Overview

If you have an Amazon Business account, now is the time to get connected! Start saving time and money before the next quarter or year end by streamlining your purchasing and workflow. Amazon Business makes it possible with integrations like Greenback to simplify your accounting and reconciling. By just connecting your Amazon accounts, you can automate your receipts for easier job costing, pass-through expensing, and improved tax compliance. How? Greenback automatically fetches your itemized receipts for you with your credentials and syncs them to your accounting platform with no manual data entry.

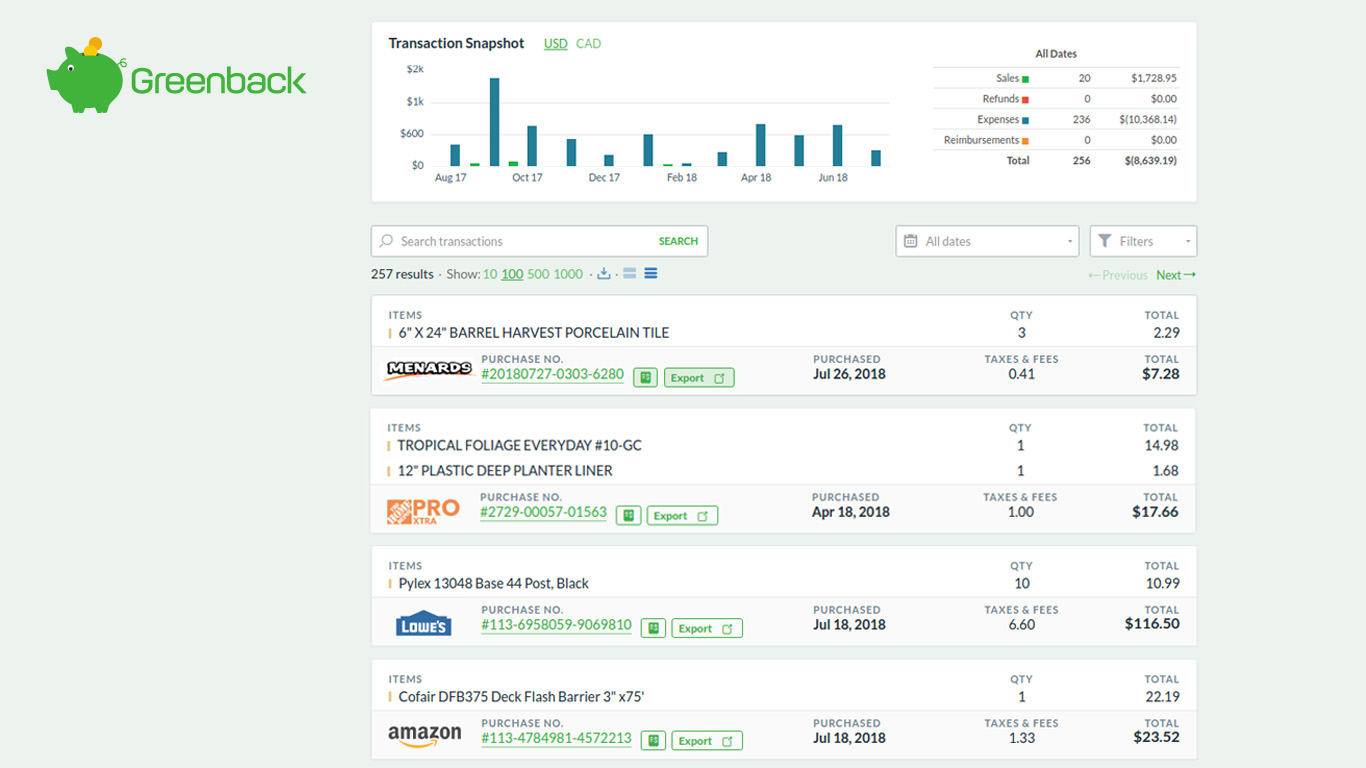

We know how annoying receipts and invoices can be even when they are online. Now there’s no need to hunt through your Amazon order history to find them! Rather than guessing what was purchased or returned, you can reconcile with the actual itemized transactions. You can see the spending totals on your dashboard instantly too. You’ll have less work and better insights for your business.

Let’s Start Automating!

Login to your Amazon Business account at AmazonBusiness.com to test your credentials if needed.

- Sign up for a Free or Premium Greenback account at Greenback.com

- Connect your Amazon accounts. How to Connect

- Connect your accounting platforms. (optional)

That's it!

