Connecting your Account

You'll need to authorize Dext Commerce to connect with your Etsy account. Follow these simple steps:

-

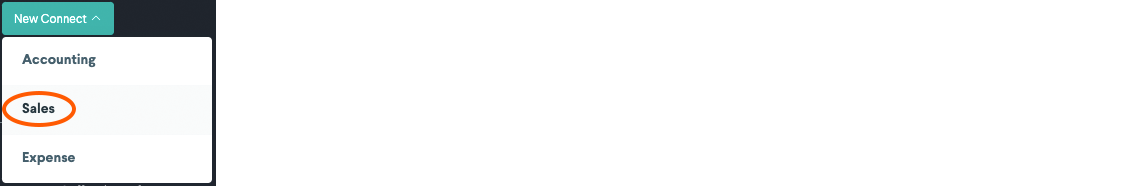

In the sidebar, navigate to Sales > New Connect and select Sales

-

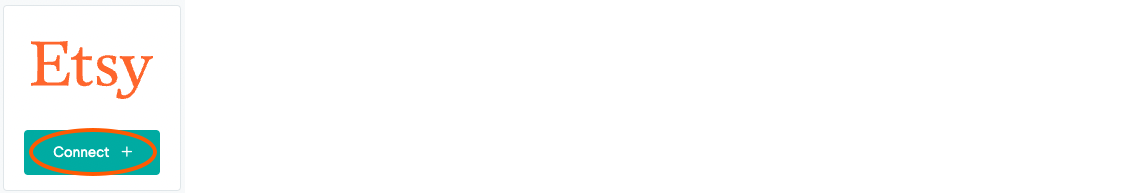

Select Etsy

-

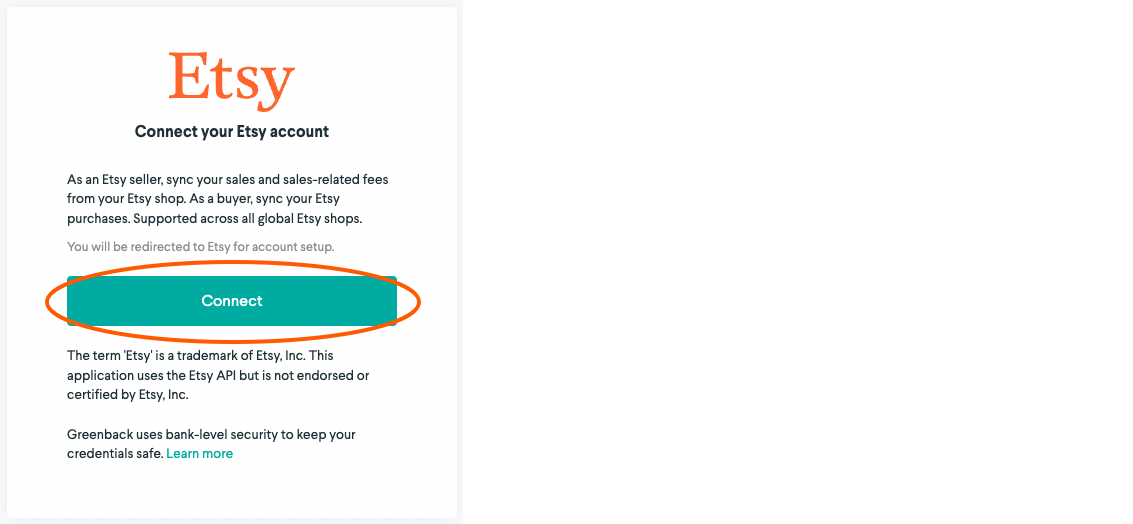

Select Connect

-

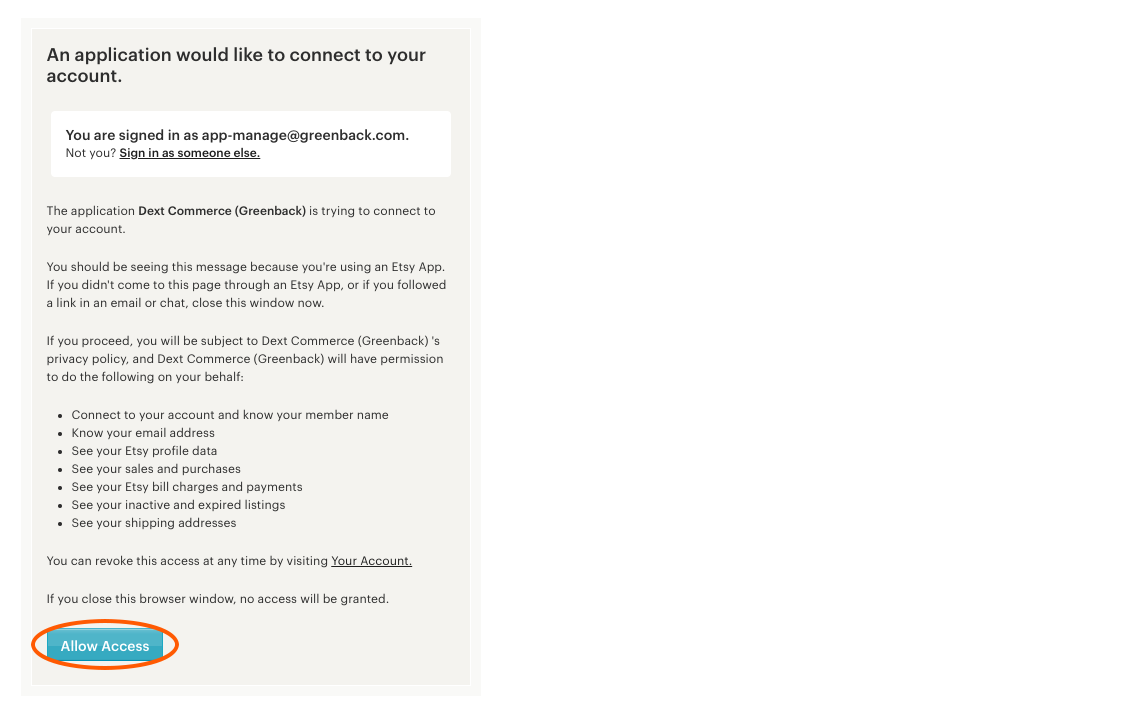

