Introduction

This article is a great place to start for e-commerce sellers that need guidance on how to account for sales tax, value added tax (VAT), goods and services tax (GST), harmonized sales tax (HST), provincial sales tax (PST) or marketplace facilitator taxes.

Sales Taxes

Greenback works hand in hand with your accounting program

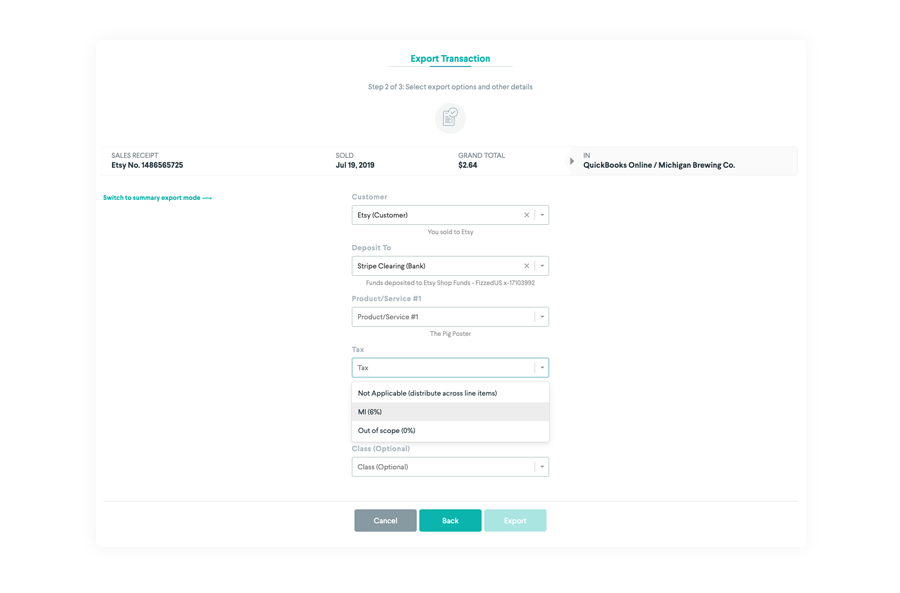

When exporting transactions Greenback will ask you to choose the appropriate tax code from a list of supported tax codes configured within your accounting program. To help you choose the correct tax code, Greenback will also display the tax jurisdiction and tax rate from the transaction as provided by the upstream provider.

Tax code memory mappings

To help automate the assignment of tax codes, Greenback works hand in hand with your accounting program to map sales taxes to the appropriate accounts during export. Greenback will look for previously exported sales transactions that match the postal code of the current transaction and default to the appropriate tax rate/jurisdiction. Sales tax rate mappings can be overwritten at any time by manually defining a different tax rate from the drop menu.

Learn more about how Greenback, in partnership with your accounting system, accounts for sales taxes:

-> Sales tax for e-commerce sellers

VAT Taxes

Similar to sales tax, Greenback works hand in hand with your accounting program to map value added taxes (VAT, GST, HST and PST) to the appropriate accounts during export. Greenback will look for previously exported sales transactions that match the VAT code of the current transaction and default to the appropriate tax rate/jurisdiction. VAT tax rate mappings can be overwritten at any time by manually defining a different tax rate from the drop menu.

Learn more about how Greenback, in partnership with your accounting system, accounts for VAT, GST, HST and PST:

-> Value Added Tax (VAT) for e-commerce sellers

Marketplace Facilitator Taxes

A Marketplace Facilitator is defined as a marketplace that contracts with third party sellers to promote their sale of physical property, digital goods, and services through the marketplace. This means most of the selling platforms today including Amazon, eBay, Etsy, Walmart and many more, will collect the appropriate sales tax on your behalf.

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from a third party seller to the marketplace facilitator. The marketplace facilitator will now be responsible to calculate, collect, and remit tax on sales sold by third party sellers for transactions destined to states where Marketplace Facilitator and/or Marketplace collection legislation is enacted.

Learn how Greenback can help you account for marketplace facilitator taxes: