Selling multi-channel with Walmart

selling your products on just one platform these days is like putting all your eggs in one basket. Not the best idea, right? That's why multi-channel selling is the new go-to strategy for e-commerce businesses

Rich Mailbox support for Home Depot and Lowe's

Contacts in QuickBooks Online

Contacts and Xero

Sales Tax and QuickBooks Online

Sales Tax and Xero

Clearing Accounts and QuickBooks

Clearing Accounts and Xero

A guide on the importance of clearing accounts in e-commerce accounting, and how to configure Xero to use them.

Technical Guide: EKM

Connect, understand, and optimize your EKM integration with Commerce.

Can Dext Commerce fetch failed Stripe payments?

read more

Reconciliation with Dext Commerce

Cost of Goods Sold with Dext Commerce

An introduction to using Dext Commerce to track your Cost of Goods Sold (COGS) in your accounting file.

How do I cancel my account?

Step by step instructions on how to make changes to your Dext Commerce subscription.

Klarna: Integration Overview

Affirm: Integration Overview

Technical Guide: Etsy

Connect, understand, and optimize your Etsy integration with Commerce.

Export Results

This details what each export result means

How do I book a one on one onboarding session in Partner Dashboard

read more

Technical Guide: Prestashop

Connect,understand, and optimize your Prestashop Integration with Greenback.

Technical Guide: BigCommerce

Connect, understand, and optimize your BigCommerce integration with Greenback.

Convert your Amazon personal to a business account

Convert your Amazon personal to an Amazon business account

How does Greenback handle transactions across multiple currencies?

Understand how Greenback helps you manage different currencies resulting from international sales.

read more

Technical Guide: Amazon Business

Connect, understand, and optimize your Amazon Business integration with Greenback.

Xero/Shopify Integration vs. Greenback

Here are the reasons why Xero users should choose Greenback to automate Shopify transactions and ditch Xero's native Shopify integration.

Technical Guide: WooCommerce

Connect, understand, and optimize your WooCommerce integration with Greenback.

Technical Guide: Xero

Connect, understand, and optimize your Xero integration with Greenback.

Introduction to Itemized Taxes

Itemized Taxes are yet another Greenback feature designed to increase automation for accountants and bookkeepers.

Technical Guide: Stripe

Connect, understand, and optimize your Stripe integration with Greenback.

Technical Guide: Big Cartel

Connect, understand, and optimize your Big Cartel integration with Greenback.

Technical Guide: Shopify

Connect, understand, and optimize your Shopify integration with Greenback.

How are exchange rates calculated?

read more

Technical Guide: Clearpay

Connect, understand, and optimize your Clearpay integration with Greenback.

Technical Guide: Afterpay

Connect, understand, and optimize your Afterpay integration with Greenback.

Technical Guide: Faire

Connect, understand, and optimize your Faire integration with Greenback.

Technical Guide: Amazon Seller Central

Connect, understand, and optimize your Amazon Seller Central integration with Greenback.

Managing Your Client Licenses

Learn more about allocating and removing licenses from the billing menu.

Technical Guide: OnBuy

Connect, understand, and optimize your OnBuy integration with Greenback.

Understanding the Types of Greenback Integrations

Learn more about the types of integrations that Greenback has to offer.

Technical Guide: Walmart Marketplace

Connect, understand, and optimize your Walmart Marketplace integration with Greenback.

How to Configure Xero for Gift Cards

Do you sell gift cards? Learn how to easily track gift card sales and redemptions in Xero

Introduction to Automatic Exports

Automatic Exports are yet another Greenback feature designed to increase automation for accountants and bookkeepers.

Technical Guide: Not On The High Street

Connect, understand, and optimize your Not On The High Street integration with Greenback.

Introduction to Rollups

Rollups are yet another Greenback feature designed to increase automation for accountants and bookkeepers.

How do I Unarchive Amazon Statements?

Gather your archived Amazon statements from your Amazon account.

read more

Updating Your Payment Information

Conveniently update your preferred billing card in app through the settings menu.

How is my transaction volume calculated?

read more

Where is my reimbursement in QuickBooks?

read more

Lesson 1 Teams and Inviting Clients

Adding SKUs to Stripe Products

Having Greenback fetch SKU data from Stripe products would be so convenient. Well, here's how to make it happen.

Lesson 2 Connecting Your Accounting Program

Lesson 3 Connecting Your Accounts

Greenback is becoming Dext Commerce

Greenback has been acquired and is now Dext Commerce!

Lesson 4 Working with Your Data

Lesson 5 Exporting and Reconciliation

Retirement of the free plan

Starting September 6, 2021 there are a number of changes being implemented to Greenback Free accounts

Why are some of my most recent Amazon Seller transactions missing?

read more

How to configure QuickBooks Online for Gift Cards

Do you sell gift cards? Learn how to easily track gift card sales and redemptions in QuickBooks

Create a Greenback Account

Export and Publish

step by step guide to export your sales to an accounting program

Best Accounting Practices Squarespace + QuickBooks Online

Greenback is the defacto solution for automating your Squarespace accounting. The following article will help you get started with automated accounting of Squarespace data to QBO.

What Makes Dext Commerce Different?

It's not just about moving data from point A to point B. Global commerce is complex.

Greenback Announces Decimal as First “Greenback for Pros” Master Partner

Greenback Announces Decimal as First “Greenback for Pros” Master Partner - bringing together advisory firms and their customers on Greenback’s accounting automation platform.