As soon as you connect your accounts, you'll set in motion the automation of your receipt data. You'll see your transactions immediately. There's no waiting for days or any setup. You do not have to be a business owner or have an Amazon Prime subscription either to sign up. See below for tips on protecting your name/registering your business. Greenback can sync all of your consumer or commercial Amazon account(s) to an unlimited number of accounts in QuickBooks or Xero which is great if you have more than one. By leveraging our amazing transaction data, Greenback supplies you key information, in the right context to help you export with confidence every time and reconcile every cent spent. All of your transaction details are indexed, and easily searchable on our platform and the data (along with the receipt) syncs to your accounting package. For high-volume users, there’s a Bulk Export feature that can save you a lot of time or when you need to catch up on record keeping.

No matter what settings you have enabled in your Amazon Business account or how you have your QuickBooks or Xero accounts configured, Greenback’s advanced technology is flexible. During syncs, Greenback automatically matches transactions or creates new ones, auto-fills fields, and automatically attaches the PDFs in your accounting platform for you. Greenback intelligently adapts to your current preferences, custom chart of accounts, and dropdowns. No training wheels are required. You don’t have to worry about duplicate transactions or errors either.

Every Amazon transaction goes thru our thoughtfully engineered validation process to ensure you have 100% accurate financial data in your accounting system. See below for tips, best accounting practices and how to use Amazon + Greenback to your competitive advantage.

Greenback’s Automated Transaction Feed

To see your Amazon Business, Apple, eBay, Office Depot, Staples, and NewEgg receipts and more all on one dashboard, try out Greenback.com—powerful technology with time-saving automated features, and 100% accuracy.

Pro-Tip Use the Greenback app to automate your workflow and repetitive accounting tasks. As a predictive tool with intelligent syncs, we provide users with recommendations on what actions to take when syncing to their accounting platform.

How to Print, Find, or Save Your Amazon Business Receipts

Sometimes you still need to print a receipt even in a paperless office. Here’s how:

- Login to your AmazonBusiness.com account and go to “Your Orders” in the drop down menu under your name. Click on “View Your Orders Paid by…”, and click on the user account and year. Choose the receipt and click on “Printable Order Summary”. You can then click on “Print this Page for Your Records” to download/save as a PDF or right click to print it out.

OR even faster…

- Login to your Greenback.com account and click on "Amazon". In the chronological Transaction Feed, easily see all of your automated Amazon receipts in detail. For an even further enhanced view, click on the chosen "Sales Receipt" to see itemized details, and live links to the purchased products or the "$" icon to see the original receipt. Right click or click on printer icon. See Skip Printing below.

Need to Find A Receipt?

With Greenback's powerful Search, find receipts quicker than you can on Amazon! Search by any detail without needing to know the year or date. Create a snapshot report of expenses, download/export a CSV file for Google Sheets, Excel or Concur, or download/print PDFs.

Stop Printing Receipts! Sync Them.

Did you know that you can skip the printing all together and still be tax compliant by integrating with Greenback? Your transactions have an IRS approved digital paper trail. Leave them in your dashboard or sync/export to your online accounting system with no manual data entry. You can do Bulk Exports for even faster syncs. Learn more about Greenback Features

How to Get Amazon Prime for Your Business for Free

If you have an Amazon Prime subscription for your consumer account, you can manually add it to your existing free Amazon Business account to extend your benefits! You'll get free 2-Day Shipping for both your business account (only applies to 1 user) and your Amazon Prime account (share with 1 user in your consumer account). If you have any employees, they can use their own existing Prime account (or purchase one) for your business shipments as well. So if you aren’t ready to upgrade to Business Prime Shipping this benefit is a custom fit for you. There’s also instant 1-2 hour shipping, and versatile front door, porch, or in-car delivery of packages, fresh food, and pantry items in select cities and countries.

Remember you also have free access to unlimited digital business books and magazines, streaming videos, music, and playlists, tv shows, and even cable tv channels. Some limitations or additional costs may apply.

How to Add Prime Shipping to your Business Account

Login to your Amazon Prime account, click “Your Account”, find “Your Prime Membership” in the right column. Scroll to bottom of page “Share Your Prime Benefits”, "Extend Your Prime Shipping Benefit”. Input your credentials.

Note: If you needed AmazonFresh for your business, you can only sign up for it with your personal account so you may need to upgrade to Business Prime Shipping.

How to Qualify for an Amazon Business Account

You aren’t necessarily required to have an EIN Employer Identification Number or business Tax ID number to qualify for a free business account on Amazon.com/business. You can check with Turbo Tax: How to Get a Business Tax ID Number or SBA: Do I Need to Register My Business? to get started. You’ll see how to register your business, make it a legal entity, or establish your business name. It could be “as simple as registering your business name with state and local governments. In some cases, you don’t need to register at all. If you conduct business as yourself using your legal name, you won’t need to register anywhere. But remember, if you don’t register your business, you could miss out on personal liability protection, legal benefits, and tax benefits.” Learn more at SBA Business Guide. At Greenback, we recommend at least keeping your personal assets separate from your business ones by using different personal bank accounts.

