Introduction

This article will take you through all the elements of transaction data on Greenback. To view the details of a transaction:

- Select the Transactions

icon.

icon.

Expense Transactions

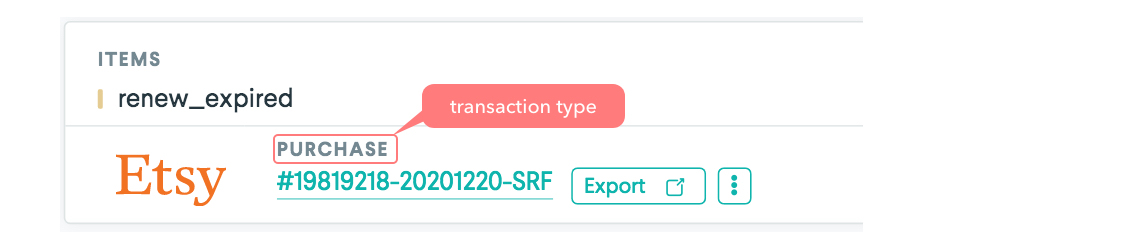

An Expense in Greenback consists of three different transaction types: Purchase, Bill, or Reimbursement. The transaction type shows on each transaction.

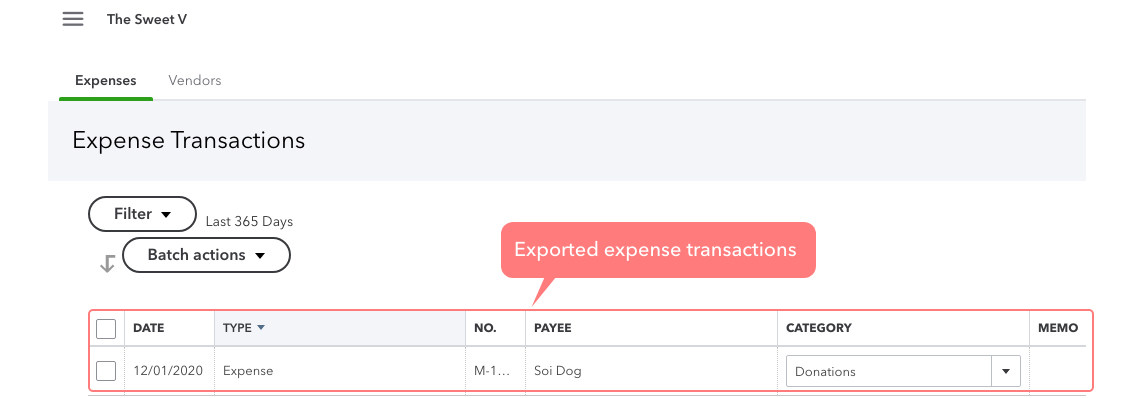

When you export an Expense from Greenback to QBO, each type will map to an expense transaction in QBO.

Sales Transactions

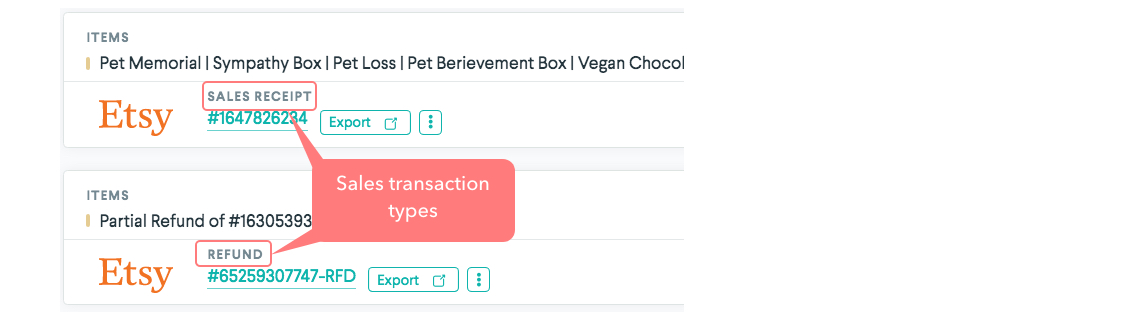

A Sale in Greenback records both the sale and the payment. A Sale consists of two transaction types: Sales Receipt or Refund. When you export a Sale from Greenback to QBO, each type will map to either a Sales Receipt (immediate payment) or a Refund in QBO.

Transaction Details

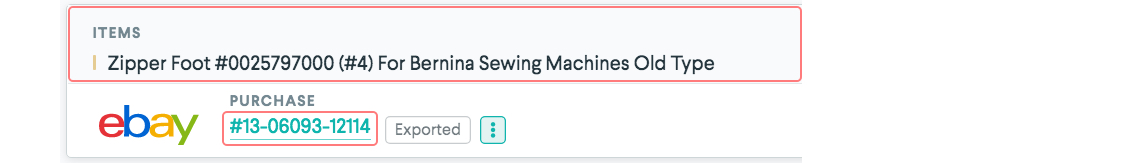

- Click anywhere in the Items area or the transaction number.

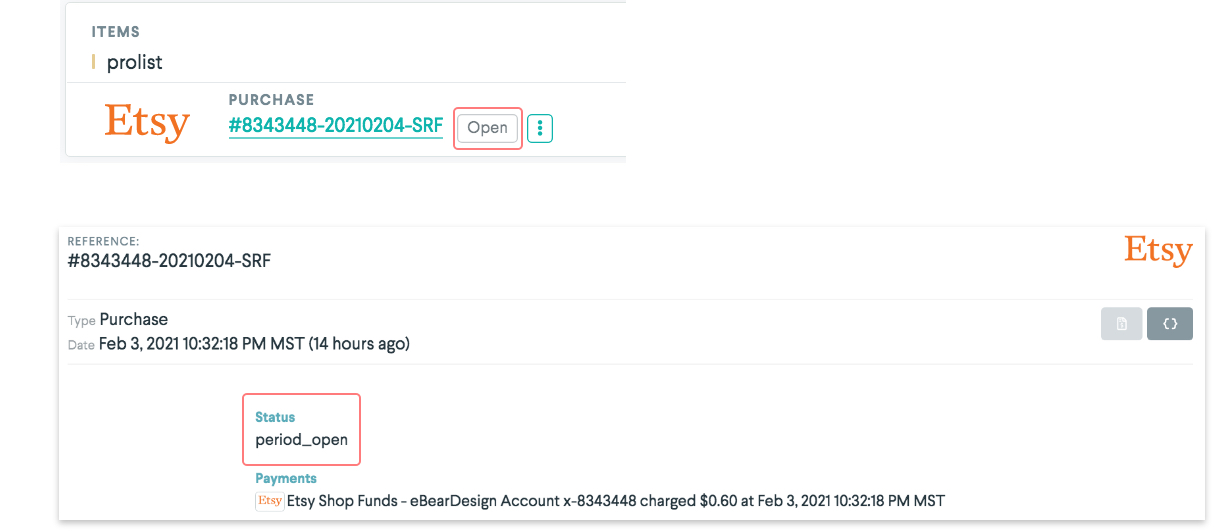

Transaction Status

If a transaction is not in a final state the transaction status shows. Open transactions are not exportable.