QuickBooks Help Guide

It is easy to export transactions from Greenback to QuickBooks Online. In this tutorial, we'll see how to export a Sale (invoice) and an Expense (purchase/bill) and post them QuickBooks Online.

Make Tax Digital Post Brexit

Find out what changes Brexit will bring to those selling in the UK.

Make Tax Digital for PayPal Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Etsy Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Amazon Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Square Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Wix Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Walmart Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Shopify Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for SquareSpace Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Stripe Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for WooCommerce Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for Big Cartel Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Make Tax Digital for eBay Sellers

Learn how Her Majesty’s Revenue and Customs guidance on the upcoming VAT Threshold changes known as "Making Tax Digital" affects your e-commerce business.

Mark Transactions as Reconciled in Xero

Here is how to mark transactions exported by Greenback as reconciled in Xero.

read more

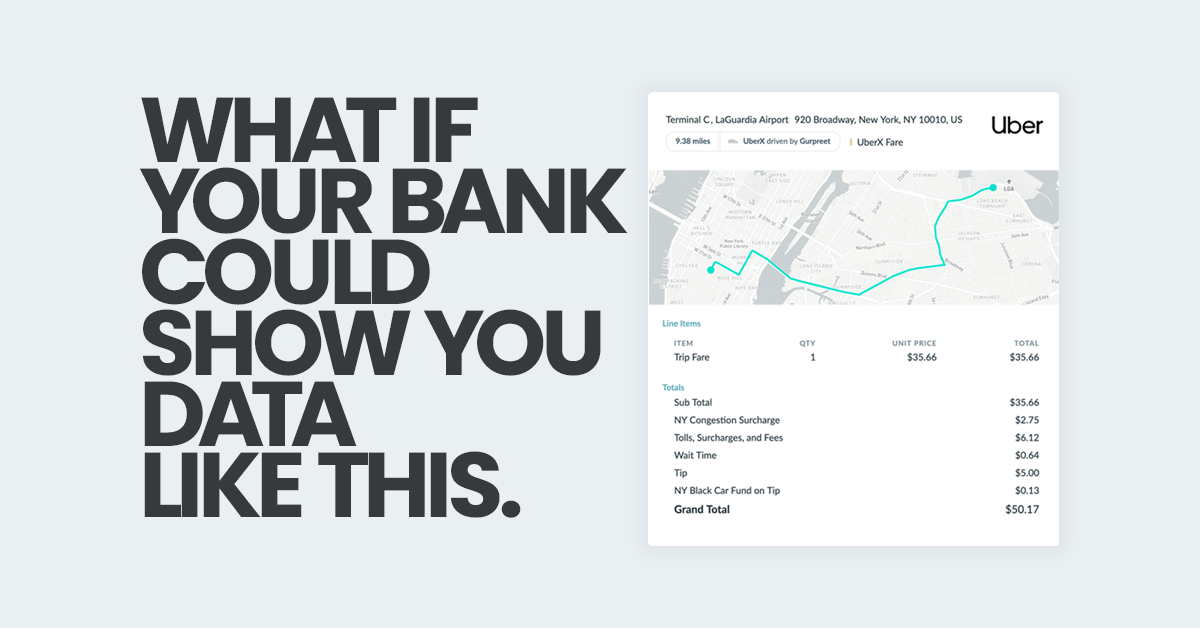

How Fintech APIs are Transforming Banking

Fintech APIs are playing a key role in open banking initiatives.

What do businesses really want from their banks?

Business customers are crying out for more frequent and more transparent transactional financial data.

How Greenback is Streamlining the Digital Paper Trail With Mailbox Connect

APIs to fetch emailed receipts from your mailboxes automatically, or alternatively submit RFC822 emails directly to the API

What High definition Data Means for Financial Services

Today there is more and richer financial data available than ever before, but the challenge has become how to properly secure it, and use it to enhance the customer experience, inspire customer loyalty and as a result increase market share.

Can Greenback help with Australian GST taxes for my e-commerce sales?

read more

Get Started with Sales

New to Greenback? Start here for a quick walk through on how to use Greenback to automate your e-commerce sales

Get Started with Expenses

New to Greenback? Start here for a quick walk through on how to use Greenback to automate your expense transactions

Automate Your eBay Sales with Managed Payments

eBay Managing payments is the new way to sell and get paid on eBay.

Best accounting practices for eBay Managed Payments + Xero

Transitioning to eBay's Managed Payments? Learn how to sync your eBay Managing Payments data with Xero.

Best accounting practices for eBay Managed Payments + QuickBooks

Transitioning to eBay's Managed Payments? Learn how to sync your eBay Managing Payments data with QuickBooks Online.

Can I sync my open Stripe invoices from Greenback to accounting?

read more

Can Greenback help me "back out" and remove previously exported transactions to my accounting file?

read more

Access Your Greenback Account

Need help accessing your Greenback account? This guide can help.

How often will data sync to Greenback?

read more

How far back can Greenback acquire historical data?

read more

How do I account for VAT taxes collected on my eBay sales?

read more

How do I address Etsy sales from the UK and EU that are missing VAT Taxes?

read more

Are sales receipts and invoices created by Greenback in my accounting file numbered sequentially?

read more

Why can’t I add a Collaborator?

read more

How many team members can I add to a team?

read more

Can Dext Commerce manage multiple currency balances in PayPal or Stripe?

read more

Can I export IIF files from Greenback?

read more

Does Greenback support Google Shopping Actions?

read more

Join the world's most advanced pre-accounting system.

Start a free trial on our growth plan now.

- Start your free trial

- Easy set-up

- Cancel any time