See also "Tax Exempt Purchases" below.

Get the Most out of Your Amazon Business Account

Exclusive Pricing

With your registered business account, you have access to business-only exclusive pricing and selection. You can compare prices from multiple sellers and even request quantity price breaks for higher-volume purchases from certain sellers. Quantity Discounts are tiered pricing discounts and not available for every product on Amazon.

License Only Products

Your practice, facility, organization, or business has access to professional-only products and supplies only available to licensed businesses. How to Apply for Federal and State Licenses. Just update your account by going to the "Manage Your Business" page, then "Add licenses" and click on "Add."

Centralized Tail Spend

Amazon knows that “tail spend can be costly and time-consuming for businesses, as it often requires managing hundreds or even thousands of different suppliers." Amazon + Greenback helps you centralize and track non-contracted spending and analyze your organization’s spending. By automating your receipts, you’ll also improve your tax compliance. Never miss a business deduction because of unknown details, missing receipts, or miscategorized transactions.

Create Shortcuts to Favorite Sellers

The “Saved Suppliers” feature means that each business account user can create their own favorited list, quickly see the seller’s storefront page, credentials, new products, and more. As you are shopping, Amazon also alerts you that the product is from your favorite seller list. Just go to the seller’s profile page or product page and click “Add supplier." To view your Saved Suppliers list, go to “Manage Suppliers” in the drop down menu.

Negotiated Contract Pricing

Suppliers who sell to business customers on Amazon Business can now move contracted prices to the Amazon Business Marketplace. When a customer is logged in and views a product with a pre-negotiated contracted price, the customer will see that price as well as marketplace pricing.

To enable this feature, suppliers can list negotiated prices via Amazon’s supplier portals for each specific customer. Prices can be uploaded in bulk or on a product-by-product basis. Customers will begin seeing the contracted prices once they have reviewed the price list and verified the accuracy of the contracted price.

Catalog Curation by Rules, Product, Supplier, or Org

Set up catalog curation by rules or group level for preferred products, preferred suppliers, etc. Even generate reports of restricted purchases. “Catalog Curation allows the business account administrator to set up rules marking product categories as restricted, certain products as preferred by their business’ purchasing standards, or suppliers as preferred organizations to purchase from. They can add approval workflows at the group level, and set the approval requirement to be triggered by any product category marked as restricted.” See How to Setup Catalog Curation

Search by PO, Category, and More

With Greenback’s powerful, faceted Search, you can easily search by expense category, by PO number, product, price, shipping address, date, and more. View your actual costs by project from all of your vendors at once rather than by just one. Or search for transactions to sync to your accounting or to create custom snapshot reports. Learn more about Greenback’s Flexible, Powerful Search.

Approval Workflows. No Expense Reports Needed!

Seamless Purchasing & Account Sharing

You can save lots of time when there are no expense reports or reimbursements needed for employees. Registered businesses of any size can take advantage of corporate account features like the ability to implement purchase approvals, connecting your team (single or multi-user), creating purchasing groups to match your org structure, and sharing payment methods across your entire organization and shipping addresses. You can customize your order approvals, add a purchase order or reference number, set spending limits and manage your organization’s buying. Control spending by seller credentials, supplier-diversity, environmental, or quality requirements. You can also create curated catalogs with tags or approval workflow messages. You can even arrange a line of credit as a payment option enhanced with security features. Business purchases are technically automatically approved.

“Either individual or shared payment options can be added by administrators of the Amazon Business account. Shared payment methods include credit cards, debit cards or an Amazon.com corporate credit line. Any authorized user of your business account can use the payment method of choice to purchase items on behalf of the business. While all authorized users will be able to use the card registered, they will only be able to see the ****last four digits to ensure security.”

Account Sharing on Greenback

Greenback also supports businesses of any size on its platform. You can connect an unlimited number of integrations, and an unlimited number of QuickBooks or Xero accounts, etc. Invite additional collaborators. Add your accountant, employees, business associates, or family members to view, track, or export your expense transactions.

Streamlined Approvals & Reconciliation

To streamline your approval workflow and reconciliation, we recommend connecting your Amazon Business account. Greenback assists with reporting, specifically tracks PO Numbers and Job Names, maps your forms of payment, and syncs your transactions to your accounting platform. When your forms of payment are consistent, it improves your tax compliance. Greenback can track your purchases by the last ****4 digits of your credit, debit, (may include pre-paid or gift cards) to help. Collaborators never see the card numbers just like on Amazon. Only the last ****4 digits are in the transaction data from Amazon and mapped by Greenback.