You will be taken to the Etsy authorization page. After reading the details, select Allow Access

-

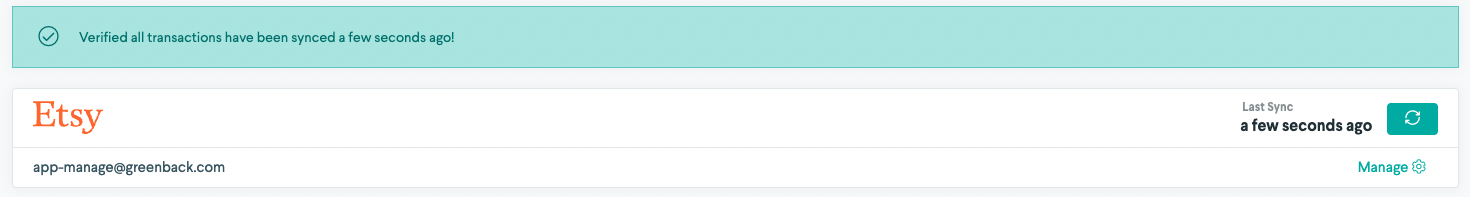

Once the connection is established, Commerce will begin to sync your data. Once complete, a verification message will display.

Reconnecting your Account

If you need to reconnect your account to Commerce, follow these steps.