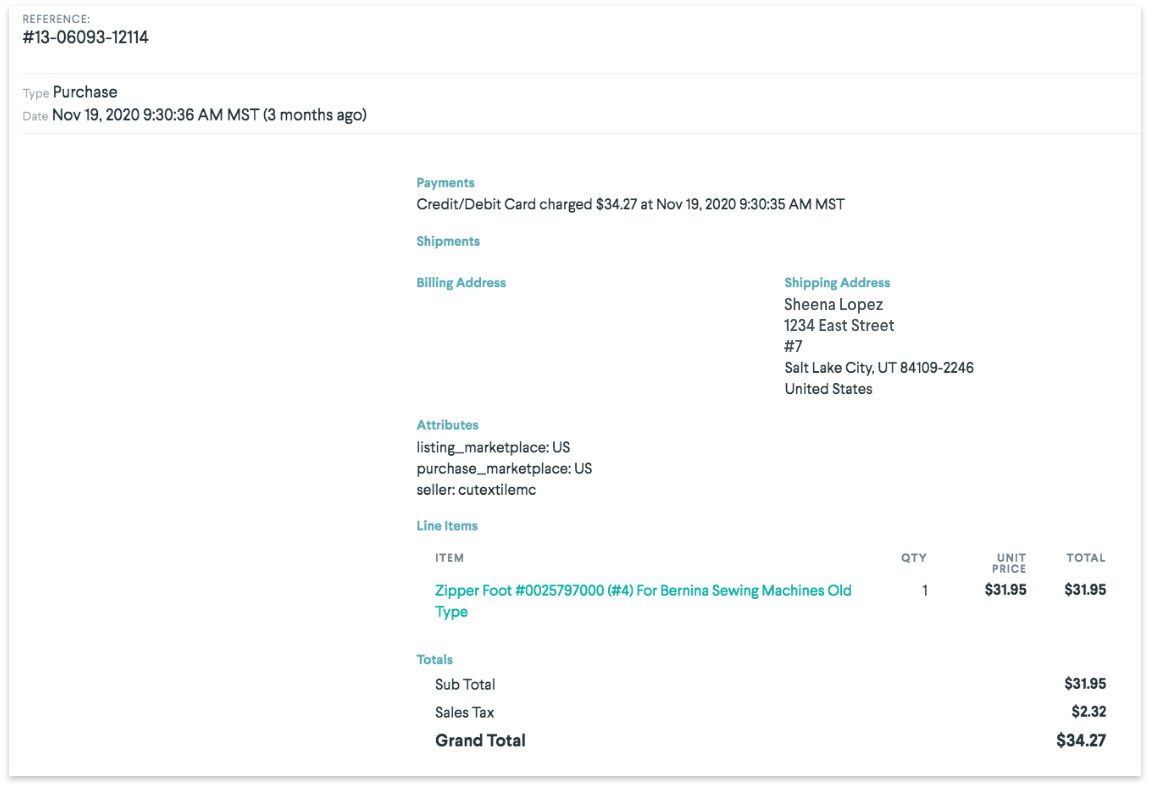

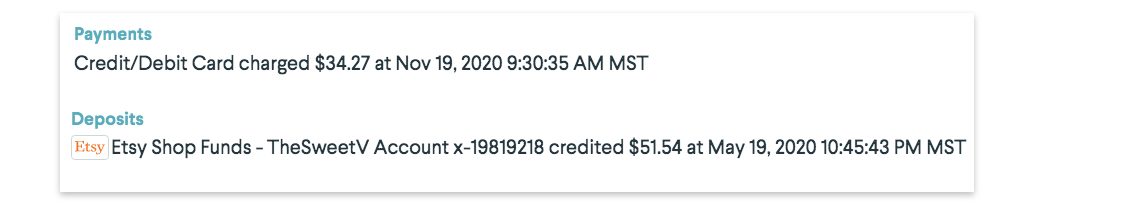

Payments & Deposits

The Payments section includes the payment type (card type, Etsy funds, etc.), the last 4 digits of the card (if used), the amount charged, and the date of payment. The Deposits section includes the account, amount, and date of payment.

For transactions with multiple payments, you will see each payment listed.

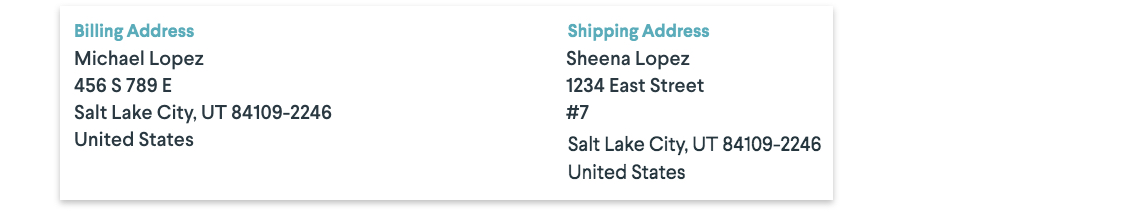

Customer Info

The customer/contact record on a Greenback transaction consists of name and address. Customer/contact records are found for both billing and shipping.

