Overview

When you connect an account to Greenback, your transactions are pulled in from that account and categorized based on type. There are two types of transactions: sales and expenses.

This lesson covers:

- The anatomy of a transaction

- Data syncing

- Mapping data

- Transforming data

- Filters & Search

- Reports

The Anatomy of a Transaction

A Sale in Greenback records both the sale and the payment. A Sale consists of two transaction types:

- Sales Receipt

- Refund

When you export a Sale from Greenback to your accounting file, each type maps to either a Sales Receipt (immediate payment) or a Refund in the accounting file.

An Expense in Greenback consists of three different transaction types:

- Purchase

- Bill

- Reimbursement

When you export an Expense from Greenback to your accounting file, each type maps to an Expense transaction in the accounting file.

Data Syncing

In an effort to streamline your accounting process, Greenback automatically syncs your transactions from connected accounts. As an account connection is made with Greenback, some recently completed transactions and all transactions from that point forward are automatically synced.

Automatic syncing frequency varies based on the integrations, but manual a sync can be performed at any time.

Greenback can fetch historical data for you as well. Request a Catch Me Up (CMU) to see additional transactions. CMUs are an automated service managed by a support engineer that ensures complete and accurate historical data. Email support@greenback.com with the account name and time frame from which you would like your data.

Mapping Data

Greenback offers 4 types of mapping, all of which are designed to make exporting your data as pain-free as possible.

Memory Mapping is our sophisticated learning software utilizing a mapping library that quickly and autonomously places future transactions in the proper accounts within your accounting program.

SKU Mapping maps transactions to the proper product or service.

Tax Mapping routes transactions to tax categories contained within your accounting program.

Customized Mapping uses a rules engine to create pre-defined mappings when multiple attributes influence transactions.

Transforming Data

Let Greenback enhance your sale & expense data by transforming it in into a desired, consistent format. Our robust transformation logic converts any volume of transactional data down to the line item. A Greenback support engineer assists in creating hassle-free data using a variety of transformations.

De-duplication helps eliminate incorrect, missing or duplicated values before they even reach your accounting platform.

Tax/SKU transforms build criteria or exceptions associated with taxes, SKU, products or services.

Advanced transforms provided by Greenback cover even the most intricate requirements for custom-fit data.

Filters & Search

Refine your transaction views by utilizing the filter and search functions in the Greenback app.

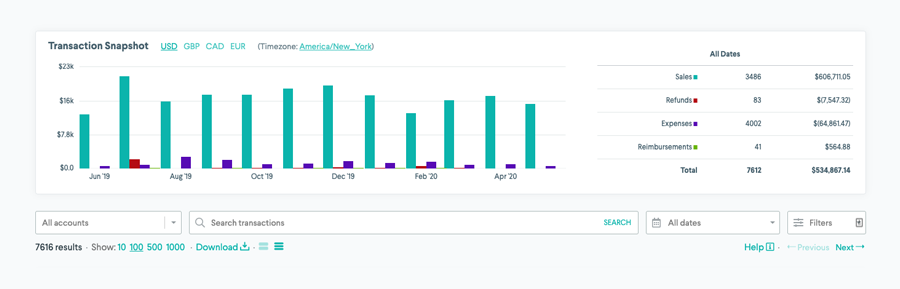

Reports

The snapshot report looks at all transactions within the current context to provide a sum of sales, refunds, expenses and reimbursements. The graph displays data on a daily, weekly, monthly or quarterly view.

Additional Resources

-> Learn more about transactions

-> Learn more about data syncing

-> Learn more about Catch Me Ups

-> Learn how to filter transactions