Greenback simplifies reconciliation too. When you connect your Amazon Business account, Greenback automatically fetches your expense receipts and intelligently syncs them for you. Click-and-mortar stores just don’t have the workflows for reconciliation. Amazon can’t sync your downloads or emails to your accounting platform. But with Greenback, it’s easy to see itemized details and do individual exports or bulk exports of your transactions. We give contextual hints and intelligently sync them to your accounting. Greenback matches transactions, enhances or creates new ones, prevents duplicates, attaches each Amazon receipt, and auto-fills fields automatically for you with little to no human intervention and manual data entry.

When Paying with Gift Cards & Reward Points

Amazon usually sees credits, gift cards/balances, and rewards points as “discounts” which they simply subtract before showing the transaction Total. But for accounting purposes, you need more detail than that in order to be GAAP (Generally Accepted Accounting Principles) and tax compliant. Typically they are ghosted amounts that go unaccounted for but Greenback detects and surfaces them. We show you all the itemized details. As a business, you need to know your true operating expenses and see them reflected accurately on your books as well. We recommend that rewards points are reserved for personal purchases only since they are not GAAP compliant and could be viewed as mixing your assets even if you aren’t. A best practice is using different debit or credit cards to separate your personal and business expenses if you don’t have a business bank account or commercial credit card yet. This maximizes your deductions, and prevents fines.

How to Sort Personal and Business Expenses for Export

Greenback indexes every line item of your Amazon transactions so that your purchases can be easily tracked by debit or credit cards (may include gift and pre-paid cards) or searched by any detail like date, product, and more. You can then simply choose which receipts you need to sync/export to your accounting platform. Greenback even gives hints within context to assist you. With an Amazon Business account, your receipts can be tracked by PO#/Job Name, or Location (shipping address) depending on the settings you’ve enabled. With a consumer account, they can still be tracked by card account number, product, or location (shipping address) etc. Note: You can export directly from your dashboard to Google Sheets, Excel, or Concur if you wish. Connecting to an accounting platform is optional.

How to Enable a Custom Order Field

To track Amazon purchases by PO#/Job Name, login to your Amazon Business account and click on “Manage Your Business”, “Billing & Shipping”, and then “Order Information”. You may be required to re-enter your password. Click to enable the field for Purchase Order Numbers, then click whether PO numbers are optional or required. Click “Update”. At checkout, there will be a prompt to fill the blank field with anything you wish. It will appear in your transaction data exactly as typed on Amazon (order history report), on the shipping label or packing slip depending on your carrier, and in the Greenback app. Other details like shipping address (location), credit card, etc. are already tracked in Greenback so you don’t need to enable more fields on Amazon.

Tax Exempt Purchases

Amazon’s Tax Exemption Program (ATEP) is a benefit that works for consumers or businesses. You are not required to have an Amazon Prime or Amazon Business account. The ATEP program makes it possible for customers to apply their tax-exempt status to eligible purchases from Amazon and all of its affiliates. Remember that not all purchases are tax exempt even when you are approved for the ATEP program. Sales tax may still be charged or may be applicable in the future. It depends on your state. You may need to pay the state sales tax for purchases at tax time so please consult with your tax advisor or accountant.

IMPORTANT: Do not mix personal with business if you are making tax exempt purchases. Use consistent payment methods. “In order to qualify for exemption, you may be required by law to pay [for Amazon orders] using your organization’s payment method (e.g., a company credit card) and not a personal payment method (e.g., a personal credit card). To the extent you have a Business Account, you acknowledge that if you, or any business user accounts associated with your Business Account, make tax exempt purchases with a tax exemption certificate associated with the Business Account, that those purchases are made with the tax-exempt organization’s funds. You will comply with such requirement to the extent required by law.” Learn more about Amazon's ATEP program

Note that in order to apply for tax exempt status with Amazon, you do need a business bank account. In order to open a businesss bank account, banks usually require a DBA, registered business name, or Federal Tax ID Number (EIN). See Also 4 Different Ways to Register Your Business Name

Taxable & Non-Taxable Purchases

As an Amazon customer, remember that even if you were not charged sales tax at the time of your purchase, you are still required to pay it at tax time. Unless it is an exempt purchase, or it is in a state that never charges sales tax. There are states that now require online stores with click-thru nexus and meets sales thresholds to collect tax from you at the time of purchase, rather than waiting for your payment at tax time. Certain products or services by city, county, or state laws also affect sales tax so please consult your tax advisor or accountant for assistance. Greenback makes sure that taxes are itemized on your transactions and uniquely handled throughout our platform for purchases that are taxable, non-taxable, and tax exempt.

Tax Compliance

It’s imperative that your keep your receipt data for at least 3-7 years (or indefinitely for some receipts) for tax compliance. Some online stores may archive up to only 90 days. According to State Farm, receipts are needed to help you file an insurance claim, make coverage decisions, secure a settlement, or verify property loss for taxes in case of fire, flood, or other casualties. Greenback recommends automating all of your receipts from all of your vendors/shops/marketplaces so that you can be worry-free.