-

Navigate to Etsy.com and login to the account you wish to use

-

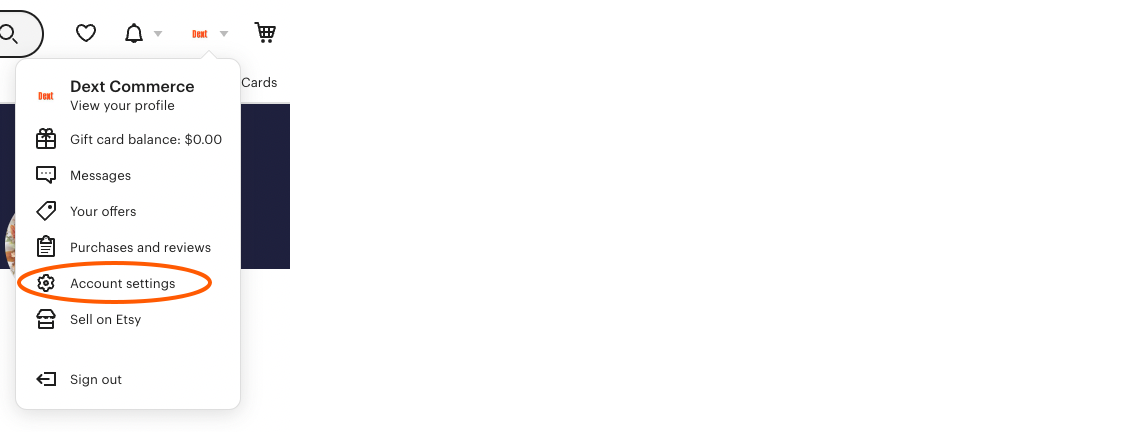

Select the account dropdown at the top right of the screen. Then select Account Settings

-

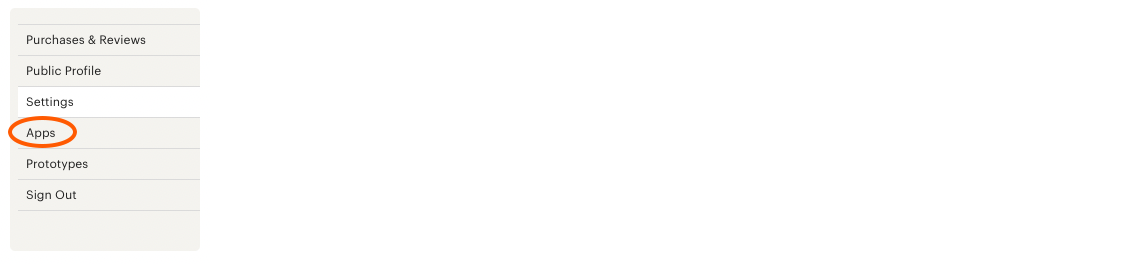

Select Apps from the navigation pane on the left

-

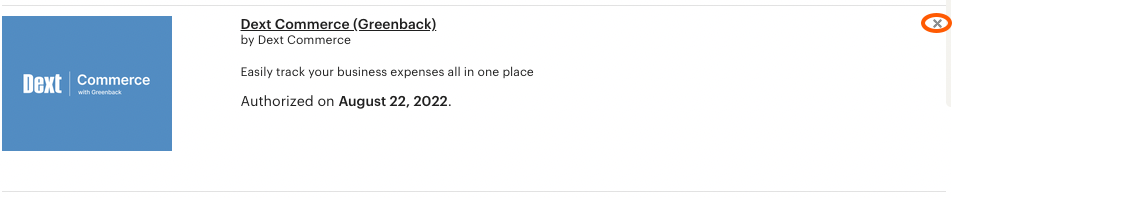

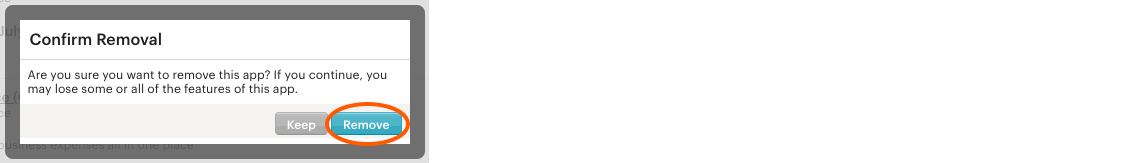

Find Dext Commerce under the connected apps and select the 'X' at the top right

-

Select Remove

-

Reconnect your account following the steps above

Supported Accounts and Regions

Commerce supports all Etsy regions and seller accounts.