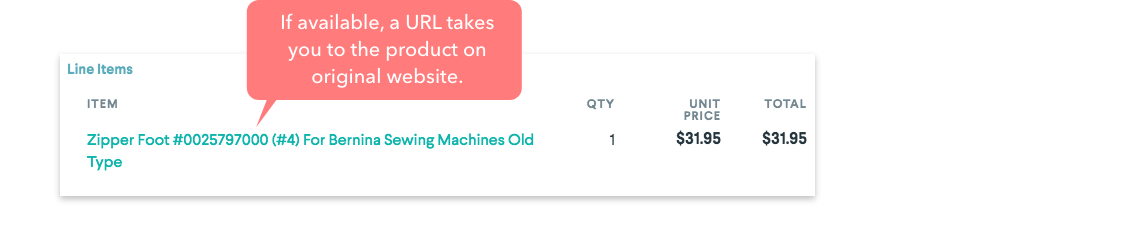

Line Items

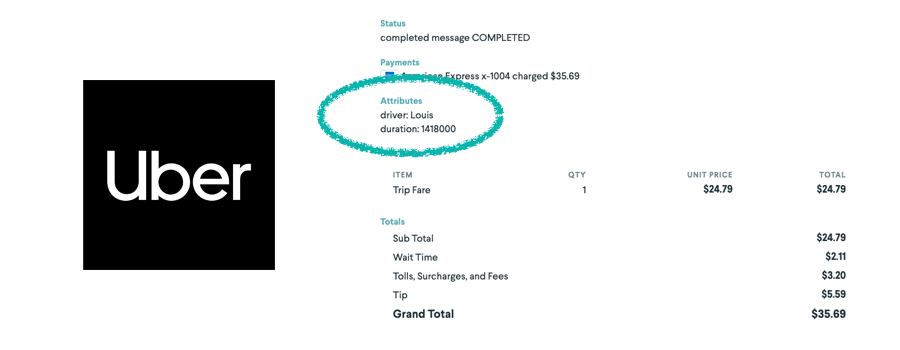

Each transaction on Greenback contains one or more line items. Line items represent the products or services you purchased or sold. Line items may also contain attributes specific to the upstream provider such as a model number.

