meet the GST registration threshold. Several marketplaces, including Amazon.com.au do not collect GST if you're an Australian company shipping to Australian customers. We highly recommend reviewing your sales data to fully understand what your seller marketplace is doing on your behalf with regard to GST.

If your marketplace is not collecting GST and you are required to submit GST, be sure to inquire about a GST Transform. A GST transform from Commerce will transform your sales data to itemize out the required GST prior to exporting your sales to an accounting program. This will allow you to accurately report on the GST liabilities within your accounting system.

Disputes

Commerce displays fees associated with disputed transactions as a Purchase line item in our data feed.