Historical Data

When you connect an account Commerce automatically fetches a few transactions prior to the connection date, and then all transactions going forward. It is possible to import additional historical data, referred to as a Catch Me Up (CMU). In most cases, Commerce will be able to fetch multiple years of Etsy data without issue.

Users on paid Growth or higher plans are provided with a 90-day Catch Me Up as part of their subscription.

Learn more about historical data and Catch Me Up's here

Tax Treatment

How Commerce gets Tax data from Etsy depends on the region of the connected account.

United States

Etsy collects and remits taxes on behalf of the seller. These taxes come through to Commerce with your Sales Data as Automatic Sales Tax.

Learn more about how Etsy handles taxes in the US here.

Canada

Canadian tax regulation requires sellers to register for a GST/HST ID and to collect and remit the tax to the CRA once they’ve reached $30,000 CAD in sales.

As of July 1st 2022, Etsy collects and remits GST and Provincial taxes on behalf of the seller. These taxes come through to Commerce with your Sales Data as Automatic Sales Tax.

Learn more about how Etsy handles taxes in Canada here.

European Union and U.K.

If you are a VAT registered seller, you may be required to collect VAT on your Etsy sales. Etsy does not include VAT automatically, so sellers may need to list products as VAT inclusive. Etsy provides no tax data for VAT inclusive transactions, so Commerce is unable to pull any through with your sales data.

However, Commerce has the ability to apply a VAT rate to your data through custom rules we refer to as transforms. This will capture the correct VAT rate, and allow your data to be accurate when exporting to your accounting system. Transforms must be applied by our support team, so please contact support@greenback.com if required.

Learn more about transforms here

Other Regions

Etsy may have additional region-specific treatment of tax. For more information, consult their tax center here.

Inventory

If you have SKU's listed with your products in Etsy, Commerce is able to pull them through with your sales data. If you have inventory enabled in your accounting system, Commerce's SKU matching allows you to accurately map transactions to the product or service sold.

Payments

Etsy allows the use of many third party payment providers. It's strongly recommended that you use a separate clearing account for each payment provider in use.

Learn more about clearing accounts here

Multi-currency

This integration supports multi-currency without any restrictions.

Disputes

Disputes are brought through to Commerce as Refunds

Fees

Etsy has a large number of fees based on various factors. Here's how Commerce handles some of the common fees associated with Etsy.

| Fee | Displays as | Description | Transaction type |

|---|---|---|---|

| Payment Processing fees | Payment Processing fees | Seller fee for payment processing. | Purchase |

| Listing fees | prolist | Seller fee for a promoted listing. | Purchase |

| Regulatory fees | regulatory_operating_fee | Seller fee for regulatory compliance. | Purchase |

| Automatic renewal fees | renew_sold_auto | Seller fee for (automatically) renewing listing after a sale. | Purchase |

| Renewal fees | renew_sold | Seller fee for renewing sold listing. | Purchase |

| Shipping fees | shipping_transaction | Seller fee for shipping costs. | Purchase |

| Shipping label fees | shipping_labels | Seller fee for postage and additional fees. | Purchase |

| Transaction fee | transaction | Seller fee for sold item. | Purchase |

Etsy does not track payment processing fees for third-party payment method sales. It's recommended that you connect any supported integrations to Dext Commerce to accurately capture them.

Known Issues

There are no known issues with the Etsy integration at this time.

Data Model

This is a complete list of the data Dext Commerce pulls from Etsy.

Transaction Data

- Sales

- Fee transactions

- Refunds

- Transaction State

- Open

- Paid

- Deposits and Payments

Contact Info

- Shipping address

- Attributes

- Buyer email address

- Buyer name

Transaction Info

- Line Items

- SKUs

- Taxes

- Discounts

- Shipping