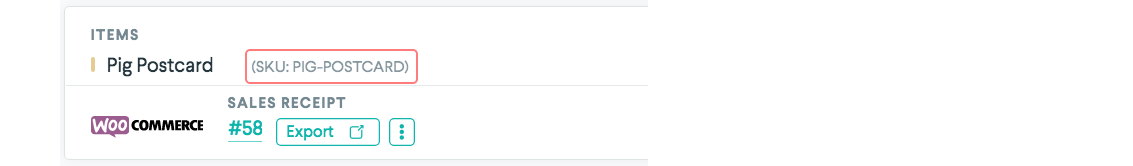

SKUs

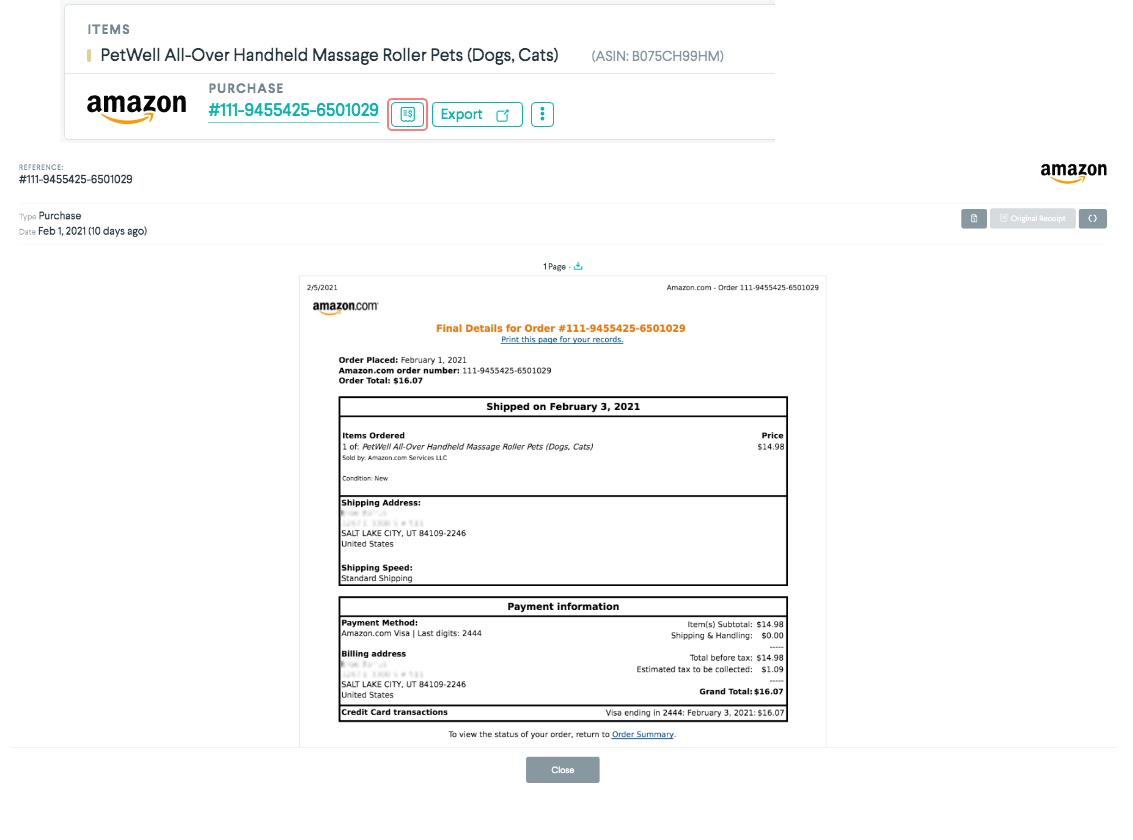

Greenback leverages machine learning models to automate the categorization of your transaction data when exporting to an accounting file. As such, SKUs play a pivotal role in the ongoing categorization.

In addition, Greenback explicitly categorizes transactions when a SKU from an upstream provider matches that of a SKU from your accounting file. Lastly, SKUs can be used to perform more complex workflows, referred to as Transforms, when exporting data to an accounting file.

Amazon uses ASIN instead of SKU but it works the same.

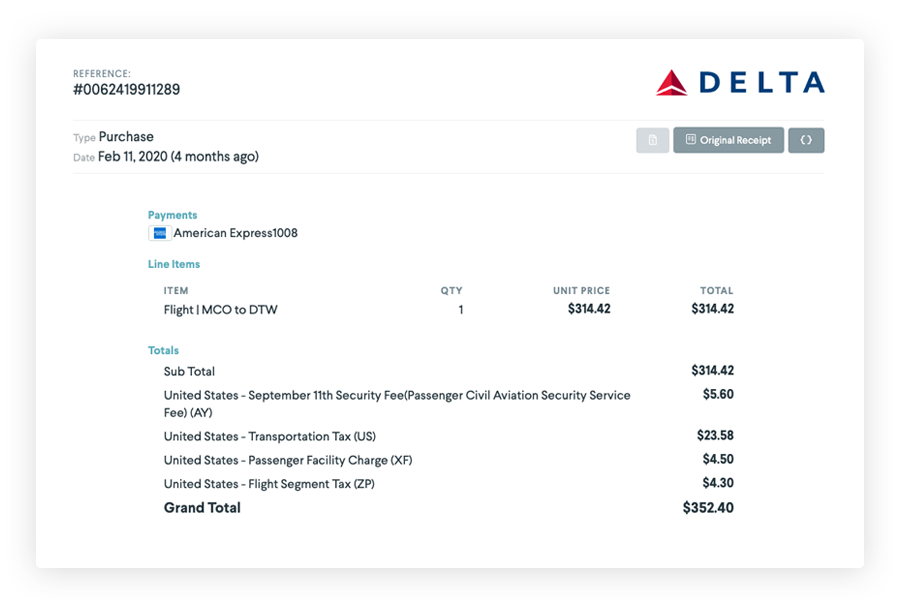

Totals

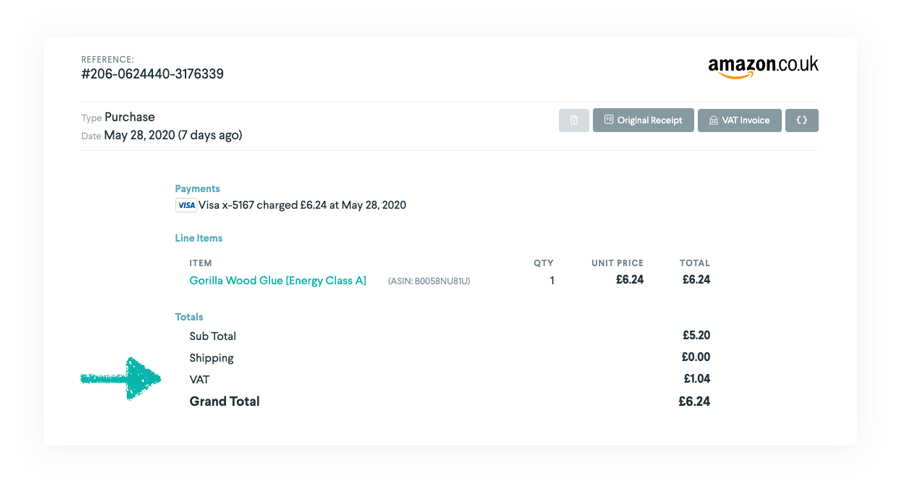

The subtotal and grand total show at the bottom of each transaction detail. The subtotal represents the sum of all items on the transaction. The grand total represents the sum of all items on the transaction plus or minus any shipping revenue, shipping expenses, taxes, fees and discounts.

Sales Tax

If your transaction was subject to sales tax it is itemized out in the transaction view.

Other Taxes & Fees

Some integrations may support additional itemized taxes and fees such as transportation related taxes and fees as shown in this example from Delta Airlines.

Value Added Tax (VAT)

If a transaction is subject to VAT, goods and services tax (GST), harmonized sales tax (HST) or a provincial sales tax (PST), they are itemized in the totals section of the transaction.

Shipping

If a transaction is subject to shipping fees, they are itemized in the totals section of the transaction. There are several options for exporting shipping fees/sales. Learn more about updating your shipping export preferences here.

Discounts

If a transaction is subject to discounts, they are itemized in the totals section of the transaction. There are several options for exporting discounts. Learn more about updating your discount export preferences here.

Meta Data

Several integrations also include custom "name > value" pair attributes in the form of meta-data. These custom attributes can be included in the export to your accounting program as well as used to configure export routing preferences. If you have specific requirements regarding the use of custom attributes, please contact Greenback support for assistance.

Original Receipts

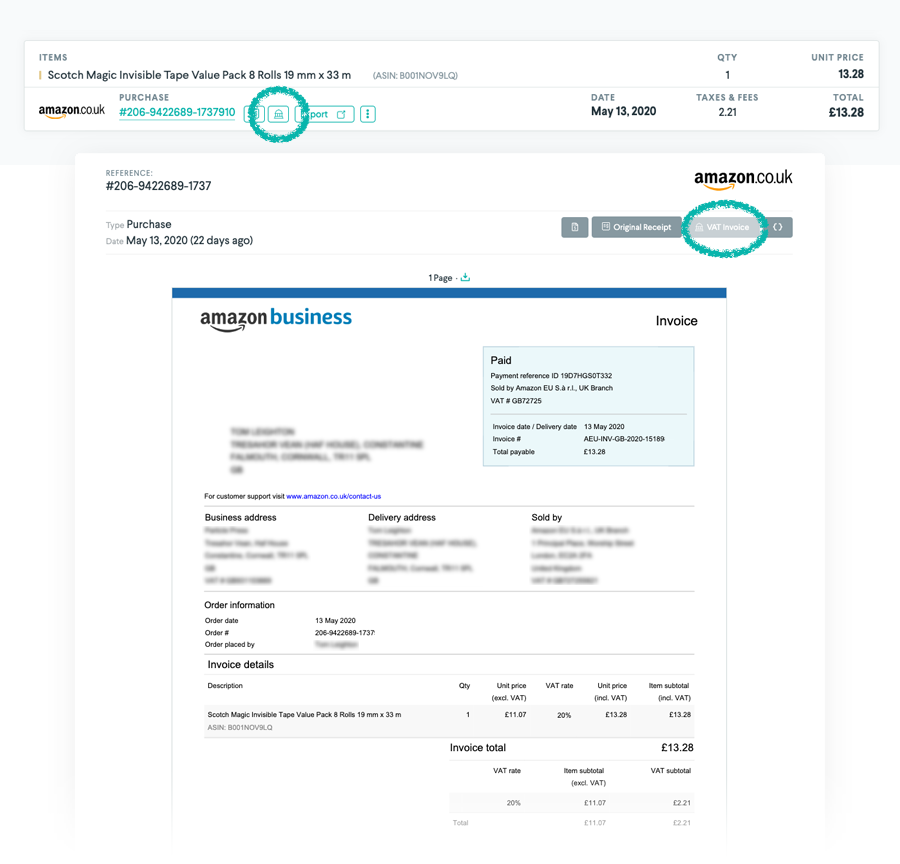

An original receipt is a PDF file from an upstream integration (e.g. Amazon) that is usually provided in your Order History. The original receipts provided by this authoritative source are shown in your Greenback transaction feed with a special callout. If an original receipt is available, a receipt icon is visible on that specific transaction.

VAT Invoices

An original VAT invoice is a PDF file from an upstream integration (e.g. Amazon) that is usually provided in your Invoices tab. The VAT/GST/HST/PST invoices provided by this authoritative source are shown in your Greenback transaction feed with a special callout. If a VAT invoice (created by the seller) is available, an invoice icon is visible on that specific transaction.